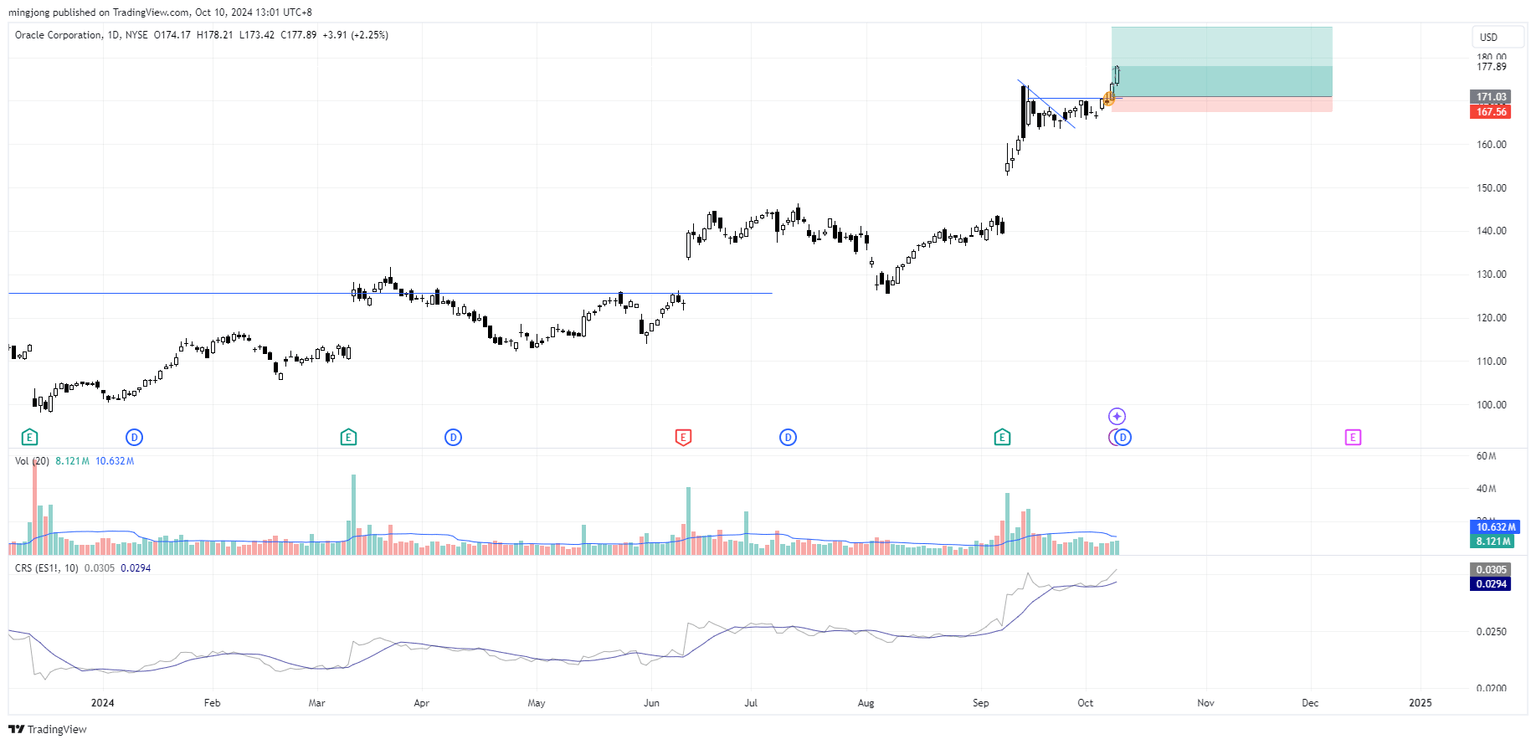

Oracle (ORCL): Bull flag breakout signals massive gain ahead [Video]

![Oracle (ORCL): Bull flag breakout signals massive gain ahead [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Software/software-code-637435356353853480_XtraLarge.jpg)

Oracle has shown impressive movement following a breakout from its recent accumulation structure. Here's what traders need to know:

-

Accumulation structure: Oracle formed a strong accumulation base, despite gaps during earnings.

-

Bull flag formation: After a sign of strength rally, a bullish flag pattern emerged, indicating possible continuation upward.

-

Key level to watch: A breakout above the $171 level will confirm this move, with potential gains ahead.

-

Stop-loss strategy: Traders should consider placing stops near the swing low around $165.

Trading plan for Oracle (ORCL) stock [Video]

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.