Okta and CrowdStrike News: CRWD stock falls despite earnings beat, while OKTA gains strongly

- CRWD stock falls in afterhours trading as earnings beat estimates.

- CrowdStrike beats on both top and bottom lines.

- OKTA beats on top and bottom lines and pushes ahead in the afterhours market.

CrowdStrike (CRWD) shares fell in the afterhours market on Thursday as the stock had put in a very strong performance during the regular session. CRWD stock closed up just under 8% at $174.02 as investors anticipated a strong earnings report. Well, that is what they got, but the stock fell anyway. "Better to travel than arrive" or "Buy the rumor/sell the fact": take your pick from the tried and trusted market excuses!

CrowdStrike Stock News: Earnings beat was priced in

CrowdStrike reported Q1 earnings per share (EPS) of $0.31, which was considerably ahead of the $0.23 estimate. Revenue also comfortably beat estimates, reaching $488 million against the average estimate of $463 million. CrowdStrike also provided updated guidance for Q2 earnings. CRWD now forecasts Q2 revenue of $514.75 million and the midpoint on EPS of $0.275. This compares with prior estimates for Q2 of $510 million in revenues and EPS of $0.24. Crowdstrike also gave upgraded guidance for 2023, which again was higher than previous analyst forecasts. Customer wins were strong with growth at 57% yearly bringing total customers to 17,945.

Okta Stock News: Earnings beat extends share price

OKTA also beat, EPS was $-0.27 versus the $-0.34 expected. Revenue reached $415 million, $26 million higher than forecast. OKTA also gave strong guidance with revenue for Q2 now forecast at $429 million versus the $422 million earlier presumption.

OKTA was and still is down sharply for 2022 – 57% – while CRWD is a much stronger performer, losing 15% in 2022. That partly explains the overreaction of OKTA relative to CRWD.

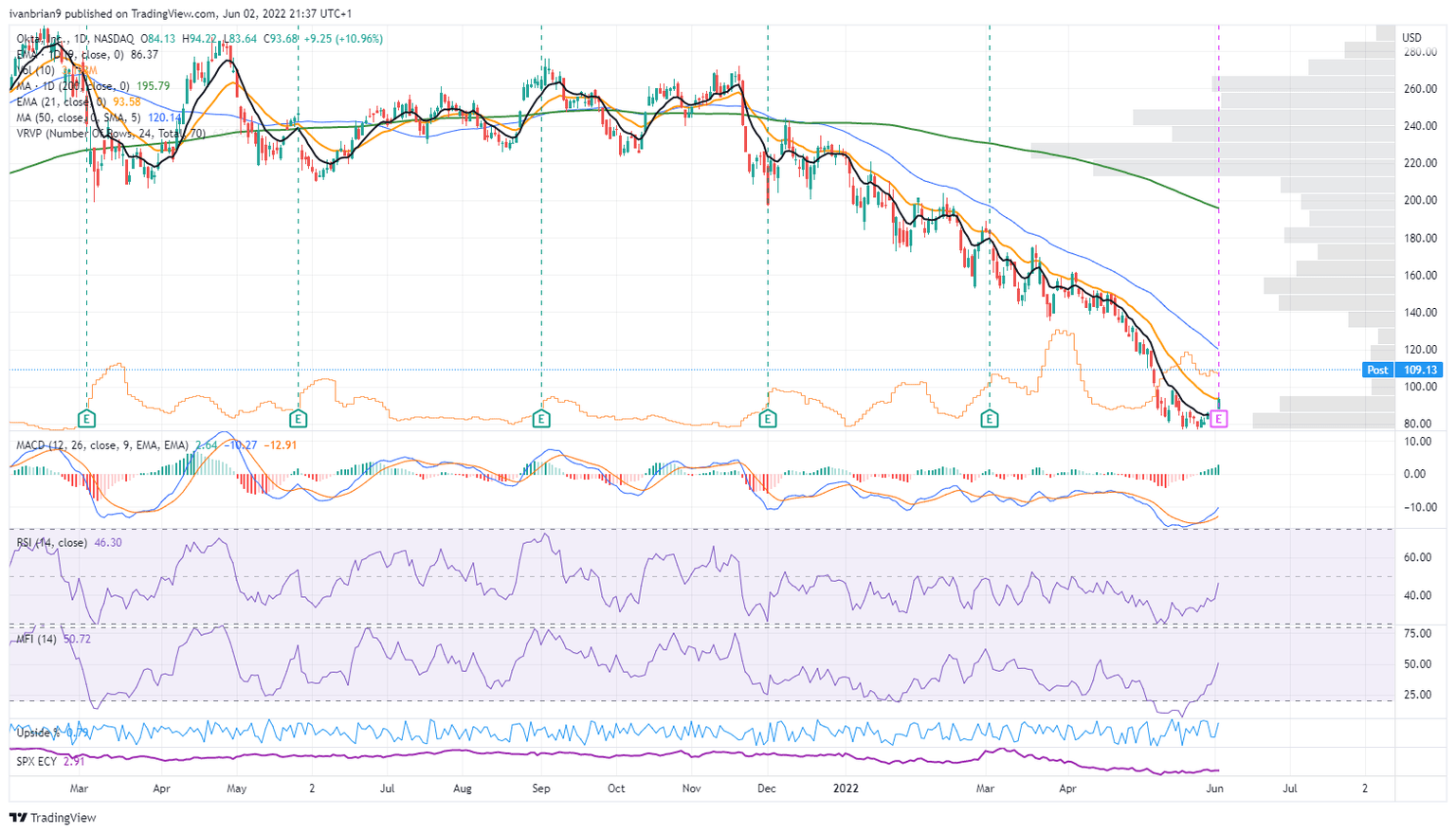

Okta Stock Forecast: Oversold signals foreshadowed price action

Oversold signals from both the Money Flow Index (MFI) and the Relative Strength Index (RSI) last week have now been added to with this strong set of earnings and guidance. A short-term bottom may be in place, and the huge volume gap from $100 to $140 is notable. This is one to watch, but a period of stability after this move is needed, which should lead to a continuation formation.

OKTA chart, daily

CrowdStrike Stock Forecast: Must retain $160 support

Again CRWD stock was showing as oversold last week on both the MFI and the RSI. Holding above $160 is key for bulls.

CRWD daily chart

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.