Palantir Technologies Stock Price and Forecast: PLTR stock steadies itself for more gains

- Palantir stock registered further gains on Tuesday.

- PLTR closes up over 1% at $25.10.

- The meme stock has been strong since results and is ready for more.

Palantir stock registered more gains yesterday as the stock stabilizes and steadies itself for further gains after an impressive recent results release. The stock broke out after results, registering a gain of over 11% on results day, August 12. Since then, it has been slow and steady. A good continuation sign. The stock is an unusual one, as it manages to straddle the institutional investor space, as well as having a large band of meme stock retail traders who follow it.

This can be seen from the massive price spike back in early 2021 when PLTR was one of the original r/wallstreetbets stocks. It has since calmed down but has produced some solid results with the last ones being perhaps the most impressive.

While Palantir the company has been around for some time, Palantir the stock is a new phenomenon only listing in 2020. Cathie Wood and her ARK Funds have been a recent buyer snapping up stocks using the earnings, and then the slight dip to add more shares to the portfolio. Goldman Sachs is also a fan with them putting out a very strong recommendation back in early 2021 commenting on the proposed 30% compound annual growth rate. Goldman still rates the stock as a buy with a $34 price target. The recent doubling of free cash flow forecasts by Palantir from $150 million to $300 million certainly appears to show a healthy business.

Palantir key statistics

| Market Cap | $48.2 billion |

| Enterprise Value | $47.8 billion |

| Price/Earnings (P/E) | 135 |

|

Price/Book | 28 |

| Price/Sales | 40 |

| Gross Margin | 0.7 |

| Net Margin | -0.95 |

| EBITDA TTM | -$1.24 billion TTM |

| 52 week low | $8.90 |

| 52 week high | $45 |

| Average Wall Street rating and price target |

HOLD $24.61 |

Palantir stock forecast

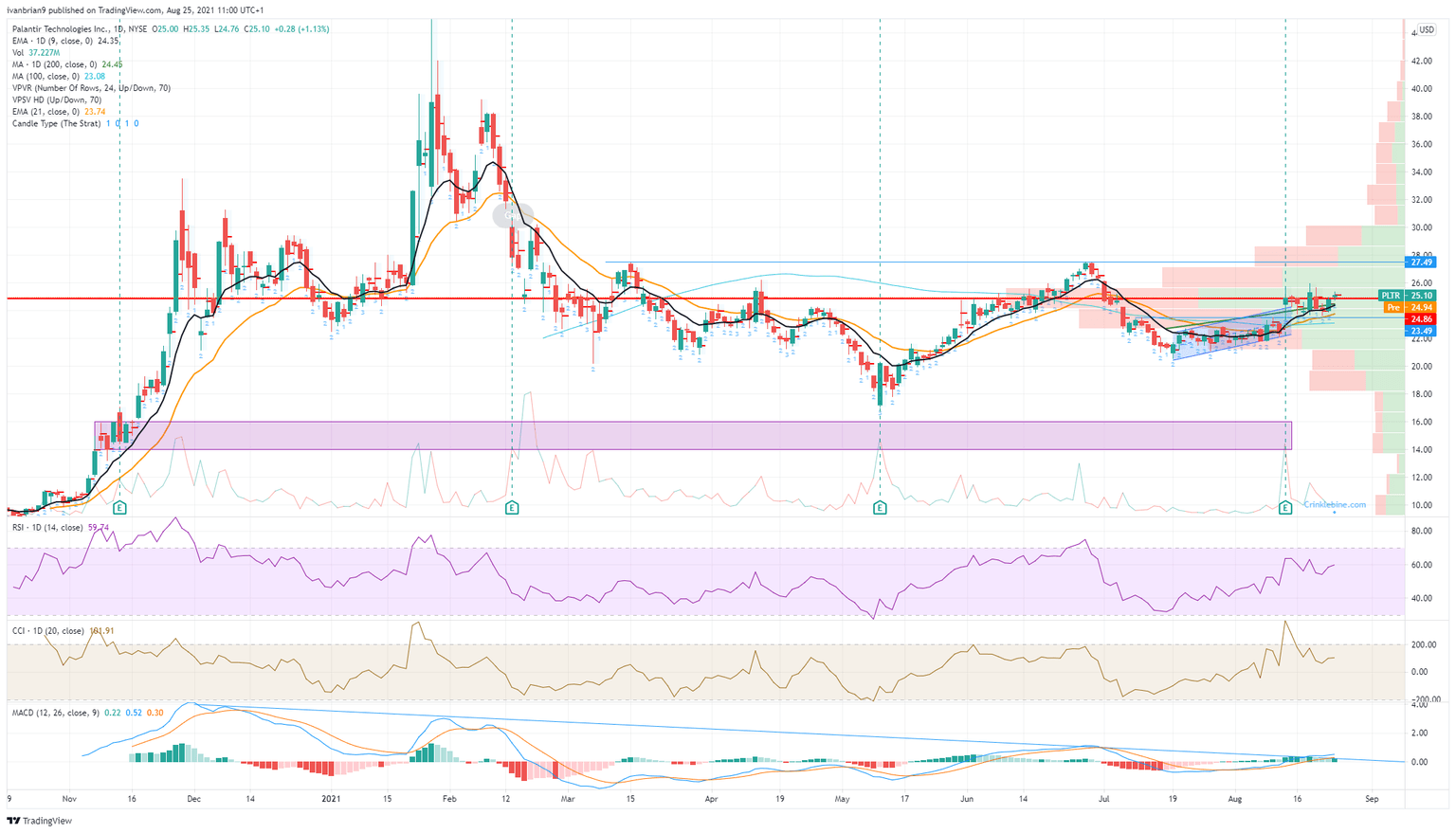

The chart remains healthy following on from the post-earnings breakout. The key level is the breakout level at $23.49. A breakout can retest the breakout level but if it goes back below then logically the breakout and any bullishness is gone. So, holding $23.49 is key for bulls. Above that, the stock can consolidate or power up for a test higher.

Palantir is in a high volume zone making moves slow and steady. It needs to break $27.49 to really get going as the volume is light above here. Given the meme stock renaissance currently sweeping across trading screens, with AMC and GME up over 20% yesterday, Palantir stock may catch some further retail attention. If it breaks $27.49 the target is to fill the gap from back in February to $31.34.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.