- NZD is one of the best performing G10 currencies on Wednesday, with NZD/USD crossing above 0.7000 again amid a softening USD.

- Month-end flows are likely to be one factor helping NZD, as are recent suggestions for the RBNZ to include house price inflation in its inflation remit.

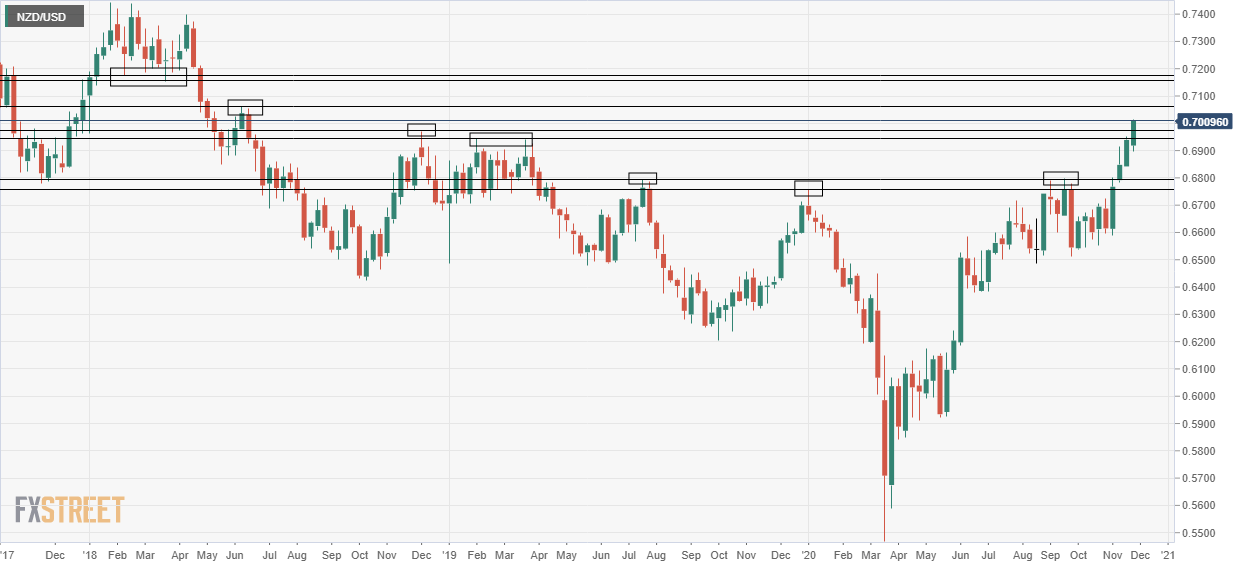

NZD/USD has again rallied north of the 0.7000 level and hit fresh highs since June 2018, marking an impressive reversal from earlier lows around 0.6960. The pair currently trades slightly less than 40 pips higher on the day or just up by just over 0.5%.

Month-end flows, reduced RBNZ negative rates bets likely helping

Month-end flows are arguably getting kicking a little earlier than usual this month, given that Thursday’s US Thanksgiving holiday largely renders the rest of the week a right off as far as US session market volume is concerned, as well as potentially signalling lower volumes ahead on Monday 30 November.

Therefore, price action into Wednesday’s 16:00GMT London fix was choppy and largely seemed to work in favour of the likes of NZD, CAD and GBP.

However, it is also likely that markets are continuing to digest Tuesday’s news about the New Zealand government throwing around the idea of having the RBNZ include house price inflation into its overall inflation targeting remit, amid concerns of an overheating property market. This, of course, would have a hawkish read across to RBNZ policy given that house price inflation has been significantly higher than consumer price inflation over recent years in New Zealand and, as such, markets might still be reducing negative rate bets (supporting NZD).

NZD/USD bulls pushing for a move back to June 2018 highs

With NZD/USD looking to have now tackled the psychological 0.7000 level, bulls are likely to increasingly push for a move higher to June 2018 highs at just under 0.7070. Conversely, if the pair loses recent upside momentum, significant areas of support reside close by to the downside; the December 2018 high sits at 0.6975, as well as the Q1 2019 highs at just below 0.6950 – buyers have already demonstrated that they were eager to jump in ahead of these levels no Wednesday when the dip to lows around 0.6960 was convincingly bought.

NZD/USD weekly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.