- PLTR shares continue to be bought by ARK Invest.

- Palantir results disappointed but ARK has been buying.

- ARK Invest bought 5.2 million shares on Thursday.

Update: Palantir shares rallied strongly on Friday as ARK Invest posted that it had bought over five million shares on Thursday in Palantir (PLTR). ARK Invest had announced on Tuesday that they had bought one and a half million shares. ARK Invest's Cathie wood had spoken on Wednesday about Palantir saying not a short term play but liked it for the long term.

PLTR Stock Forecast

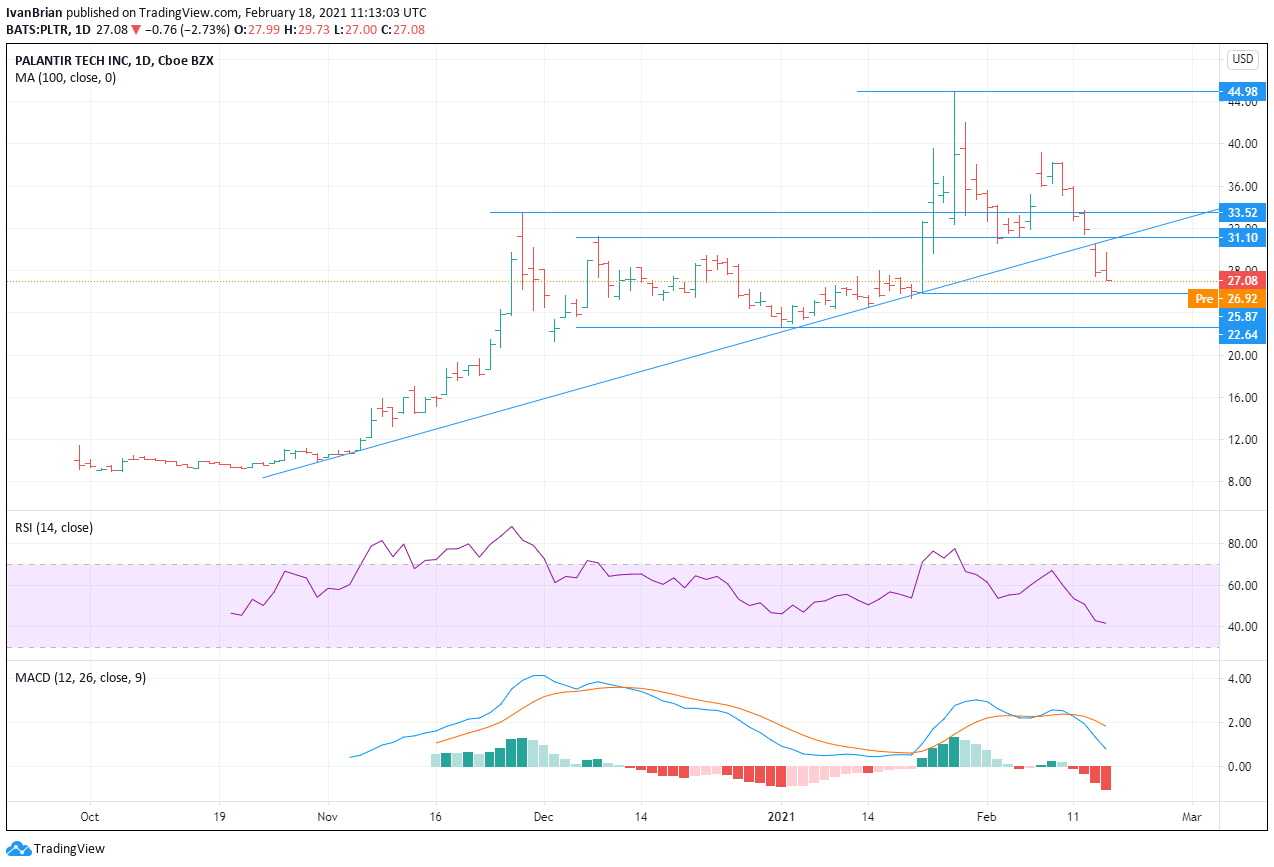

Shares in Palantir continued to suffer a post results fall, closing out Wednesday with a near 3% loss at $27.08. At the time of writing Palantir shares are lower again during early pre-market trading on Thursday at $26.23, another 3% loss.

PLTR shares had been one of the hot stocks of 2021 and the new breed of retail investor had been very bullish on the stock. PLTR shares began 2021 at $23.91 and quickly spiked up to $45 as the Reddit mania targetted the stock.

But Palantir is not a struggling industry and had good reason to be bid up. Palantir is backed by legendary silicon valley investor Peter Thiel, he of PayPal fame. PLTR has a strong government based client list including nearly all US intelligence agencies and multiple branches of the military.

Palantir has recently begun aggressive expansion into the corporate world winning clients such as Rio Tinto, Proctor&Gamble and IBM.

PLTR Stock News

Palantir has developed possibly the most sophisticated data analysis software available. The software mines through enormous amounts of data making connections beyond human capabilities. Given the secretive nature of the company and its highly sensitive client base, it was a surprise to many when the company launched on the stock market. However, that has enabled it to raise capital to expand into the corporate world while maintaining its strong government client base.

PLTR Results disappoint

Investors had been hoping to see continued progress in the Q4 results release on Tuesday. However Palantir posted a surprising EPS loss, but PLTR did impress on sales growth. Palantir also forecasted sales growth of 30% yearly out to 2025, this is what caught the attention of Goldman Sachs. "With improving visibility into near- and long-term growth, we believe PLTR should trade more in line with 30%+ growth businesses, which are trading at 44x CY21 sales, our new target multiple for PLTR on SNTM sales." However other Wall Street analysts were less bullish. Morgan Stanley maintained an Underperform rating and upped the price target from $17 to $19. William Blair downgraded the stock from Market Perform to Underperform. Credit Suisse maintained an Underperform and lifted the price target from $17 to $20.

However this did not stop noted technology investor Cathie Wood of ARK Invest from buying into Palantir. ARK Invest said "if short erm in focus, best to stay away from Palantir", but also said some of the most impotant innovations of our lifetime have "started in government" and Palantirs attituede is "refreshing in investing aggressively". On Tuesday ARK invest purchased over 1.5 million shares in Palantir.

Palantir Technical analysis

We have some key support levels being tested. Bullish trend channel support has been broken and the last chance for the bullish trend is support at $25.82.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.