Palantir Technologies (PLTR) Stock Price and Forecast: Ark Investment boosts shares

- Palantir shares jump after ARK Invest tops up.

- PLTR shares had suffered post Q4 results miss.

- Palantir shares still meme stock for 2021 retail traders.

Update: Shares in PLTR continue to bounce on Monday as JPMorgan invests in a stock trading venture with links to Palantir, according to reports from CNBC. Zanbato is a Californian-based fintech startup that has over 100 banks as members. Zanbato's trading platform ZX was launched in 2016. The firm itself Zanbato was founded in 2010 by Joe Lonsdale one of Palantir's co-founders. It is not clear if Palantir has any business dealing with Zanbato or if Zanbato uses any of Palantir's data analytics software products. Zanbato allows trading in pre-IPO stocks, a meme sector now given the interest in SPAC shares.

Palantir shares are another of the meme stocks for 2021, being targeted heavily by the new breed of retail traders. Palantir's share opened 2021 at $23.91 before being pushed higher by retail bulls. PLTR shares peaked at $45 on January 27. That matched the Gamestop day peak, when most retail interest shares, such as AMC, BBBY, BB and others, all topped as the /wallstreetbets mania reached its zenith.

PLTR stock news

From that peak on January 27, PLTR steadily slid back towards $30 as Q4 results were awaited. Investors were optimistic ahead of Q4 numbers, which were released on February 16. However, the results disappointed as Earnings Per Share (EPS) posted a surprising loss while sales numbers did meet expectations. The negative EPS number was the main focus though and PLTR shares slid 12% on Feb 16.

Post results, a number of analysts cautioned on the stock. William Blair downgraded PLTR from market perform to underperform, Morgan Stanley maintained an underperform rating but raised its price target for PLTR to $19 and Credit Suisse maintained an underperform but raised its price target to $20. Jeffries were slightly more upbeat, liking the long-term prospects for Palantir but remaining cautious due to the expiry of the founder's lock-up period.

PLTR stock forecast

The main catalyst though for the recovery seen on Friday was news that Goldman significantly upped its price target for Palantir. Goldman raised its target from $13 to $34 and upgraded its rating for Palantir from Neutral to Buy. This stopped the post results sell-off and gave a base to the stock.

Better news followed for PLTR holders as ARK Invest's Cathie Wood spoke on CNBC about Palantir saying she liked the stock for the long term. ARK Invest disclosed on Tuesday that it had purchased nearly 1.5 million shares in Palantir. Friday saw the real boost for bulls as ARK Invest disclosed they had purchased another 5 million shares in PLTR.

It is unclear whether this was purchased from Palantir executives who had been prevented from selling shares until after Q4 results. We will have to wait for SEC filings to confirm this or not. The lock-up had been holding some analysts from being more positive on Palantir stock. Shareholders with substantial holdings have 10 days to report transactions to the SEC.

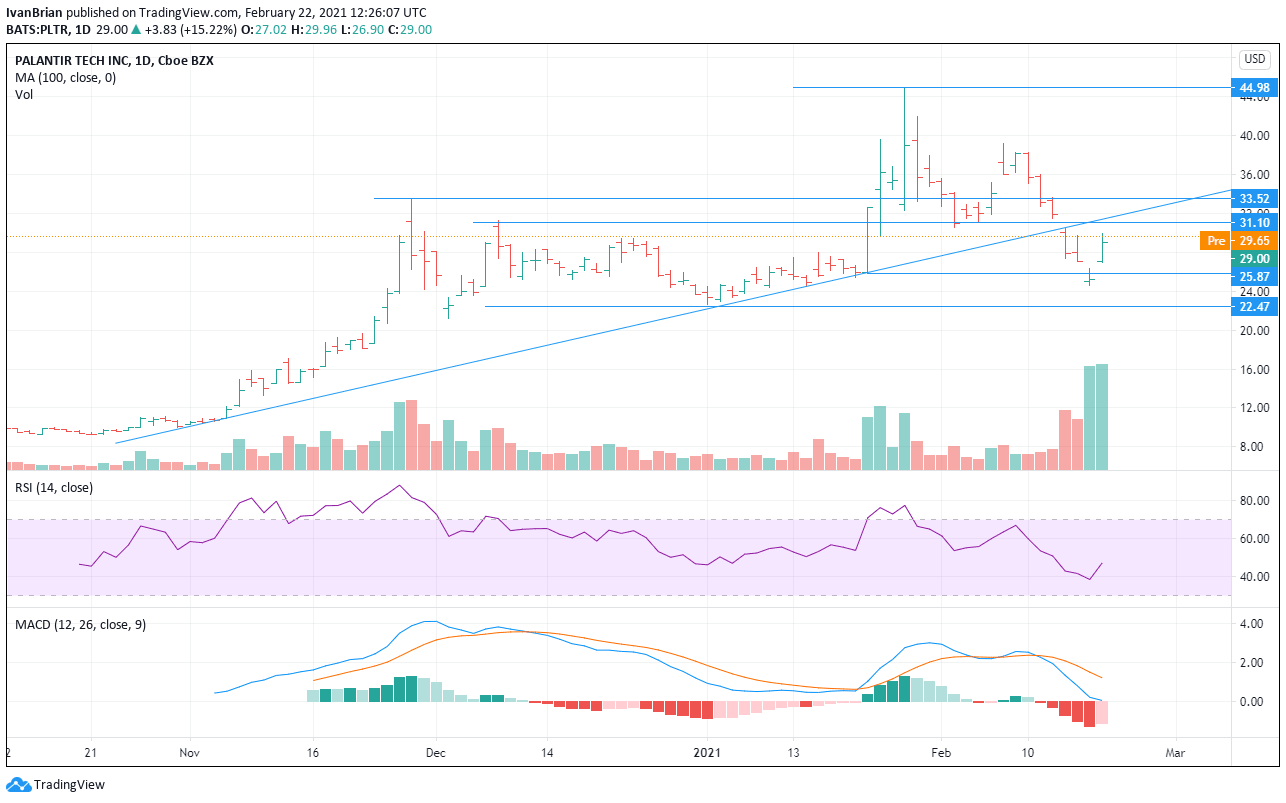

PLTR technical analysis

PLTR just maintained its bullish trend which was held by not breaching the $22.47 low from January 4. The first target is psychological $30 and then $31.10. Volume has spiked for the bounce which is a further positive.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.