Watch the video extracted from the WLGC session before the market open on 13 Feb 2024 below to find out the following:

-

The key support level for the Nasdaq 100

-

The directional bias for the long-term, swing and immediate term.

-

The red flags you need to be aware of in this current market.

-

and a lot more...

Market update 14 Feb 2024

A sharp selloff happened after the live session as the market reacted to the CPI data.

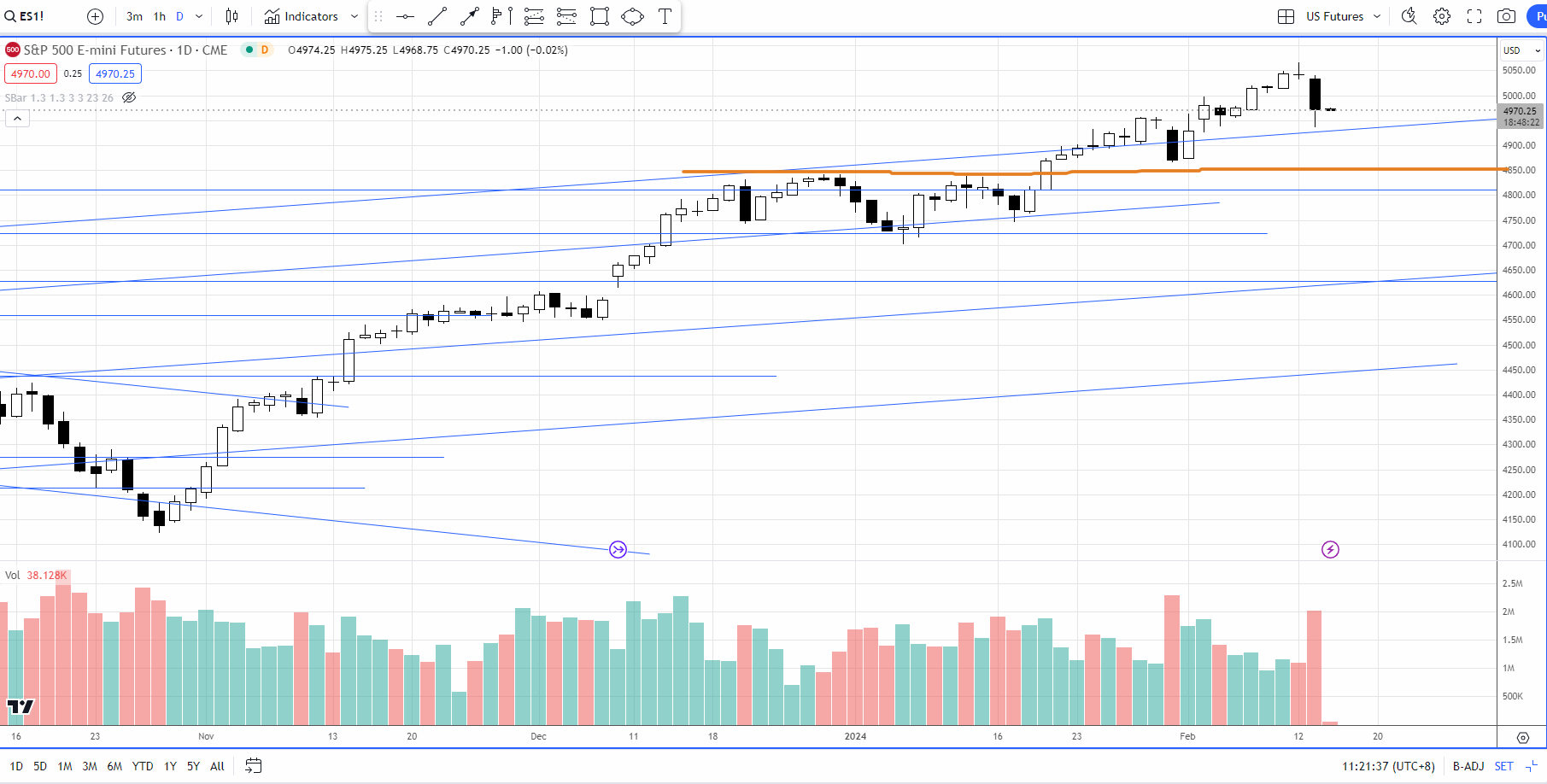

The magnitude and supply are slightly less than 31 Jan 2023. So far yesterday’s drop in S&P 500 (ES) did not pose a great concern yet. 4850 is a meaningful support that needs to hold.

