- NASDAQ:OCGN drops by 20.24% despite the NASDAQ breaking through the 14,000 barrier.

- One Wall Street analyst warns OCGN has risen too high in a short amount of time.

- OCGN is attempting to bring its COVID-19 vaccine candidate to the United States.

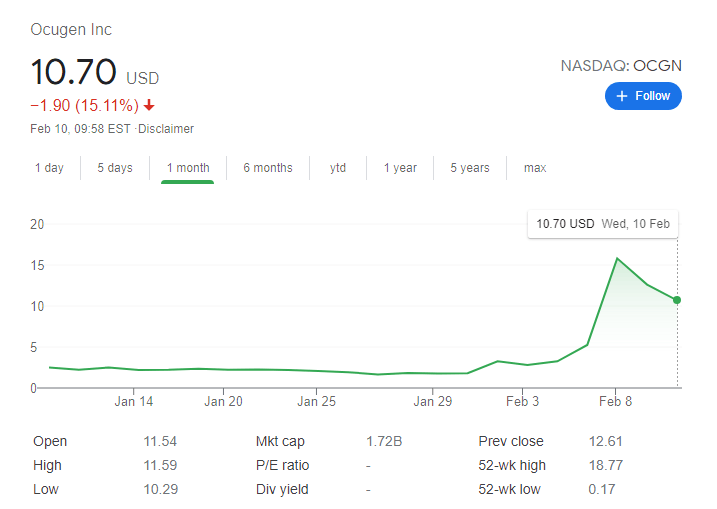

Update: Ocugen Inc (NASDAQ: OCGN) has kicked off Wednesday's trade with a substantial decline of around 15% to trade below $11. Shares of the Malvern, Pennsylvania-based company are falling for the second consecutive day after hitting an all-time high of $18.77. One of the reasons for the decline from the highs – it is essential to note that OCGN was a penny stock back in December – is profit-taking. Another factor is that some investors are concerns that the deal that Ocugen struck with Bharat BioTech may not yield the dividends that some expect. The road to a COVID-19 vaccine may be long. See all the latest hot stocks news.

NASDAQ:OCGN has finally hit a speed bump as the penny biotech stock surged to a new all-time high in 2021, already returning over 500% to its investors. On Tuesday, the stock fell 20.24% to close the trading day at $12.61 as Wall Street cautioned investors on the meteoric stock performance. Even with the drop, Ocugen has grown from a stock worth $0.20 to a $2 billion market cap company all within the span of the past 52-weeks, as the Pennsylvania-based firm uses its leverage to take on some pharmaceutical giants.

Those companies that Ocugen is challenging include Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA), the two leaders in the COVID-19 vaccine race. Ocugen is not producing their own vaccine though, but rather are working on receiving FDA Emergency Use Authorization to bring over Bharat’s vaccine candidate, Covaxin. Bharat is an Indian pharmaceutical titan that has produced an intranasal vaccine for COVID-19 that does not require a shot. Bharat would supply the initial doses but Ocugen is looking to work with American-based biotech companies to produce subsequent doses of Covaxin.

OCGN stock news

OCGN also received an analyst downgrade on Tuesday as Chardan analyst Keay Nakae warned of the euphoria surrounding Ocugen, and lowered the price target to $13. While Ocugen certainly has a high ceiling moving forward given it has agreed to a 45% revenue split with Bharat, Covaxin still has yet to receive FDA EUA. In fact, Ocugen has yet to even approach the FDA and Phase 3 clinical trials are still taking place until March. Investors who have ridden Ocugen up from its penny stock status may want to trim some profits until more affirmative news is released.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds losses below 1.1400 amid US Dollar recovery

EUR/USD remains pressured below 1.1400 in the European trading hours on Tuesday. The Euro weakens amid rising expectations of further ECB interest rate cuts while the US Dollar draws support from some progress on US trade deals with its major global trading partners. US jobs data awaited.

GBP/USD retreats below 1.3400 ahead of US data

GBP/USD reverses its direction and trades below 1.3400 after setting a multi-year high near 1.3450 earlier in the day. The US Dollar (USD) stays resilient against its rivals as markets remain optimistic about a de-escalation in the US-China trade conflict. Focus shifts to key macroeconomic data releases from the US.

Gold declines toward $3,300 on improving risk mood

Gold price remains heavily offered through the early European session, though it manages to hold above the $3,300 mark amid mixed fundamental cues. Signs of easing US-China trade tensions continue to drive flows away from traditional safe-haven assets and undermine demand for the precious metal.

JOLTS job openings expected to dip slightly in March as markets eye April employment data

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to retreat to 7.5 million on the last business day of March with the growing uncertainty surrounding the impact of Trump’s trade policy.

May flashlight for the FOMC blackout period – Waiting for the fog to lift

We expect the FOMC will leave its target range for the federal funds rate unchanged at 4.25-4.50% at its upcoming meeting on May 6-7, a view widely shared by financial markets and economists. Market pricing currently implies only a 9% probability of the FOMC cutting the fed funds rate by 25 bps.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.