Palantir Technologies (PLTR) Stock Price and Forecast: Keeps falling, as $25 yields in

- Palantir falls for the third straight day, but not out of the woods yet.

- PLTR stock accumulates 15% losses since the week started.

- PLTR has seen selling from Cathy Wood of ARK Invest.

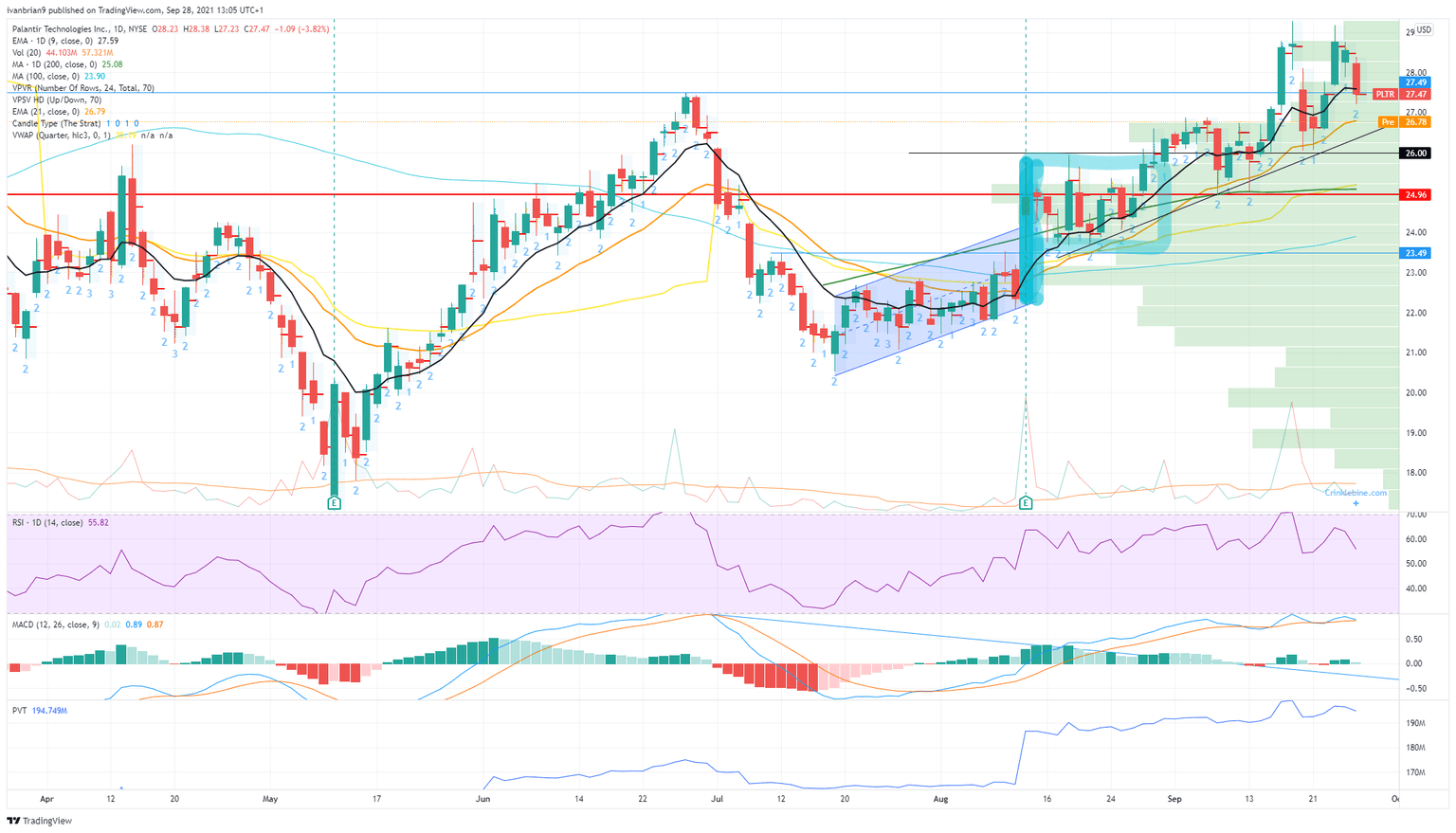

Update September 30: The rout in NYSE: PLTR seems far from over, as the stock price shed another 3.24% on Wednesday, constituting 15% loss over the week so far. Palantir Technologies share price breached the psychological $25 mark, reaching the lowest levels in five weeks, despite the rebound in the Wall Street indices. The downside got accelerated after the stock price breached the critical 200-day simple moving average (DMA). Further, a surge in the bearish put contracts also added to the pain in PLTR stock price.