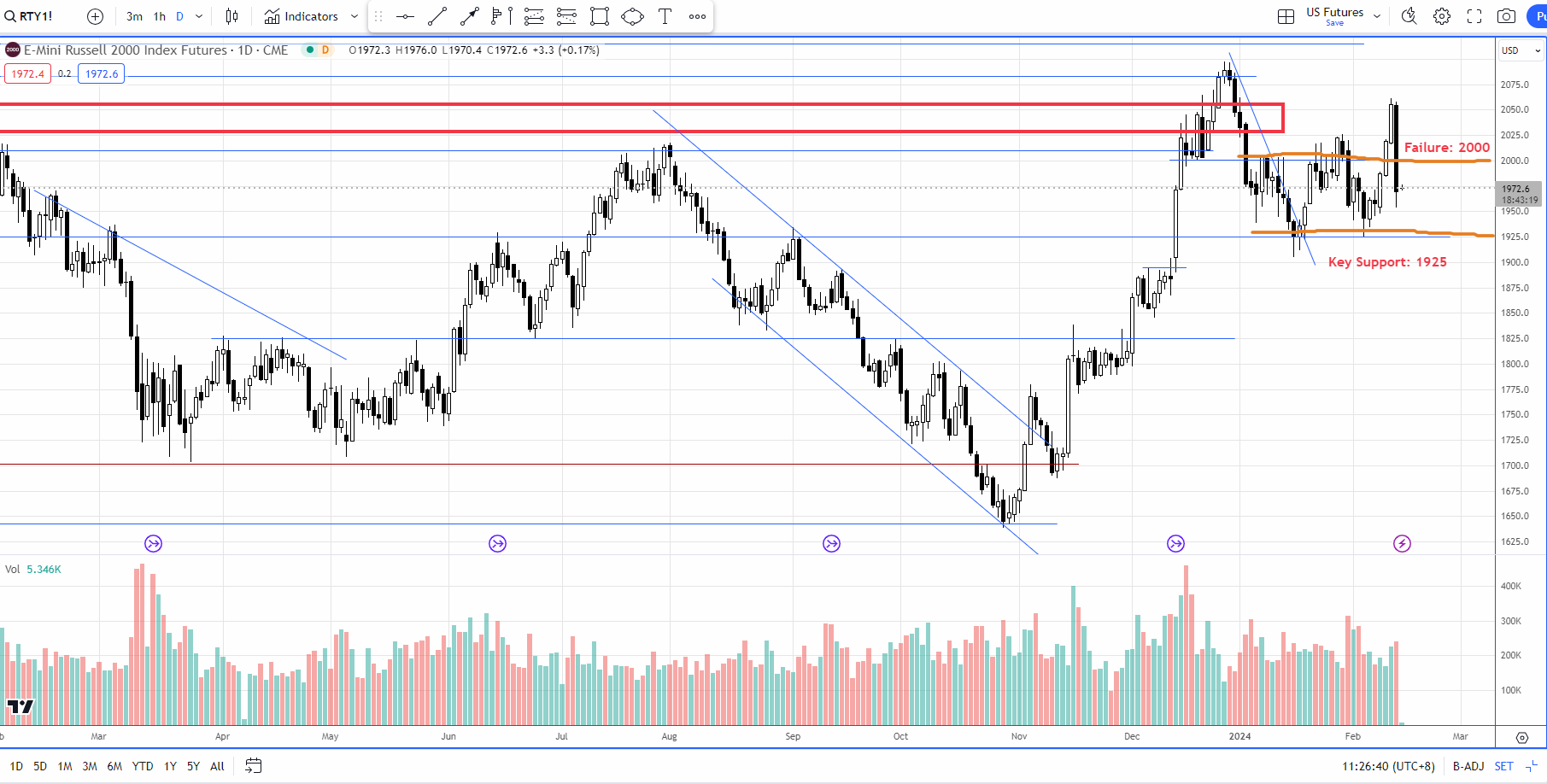

Meanwhile, Russell 2000 (RTY) had a more severe drop, as shown below:

RTY failed at the key level - 2000 twice.

If it breaks below the support at 1925, the major indices like S&P 500, Nasdaq 100, and Dow Jones are likely to join the sell-off as Russell 2000 leads the way down.

A commitment above 2000 is the key to broadening market breadth and the bullish momentum will return.

We will get more clues in the next few days.

The bearish analogue in S&P 500 discussed in the tweet below is still valid and could be unfolding accordingly.

"This is like a topping formation. We have seen it right here. Although this probably like a megaphone type of the formation rather than a rectangle.

— Ming Jong Tey (@MingJong) February 7, 2024

In terms of the overbought condition analog. There's a chance for it to follow this kind of the pullback." $ES $SPX #SP500 pic.twitter.com/fVEZuen9iQ

Market environment

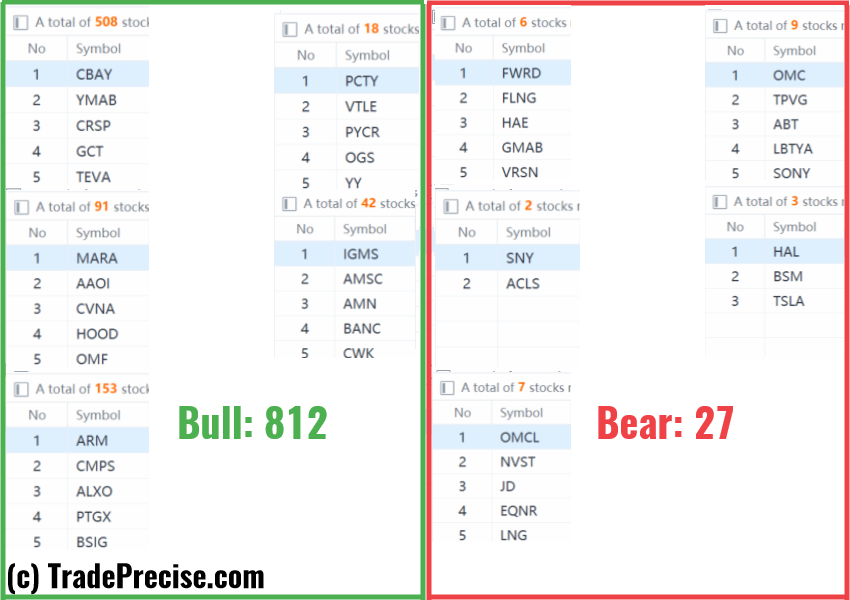

The bullish vs. bearish setup is 812 to 27 from the screenshot of my stock screener below.

9 “low-hanging fruits” (NFLX, CYTK, etc…) trade entries setup + 12 actionable setups (AMD etc…) plus 11 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

CYTK

NFLX

AMD

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.