NZD/USD tumbles to fresh two and half-year lows, as the king dollar flourishes

- NZD/USD fell to two and half-year lows at 0.5544 as the greenback strengthened.

- Fed’s policymakers emphasized rates need to be restrictive for some time, above the 4% threshold.

- Last week’s US NFP opened the door for further Fed hikes.

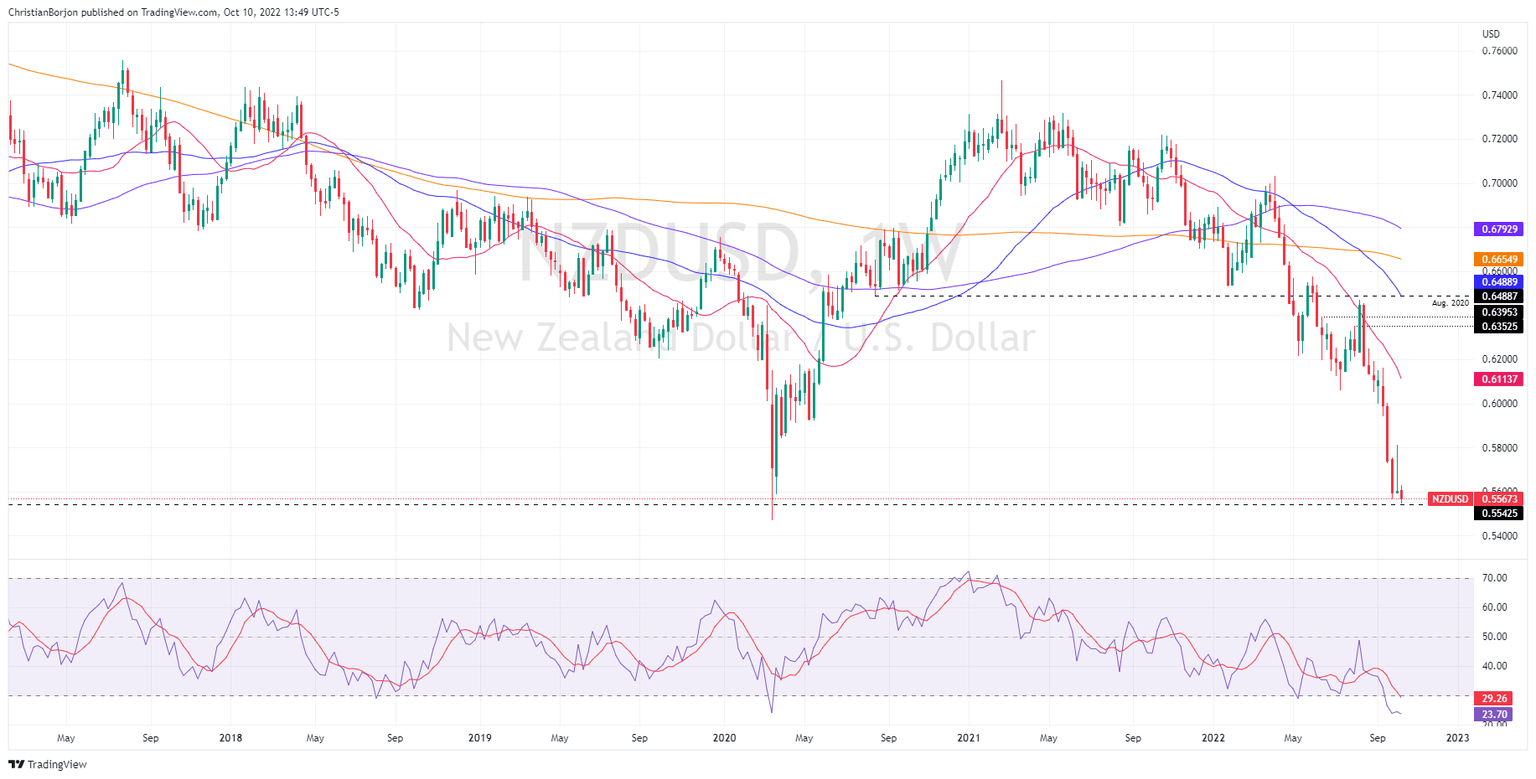

- NZD/USD Price Forecast: To re-test the 2020 YTD low at 0.5469 if it breaks below 0.5500.

The NZD/USD fell to a fresh two and half-year low at 0.5544, due to a dampened market mood, with investors seeking safety bolstered the greenback on several factors. At the time of writing, the NZD/USD is trading at 0.5567, after hitting a daily high at 0.5629, below its opening price by 0.67%.

Given the backdrop of the Federal Reserve’s aggressive tightening, which could take a toll on US Q3 company earnings, geopolitical risks and US-China arising tensions, are the main drivers of market mood.

Of late, comments of Fed officials led by Vice-Chair Lael Brainard commented that the US economy has decelerated by “more than anticipated”, but added that some sectors are not feeling the effects of rate hikes. She said that monetary policy needs to be restrictive for some time to ensure that inflation returns to the Fed’s 2% target. Earlier, Chicago’s Fed Evans expressed that the US central bank could be able to slow down inflation “while also avoiding a recession,” and still sees the Federal funds rate (FFR) above the 4.5% early in 2023 “and then remaining at this level for some time.”

Last week’s US economic data, mainly the Nonfarm Payrolls, justifies the Fed’s need for additional rate increases. With the US economy adding more than 263K jobs to the economy and the unemployment rate easing, the odds of the Fed hiking rates by 75 bps lie at 80% for November’s meeting

The US Dollar Index, a gauge of the greenback’s value, climbs 0.21%, at 112.980, gaining against most G8 currencies.

Albeit the NZD/USD dropped to fresh YTD lows, prices might be capped by the Reserve Bank of New Zealand’s (RBNZ) hawkish rhetoric and 50 bps rate hike during the last week’s meeting.

According to ANZ analysts: “In our view, the RBNZ said “all the right things” last week, and are clearly determined to get on top of rampant inflation, but markets continue to fret about recession risks, and at the same time, US interest rates continue to rise, undermining higher Kiwi rates. It’s all a bit messy, and market participants pushing back against the trend softening in risk appetite continue to get hit hard.”

NZD/USD Price Forecast

The NZD/USD weekly chart suggests the major could be testing the 2020 yearly low of 0.5469, 100 pips lower than the exchange rate at the time of typing. Nevertheless, RSI’s standing in oversold conditions, alongside price exhaustion, it opens the door for a consolidation. However, traders need to be aware that the release of US inflation figures on Thursday could open the door for further losses beyond 0.5469.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.