Omicron Covid update: Wait and see, meanwhile, traders buy the dip

- Asian share markets are trading in positive territory following a recovery on Wall Street.

- Markets take solace in cautious optimism over the new covid variant.

Nations are looking to take precautionary measures and speed up the vaccination processes while monitoring to see whether it emerges that the new coronavirus variant, Omicron, is no more dangerous than the Delta variant. Investors are of the mind that markets are cheap at this juncture following the knee-jerk reaction at the end of last week.

Asian share markets are trading in positive territory on Tuesday due to the cautiously optimistic outlook on the new Omicron variant following comments made by global officials that have eased the angst. Sentiment in markets has been helped by the WHO; while urging caution, the organization noted that symptoms linked to the new strain so far have been mild. Additionally, Moderna added to the positive sentiment by predicting it would have a modified vaccine ready by early 2022.

Additionally, US President Joe Biden that new lockdowns as a result of the variant were off the table for now. Covid symptoms linked to the new omicron variant have also been described as “extremely mild” by the South African doctor who first raised the alarm over the new strain. Dr. Angelique Coetzee told the BBC on Sunday that the patients seen so far have had “extremely mild symptoms.” This equated to a relief rally on Wall Street and made for a brighter lead for Asian markets.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.52% higher on Tuesday early in the day while, in Australia, the S&P/ASX200 .AXJO was up 1.15%. Japan's Nikkei NI225 was trading 1.2% higher early in the session also. However, Hong Kong's Hang Seng Index HSI underperformed, down 0.25% while China's blue-chip CSI 300 index 399300 was up 0.13%.

Meanwhile, the WHO has said it will take weeks to understand how the variant may affect diagnostics, therapeutics and vaccines. As for cases found around the world, CNN published the following within the last few hours:

Australia: 2 cases.

Austria: 1 case.

Belgium: 1 case.

Botswana: 19 cases.

Canada: 3 cases.

Czech Republic: 1 case.

Denmark: 2 cases.

Germany: 3 cases.

Hong Kong: 3 cases.

Israel: 1 case.

Italy: 1 case.

Netherlands: 13 cases.

Portugal: 13 cases.

South Africa: 77 cases.

Spain: 1 case.

United Kingdom: 9 cases.

Forex markets in a correction

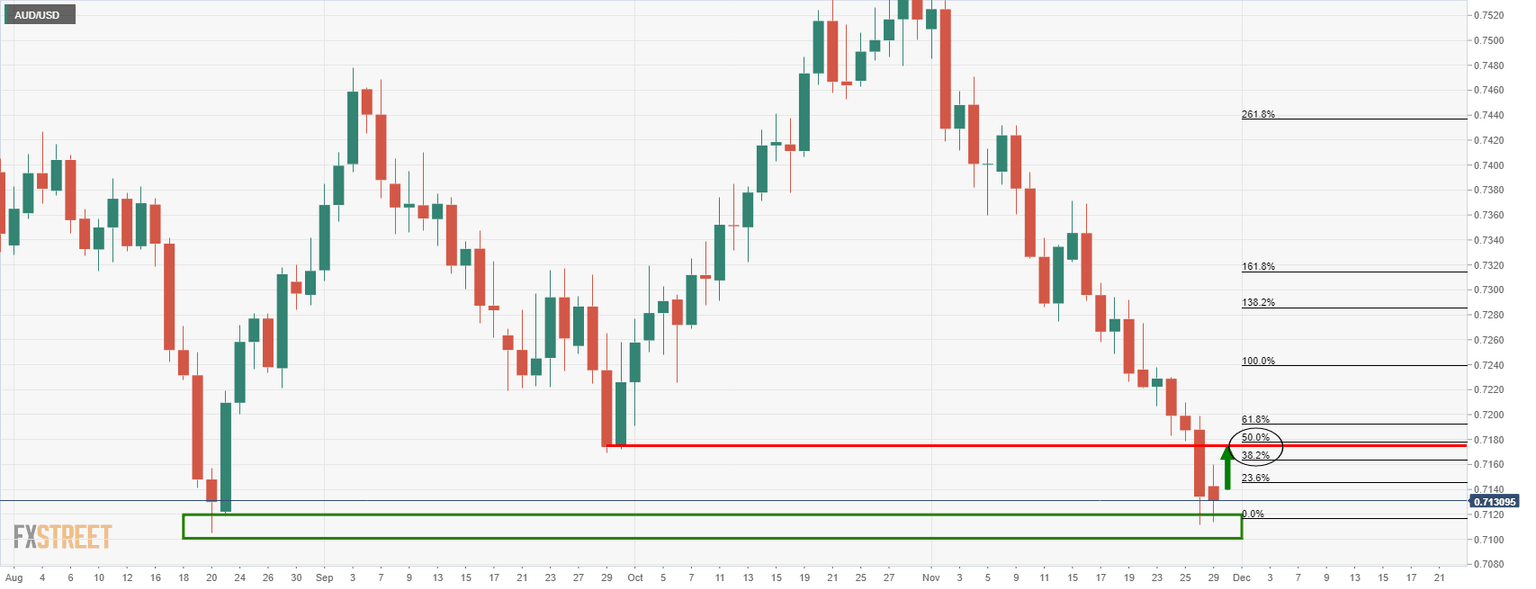

Traders are buying the dip as solace is found in the optimism so far and we are seeing corrections in risk-related FX such as in the Aussie and yen crosses:

AUD/USD is making headway towards a 38.2% Fibonacci retracement near 0.7160.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.