Palantir (PLTR) stock suffered a pretty sharp fall on Monday, closing nearly 4% lower. Palantir is closely followed by the retail community and social media mentions of this one have dropped off lately. Yesterday's move though was more likely down to general malaise about high growth stocks, of which Palantir is definitely one. Goldman earlier this year spoke of a 30% compound annual growth rate. In its last results in the middle of August, Palantir doubled its forecasts for free cash flow generation from $150 million to $300 million.

The trouble with high growth stocks is that they are very interest-rate sensitive. Palantir and other high growth names do not like what is happening with the yield on the US 10-Year. This has spiked to over 1.5% now since Friday. Higher yields and interest rates mean a greater discount when accounting for future cash flows. Growth stocks have high future cash flows, so the higher the prevailing yield or interest rate then the greater the discount back to present value is going to be. Also, a higher growth rate is then needed to offset the relative merits of a guaranteed yield versus predicted future yields.

Yesterday saw this play out with the Nasdaq being the worst performing index by far, losing almost 1%. See our chart below for a look at how the Nasdaq and 10-year are highly correlated. The yield on the 10-Year is inversely correlated to its price.

Palantir key statistics

| Market Cap | $56 billion |

| Enterprise Value | $47.8 billion |

| Price/Earnings (P/E) | N/A |

|

Price/Book | 33 |

| Price/Sales | 45 |

| Gross Margin | 0.7 |

| Net Margin | -0.95 |

| EBITDA TTM | -$1.24 billion TTM |

| 52-week low | $8.90 |

| 52-week high | $45 |

| Short Interest | 3.1% |

| Average Wall Street rating and price target |

HOLD $24.61 |

Palantir stock forecast

More worrying than just the yield issues mentioned above is the strong likelihood that PLTR stock has formed a bearish double-top. This is one of the more powerful technical chart signals. If this plays out, that gives PLTR a target of $22. The target is on a break of the neckline and is the length of the neck and head, $4 in this case. On Monday, we stated that everything was fine chart wise, so long as $27.49 was held, as this was the previous high back in June and the level PLTR had broken through in a powerful surge last week. Monday's close at $27.47 does not exactly count as being broken, but the premarket is not looking good so far on Tuesday with European markets down and US futures lower.

We can also see some bearish divergences from our indicators. The Moving Average Convergence Divergence (MACD) is about to cross, a bearish signal. The Price Volume Trend (PVT) also did not form a double-top in line with the stock price.

FXStreet View: Neutral but with some strong bearish signals as mentioned. Bullish above $29.19. Bearish below $26 now.

Previous updates

Update September 29: NYSE:PLTR shed 3.24% on Wednesday to close the day at $ 24.52 per share, despite the better tone of Wall Street. Most indexes closed in the green, with the NYSE Composite up 15 points or 0.09%. The Nasdaq was the worst performer, losing 34 points or 0.24%. Investors are still struggling to digest US Federal Reserve chief words on inflation and tapering, as the central bank paves the wage for a tighter monetary policy.

Update: NYSE: PLTR tumbled 7.75% on Tuesday to reach the lowest levels in two weeks at $25.21 before recovering to finish the day at $25.34. The 2% sell-off in the broader Wall Street indices exacerbated the pain in Palantir Technologies shares, as investors were shaken off by the energy crisis in the Euro area and China. Further, the relentless surge in the US Treasury yields hurt the tech stocks amid expectations of higher interest rates. The stock price fell for the second straight day, looking to end September on a negative note.

Update: NYSE:PLTR plunged on Tuesday to close the day at $25.34 per share, down 7.75% on the day. Wall Street suffered a sentiment sell-off, as market participants rushed into safety amid renewed fears of a slowing global economic comeback. Bottlenecks and disruptions in the supply chains are the main issues that major economies face these days. All US indexes closed in the red, with the NYSE Composite losing 225 points or 1.36%.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.