Palantir Technologies Stock Price and Forecast: Is PLTR ready to push higher and break $27.49?

- Palantir stock gets ready to push higher.

- PLTR stock has been bullish since results in August.

- Palantir flags more gains to come.

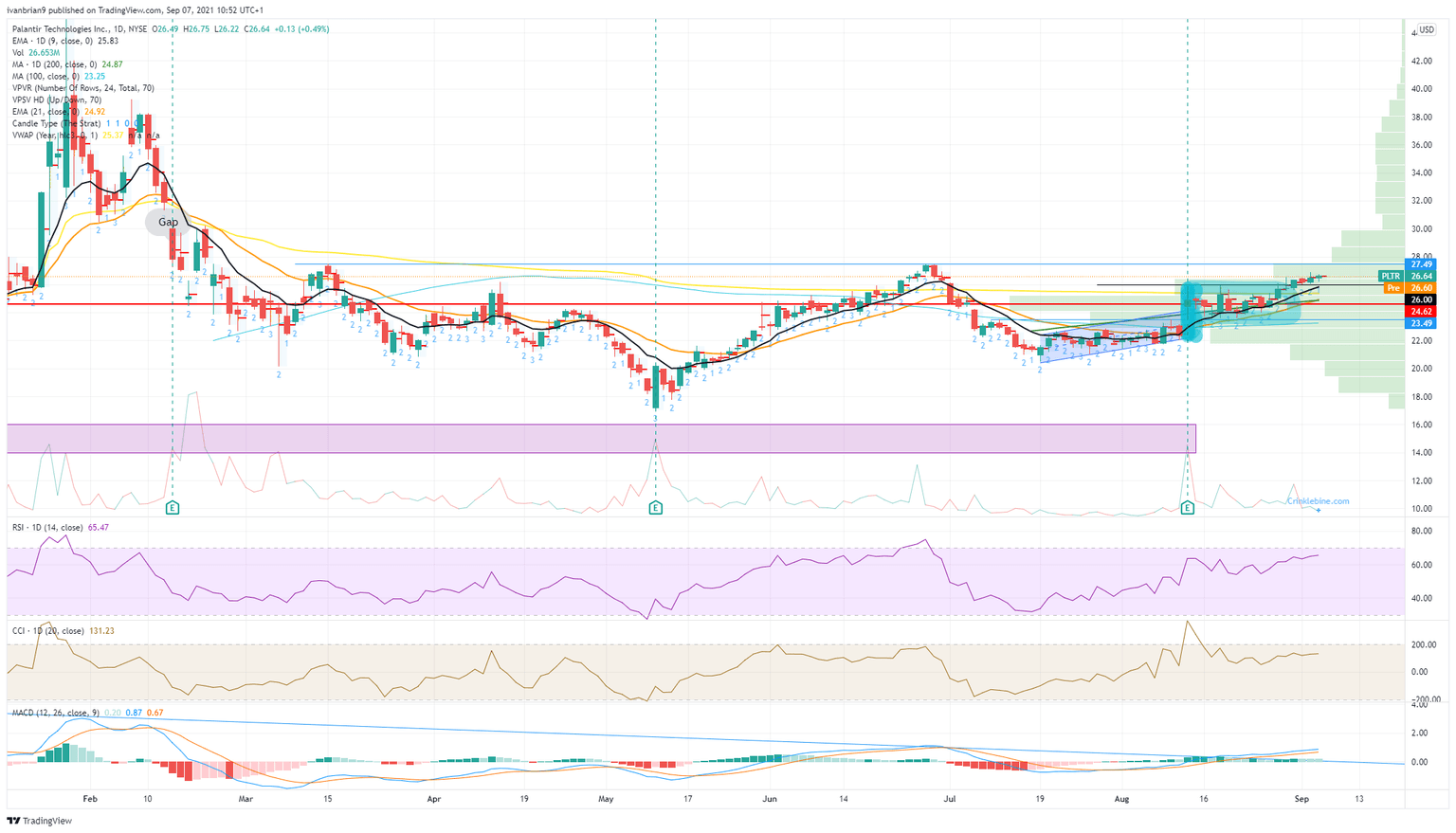

Palantir stock is getting ready to continue the recent bullish gains and push higher. The key resistance to target is the high from June at $27.49. The stock initially broke higher after a set of very strong results on August 12. The earnings per share (EPS) and revenue numbers came in ahead of Wall Street analyst forecasts, but the real showcase was the forward guidance. Palantir doubled its free cash flow guidance from $150 million to $300 million. The company also presented well in the post-earnings conference call, impressing investors with the number of customer wins, large customer revenue and continued progress in winning both public and private sector customers.

This saw Palantir stock rally 11% and break out of the trend channel it had been in. The move then consolidated, something we like to see after a strong move. Further bullishness was evident when some bad news hit the stock. The New York Post carried a story about a software glitch that Palantir rebutted. The stock was hit, but importantly it did not go below the breakout level after earnings. Rather, the dip was bought by many including ARK Invest who topped up their holdings. We, therefore, had the doubly bullish defense of the breakout level and the bad news not seeing a meaningful negative follow through to the stock price. This price action resulted in a continuation flag formation, which PLTR now looks like it has broken out of.

Palantir key statistics

| Market Cap | $51.2 billion |

| Enterprise Value | $47.8 billion |

| Price/Earnings (P/E) | 135 |

|

Price/Book | 28 |

| Price/Sales | 40 |

| Gross Margin | 0.7 |

| Net Margin | -0.95 |

| EBITDA TTM | -$1.24 billion TTM |

| 52-week low | $8.90 |

| 52-week high | $45 |

| Average Wall Street rating and price target |

HOLD $24.61 |

Palantir stock forecast

We got the continuation flag formation, and now it looks like TSLA has broken out of that. PLTR stock really needs to push on and break $27.49. This will attract more momentum buyers into the stock and help push the move onward. Breaking $27.49 will also see the volume profile drop off pretty sharply, meaning more gains are likely and easier to sustain. The gap at $31.34 is the next obvious target, which was created after results back in February.

The Moving Average Convergence Divergence (MACD) has broken nicely out of the long-term downtrend and the Relative Strength Index (RSI) is trending higher in line with the price. Bullish above $26, neutral from $26 to $23.49, and bearish below – that is our opinion on the stock. As ever please use stops and careful risk management.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.