Oil jumps over 1% with IEA seeing world oil demand growing in 2024

- WTI Oil trades up around 3% in just two trading days.

- Oil traders are seeing bullish positioning paying off after US stockpiles unexpectedly declined.

- The US Dollar Index trades at 103.00 after hot PPI data.

Oil prices are rallying for a second consecutive day after the weekly US Crude data pointed to a drawdown in stockpiles. The recent drop was unexpected, although traders were already positioned for a draw in recent days with markets asking questions on how long the US could keep up this pace of pumping up Oil. It looks like OPEC and the US are playing a game of chicken to see who will be the first one to lose: the US by seeing its stockpile decline substantially, or will it be OPEC forced to apply more, longer, and deeper production cuts?

The US Dollar, meanwhile is trading substantially higher after US Producer Price data came out higher on all fronts. The beat on estimates and the upside surprise leaves traders now puzzled on what to do next. US Federal Reserve Chairman Jerome Powell said the Fed would cut once data came down significantly and confirmed containment of price pressure, though an uprise in inflation has not been communicated by the Fed. This could threaten the projection of a June initial rate cut being pushed further away.

Crude Oil (WTI) trades at $80.13 per barrel, and Brent Oil trades at $84.32 per barrel at the time of writing.

Oil news and market movers: IEA sees growth in demand

- The US Crude stockpiles are decreasing. According to the US Energy Information Administration, stockpiles fell by more than 1.5 million barrels in the week ending March 8, against expectations of an increase. This adds to data from the American Petroleum Institute (API) released on Tuesday, which showed a decline of 5.5 million barrels in the same period.

- The International Energy Agency (IEA) sees room for OPEC to boost production by the end of 2024 under a supply deficit that starts to form. The IEA pencils in July as the moment when OPEC+ could fully unwind its production cuts.

- The IEA also revised its demand for oil, making its growth forecast being bossted again by roughly 50% since introduced last year in June.

- The US has held secret talks with Houthi Rebels on Red Sea attacks.

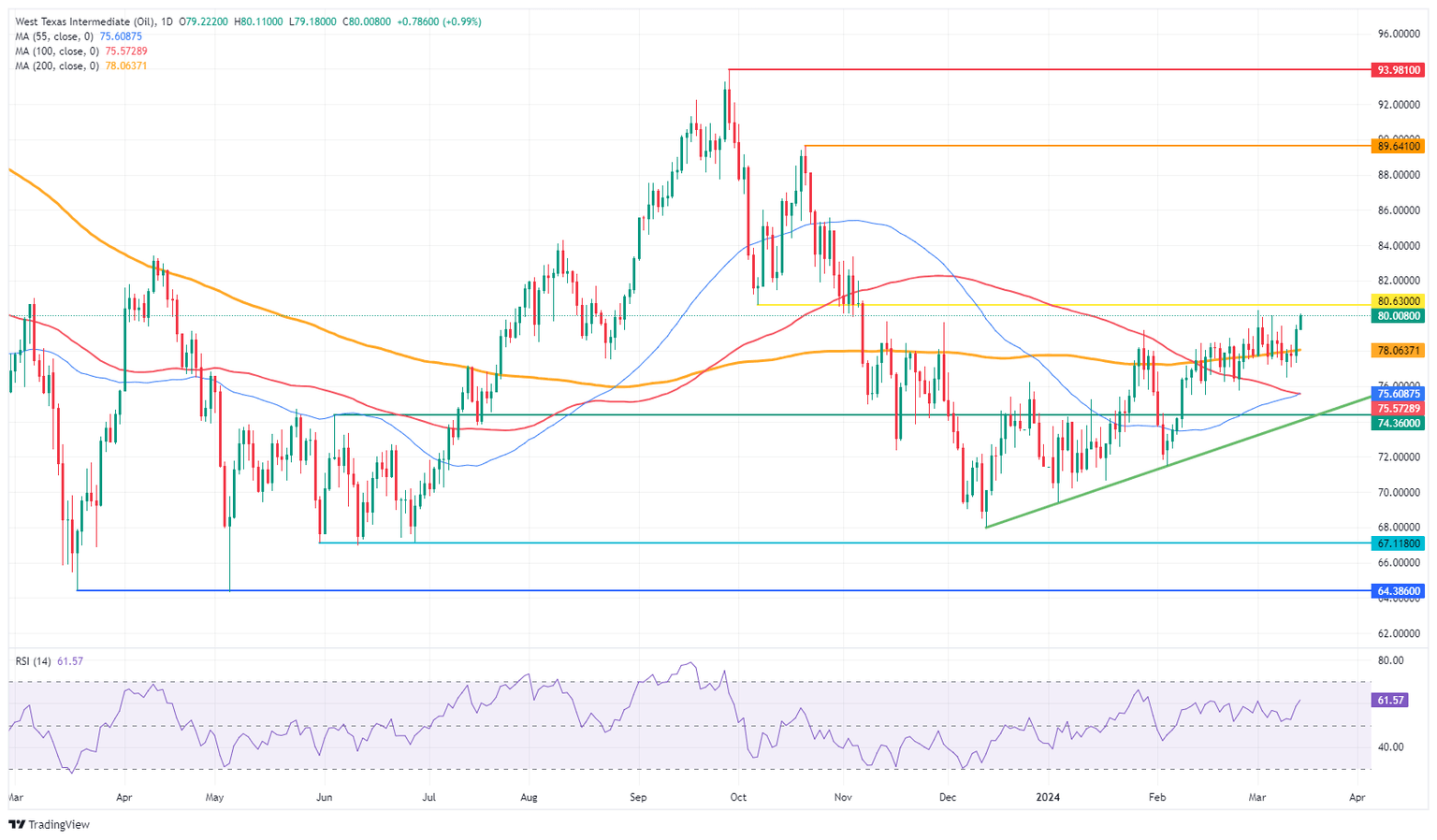

Oil Technical Analysis: OPEC steady and having a good hand

Oil prices could be entering a broad uptrend when it comes to a purely technical angle. The 55-day Simple Moving Average (SMA) at $75.61 is crossing the 100-day SMA at $75.57. Once both elements are starting to head higher, Oil prices should see more inflow with more bullish bets being placed in the option space, widening the spread between puts and calls, and thus creating volatility which could see Crude sprint to $89.64 by summer.

Oil bulls still clearly see more upside potential seeing the spreads on Oil futures in favor. The break above $80 needs to see a daily close in order to confirm a change in sentiment. Next up is the $86 level. Further up, $86.90 follows suit before targeting $89.64 and $93.98 as top levels.

On the downside, the 100-day and the 55-day Simple Moving Averages (SMA) are near $75.57 and $75.61, respectively. Add the pivotal level near $75.27, and it looks like the downside is very limited and well-equipped to resist the selling pressure.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.