Palantir Technologies (PLTR): Stock News and Forecast: Shares bounce sharply higher as ARK Invests

- Palantir (PLTR) shares bounce sharply on Friday.

- PLTR results disappointed as it posted an EPS loss.

- ARK Invest adds to its position in Palantir (PLTR).

Update: Shares in Palantir bounced sharply on Friday as traders circulated news mentioned here on Thursday that ARK Invest had upped its position in PLTR. Cathie Wood speaking on CNBC on Thursday had downplayed PLTR as a short-term play but was happy with the long-term growth outlook. Goldman Sachs had also strongly upgraded PLTR. Shares are now up 9% at $27.02.

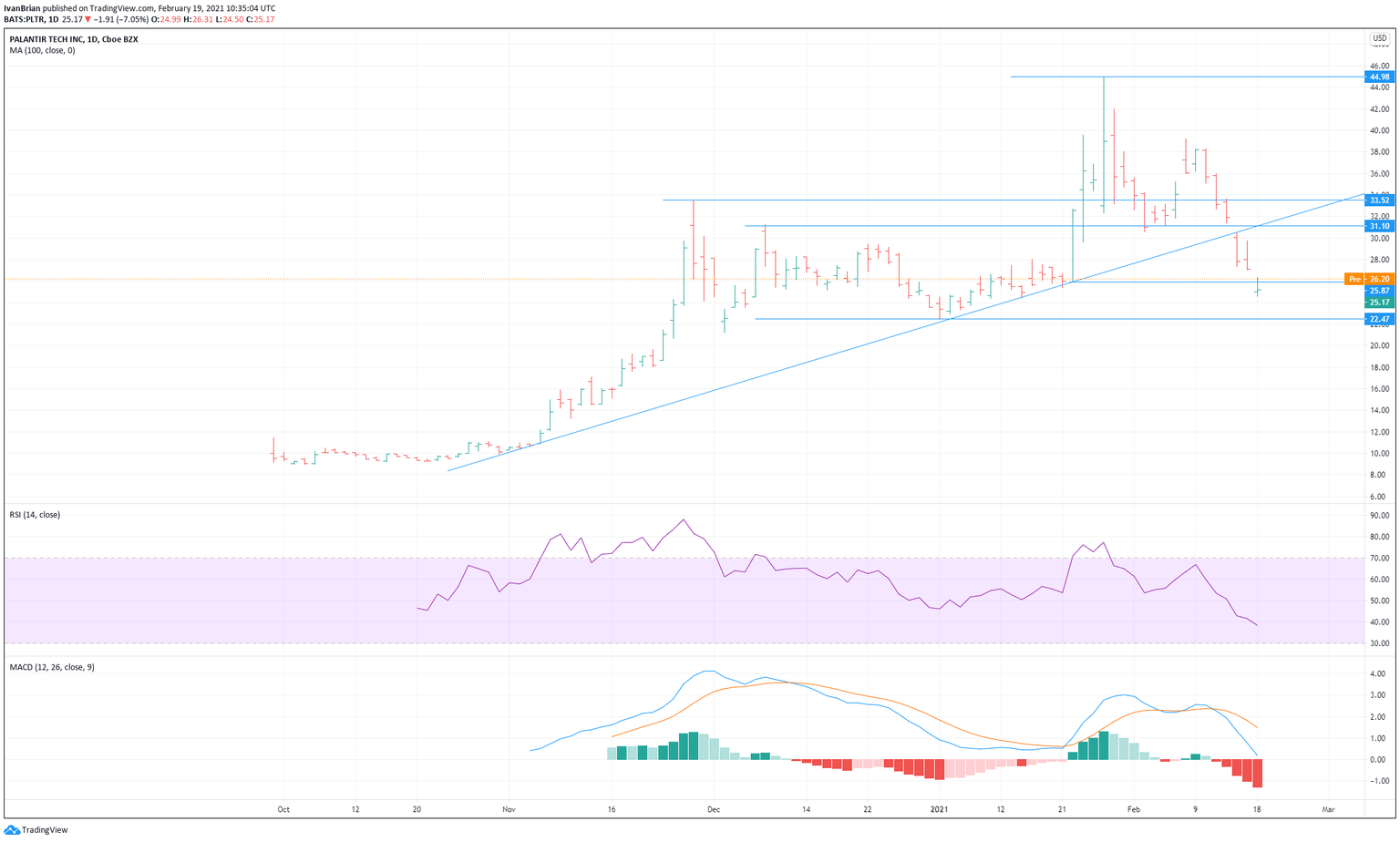

PLTR Stock Price

Shares in Palantir continued their post-earnings slide on Thursday with the shares closing down 7% at $25.17. PLTR shares have continued their fall as investors were expecting a positive EPS result on Wednesday. While EPS did disappoint, sales numbers and outlook were encouraging. The shares are now approaching key support at $22.50, the last significant low from January 4.

PLTR Stock News

Post results saw some target price upgrades but the most notable was Goldman Sachs upping their price target from $13 to $34 and giving PLTR stock an Buy rating from a previous neutral. Goldman said "With improving visibility into near- and long-term growth, we believe PLTR should trade more in line with 30%+ growth businesses, which are trading at 44x CY21 sales, our new target multiple for PLTR on SNTM sales". Jeffries also remain upbeat on Palantir despite he earnings miss saying Palantir is "a highly unique story for long-term investors" but noting caution due to the expiring lock up and recent appreciation. Cathie Wood of ARK Invest also promoted the long-term value in Palantir as she increased her investment in Palantir saying it was a long-term play, best to "stay away short term" and that "Palantir's attitude is refreshing in investing aggressively".

Other analysts were less bullish with William Blair downgrading the stock from market perform to underperform, Morgan Stanley maintained an underperform rating but raised its price target for PLTR to $19 and Credit Suisse maintained an underperform but raised its price target to $20.

PLTR Lock up

Palantir founding shareholders and key executives have been restricted from selling their shares until after Q4 results. That lock-up period expires today Friday, February 19. This has concerned some investors and analysts, fearful that the recent surge in the stock price may lead to some block selling from founder shareholders. This may be weighing on the stock and insider transaction reports will give an idea as to management's confidence in the growth outlook.

PLTR Technical analysis

PLTR has lost the bullish trend and key support now is at $22.50 the low from early January. RSI and MACD confirm the recent sell off with MACD widening perhaps indicating the sell off is reaching exhaustion. Significantly yesterday PLTR shares closed higher than their open on a negative day for technology tocks overall.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.