NZD/USD retraces from 5-month highs above 0.6400, as US consumer sentiment improves

- NZD/USD retreats from five-month highs amid profit-taking ahead of the weekend and the backdrop of easing US inflation.

- US economic data for the week revealed a disinflation process in progress, impacting investor anticipation of further rate hikes beyond the expected July FOMC decision.

- Reserve Bank of New Zealand’s decision to hold rates steady has not weakened the Kiwi, which is set to finish the week with gains of over 2.70%.

NZD/USD retreats from five-month highs reached at 0.6411 earlier, drops 0.31%, as traders square off their positions ahead of the weekend. US economic data revealed on Friday portrays inflation is easing, while a University of Michigan (UoM) poll showed consumer sentiment improved. The NZD/USD is trading at 0.6372.

NZD set to end the week with solid gains vs. the USD despite pullback

During the week, the US economic agenda showcased the Consumer Price Index (CPI) and the Producer Price Index (PPI) June figures, showed the disinflation process is gathering momentum. Hence, investors trimmed a possible rate hike past the July FOMC’s decision, in which the Federal Reserve is expected to lift rates by 25 bps to leave rates at 5.25%-5.50%.

Consequently, US Treasury bond yields plunged, while the greenback holds one of its most significant weekly losses since November 2022, as shown by the US Dollar Index (DXY). As of writing, the DXY, which portrays the US Dollar’s performance against a basket of six currencies, gains 0.17%, up at 99.943.

Data-wise, Friday’s US agenda witnessed Import and Export prices slowing down for the second consecutive month, with figures coming below May’s and analysts’ forecasts. That reinforced US CPI, and PPI data revealed during the week a headwind for the US Dollar.

The University of Michigan (UoM) revealed an improvement in US Consumer Sentiment, which was expected to print 65.5 but came at 72.6m at a two-year high. Further data showed that inflation expectations for one year were upward revised to 3.4% from 3.3% in June, while for five years, it edged high to 3.1%, up from 3%.

Joanne Jsu, the UoM Surveys of Consumers Director, said, “The sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets.”

On the New Zealand front, the latest Reserve Bank of New Zealand (RBNZ) monetary policy decision to hold rates unchanged didn’t weaken the Kiwi (NZD), which is set to finish the week with solid gains of more than 2.70% against the US Dollar (USD).

Upcoming events

NZD/USD Price Analysis: Technical outlook

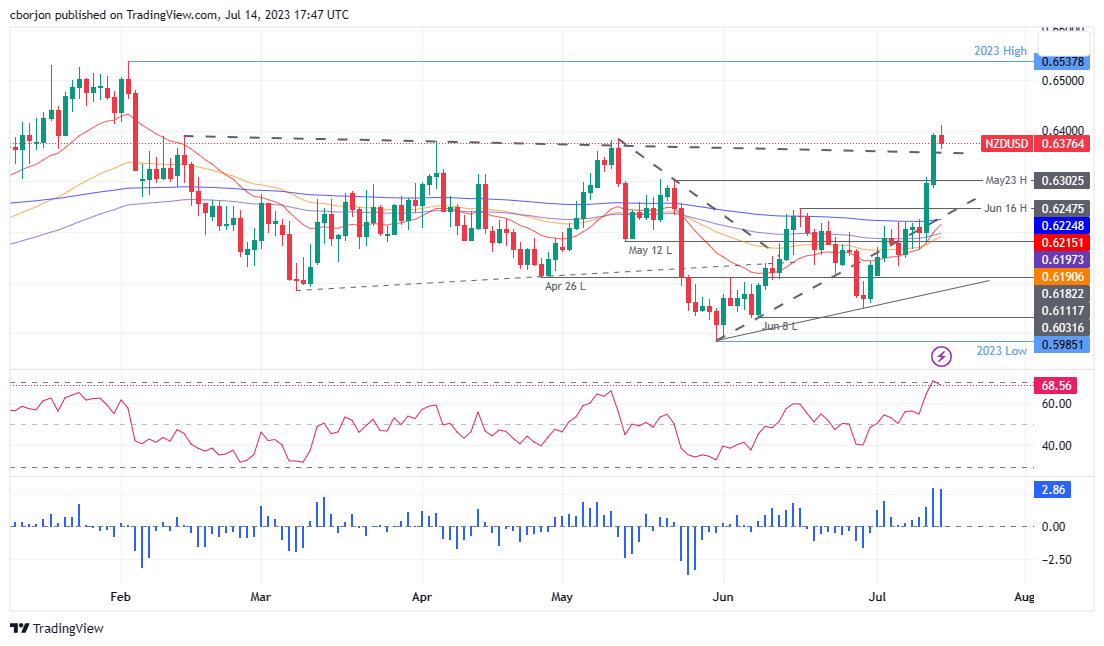

The NZD/USD daily chart portrays the pair as upward biased, though it should be said that it is trading below the May 23 daily high of 0.6385, opening the door for further losses. Traders should note the Relative Strength Index (RSI) indicator is exiting overbought territory, which could pave the way for deeper correction while keeping the bias intact.

NZD/USD’s support emerges at a five-month-old broken resistance trendline turned support at around 0.6350/60. A breach of that area, the NZD/USD could dive toward the May 23 high-turned support at 0.6302 before extending its losses to June’s 16 swing high-turned support at 0.6247

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.