NZD/USD Price Analysis: Struggles to hold 0.6100

- NZD/USD falls sharply to 0.6100 as waned Fed rate-cut hopes weakens market sentiment.

- The market mood turns cautions as the Fed is expected to keep interest rates steady with a hawkish outlook.

- A slowdown in NZ’s disinflation progress has pushed RBNZ’s rate-cut expectations beyond 2024.

The NZD/USD pair struggles to gain ground near the round-level support of 0.6100 in Monday’s European session. The Kiwi asset falls on the backfoot as the US Dollar (USD) strengthened after the United States (US) Nonfarm Payrolls (NFP) report for May indicated a robust labor demand and strong wage growth, which diminished expectations for the Federal Reserve (Fed) to start easing the monetary policy from the September meeting.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to an almost monthly high near 105.45.

Meanwhile, uncertainty among investors ahead of the US Consumer Price Index (CPI) data for May and the Fed’s monetary policy decision, which are scheduled for Wednesday, has also boosted the US Dollar’s demand. The market sentiment turns risk-averse as investors expect that the Fed would argue in favor of keeping interest rates at their current levels until they get evidence that price pressures will sustainably return to the desired rate of 2%,

On the Kiwi front, investors continue to reaffirm expectations in the Reserve Bank of New Zealand (RBNZ) holding its key Official Cash Rate (OCR) at their current levels beyond 2024 amid absence of signs indicating progress in the disinflation process.

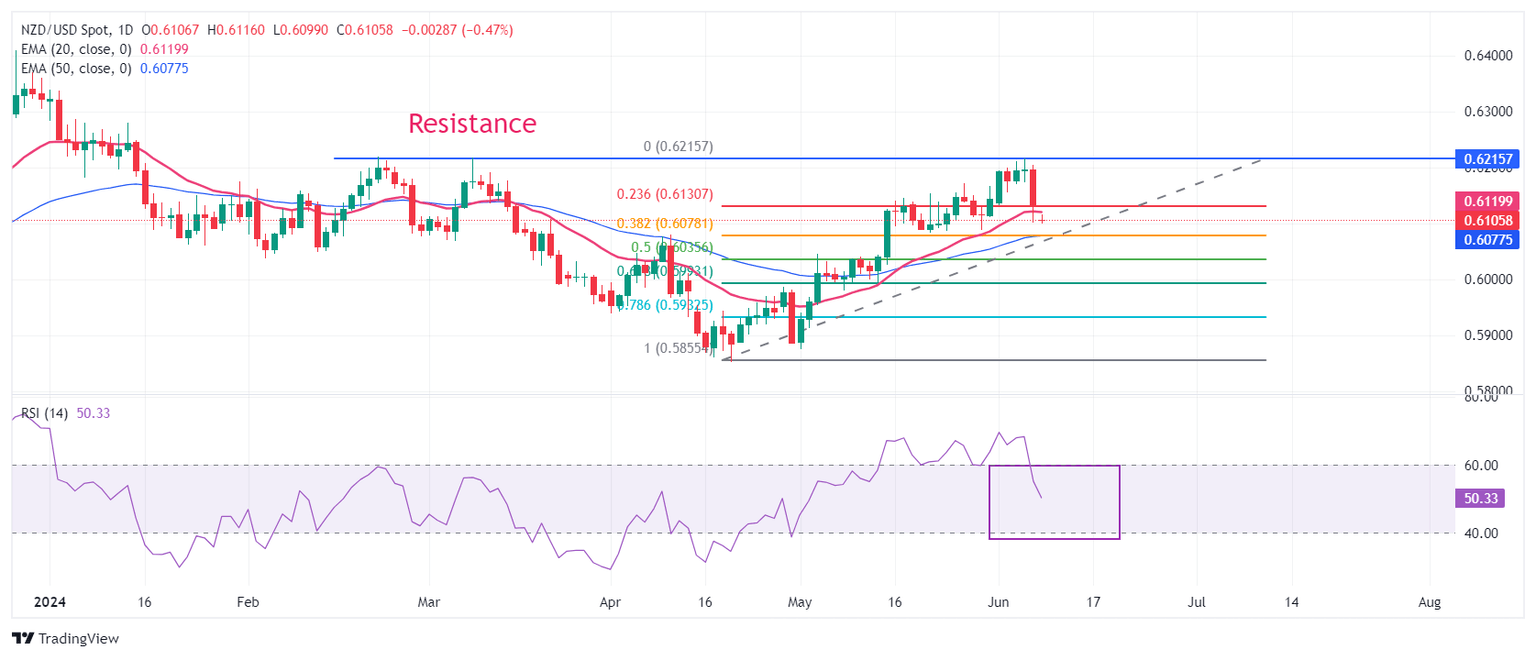

NZD/USD drops after facing selling pressure near the horizontal resistance plotted from February 22 high at 0.6219. The Kiwi asset declines toward the 38.2% Fibonacci retracement support (plotted from the April 19 low of 0.5851 to the June 6 high at 0.6216) at 0.6076. The pair has slipped below the 20-day Exponential Moving Average (EMA), which trades around 0.6120. While the 50-day EMA near 0.6076 still acts as a support for the New Zealand Dollar bulls.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the upside momentum has faded. However, the bullish bias remains intact.

An upside move above June 6 high at 0.6216 will drive the asset January 15 high near 0.6250, followed by January 12 high near 0.6280.

On the contrary, fresh downside would appear if the asset breaks below April 4 high around 0.6050 This would drag the asset towards the psychological support of 0.6000 and April 25 high at 0.5969.

NZD/USD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.