NZD/USD Price Forecast: Falling in possible C wave of bearish pattern

- NZD/USD is steadily declining in what could be the final wave of a large zig-zag pattern.

- It is not yet oversold and could reach lower lows given the bearish short and medium-term trends.

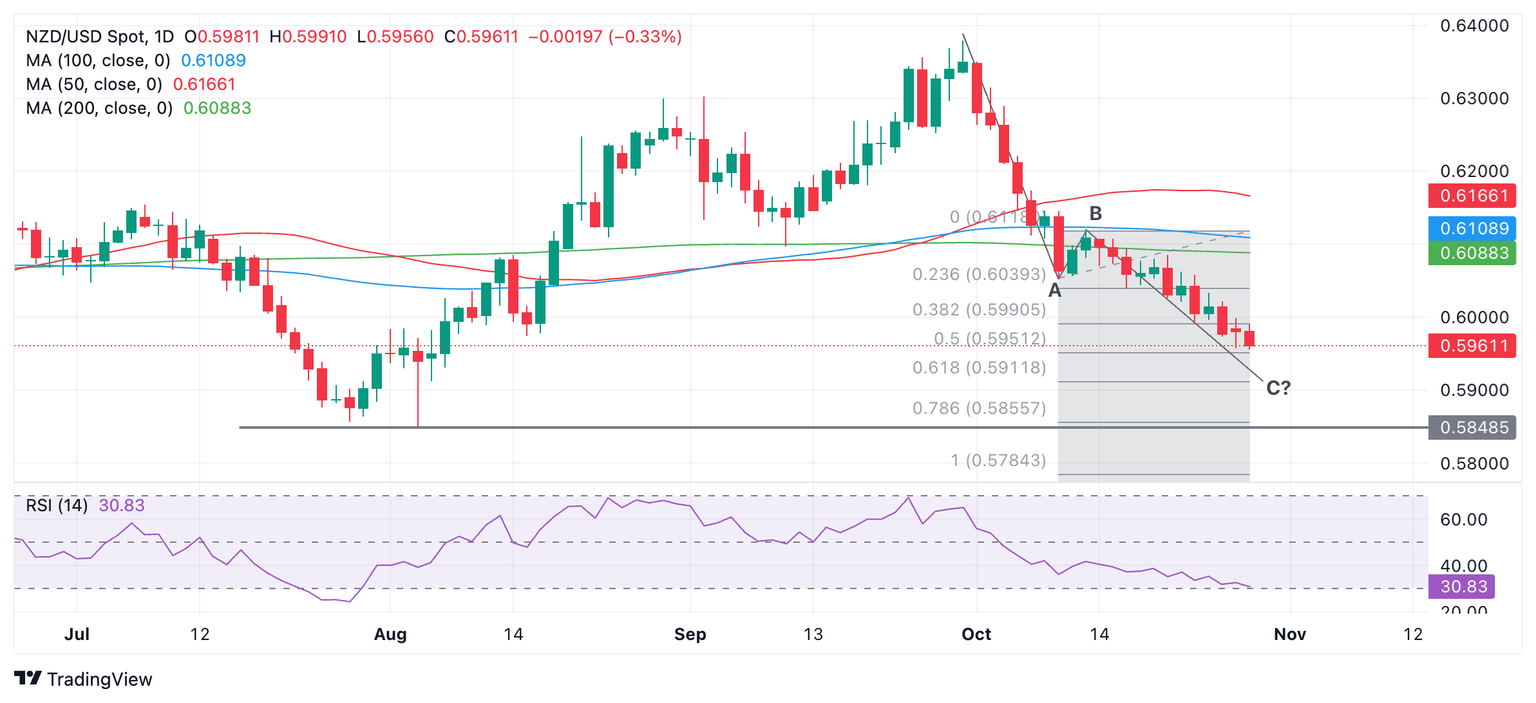

NZD/USD is falling in what might be the C wave of a bearish ABC pattern which began life at the September 30 highs.

ABCs are zig-zag patterns in which waves A and C are usually of a similar length or a Fibonacci 61.8% of the other.

NZD/USD Daily Chart

NZD/USD will probably fall to a target at 0.5911, the point where wave C is 61.8% of A. A break below the 0.5956 low would provide confirmation.

It is possible it could fall all the way to the major support level at 0.5849 (August 5 low). A really bearish move could even see an extension to 0.5784, the point where wave C = A.

The outlook is supported by the fact that the pair is in a bearish short and medium-term downtrend and “the trend is your friend”. The Kiwi pair is, however, in a sideways long-term consolidation.

The Relative Strength Index (RSI) momentum indicator is not yet oversold (below 30) suggesting there could be more downside to come. When it reaches oversold traders will be advised to not add to their existing short positions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.