NZD/USD Price Analysis: Rangebound trading persists, bears maintain control

- Consolidation persists within the 0.5900-0.6000 range, with neutral technical indicators.

- Bearish momentum remains intact, favoring further declines, but a break above 0.6000 could shift sentiment.

- Volume remains average, with key support and resistance levels inching closer.

On Monday's session, the NZD/USD declined by 0.40% to 0.5930, extending its rangebound trading pattern. On the bright side, bulls managed to clear losses which saw the pair diving below 0.5900 earlier in the session.

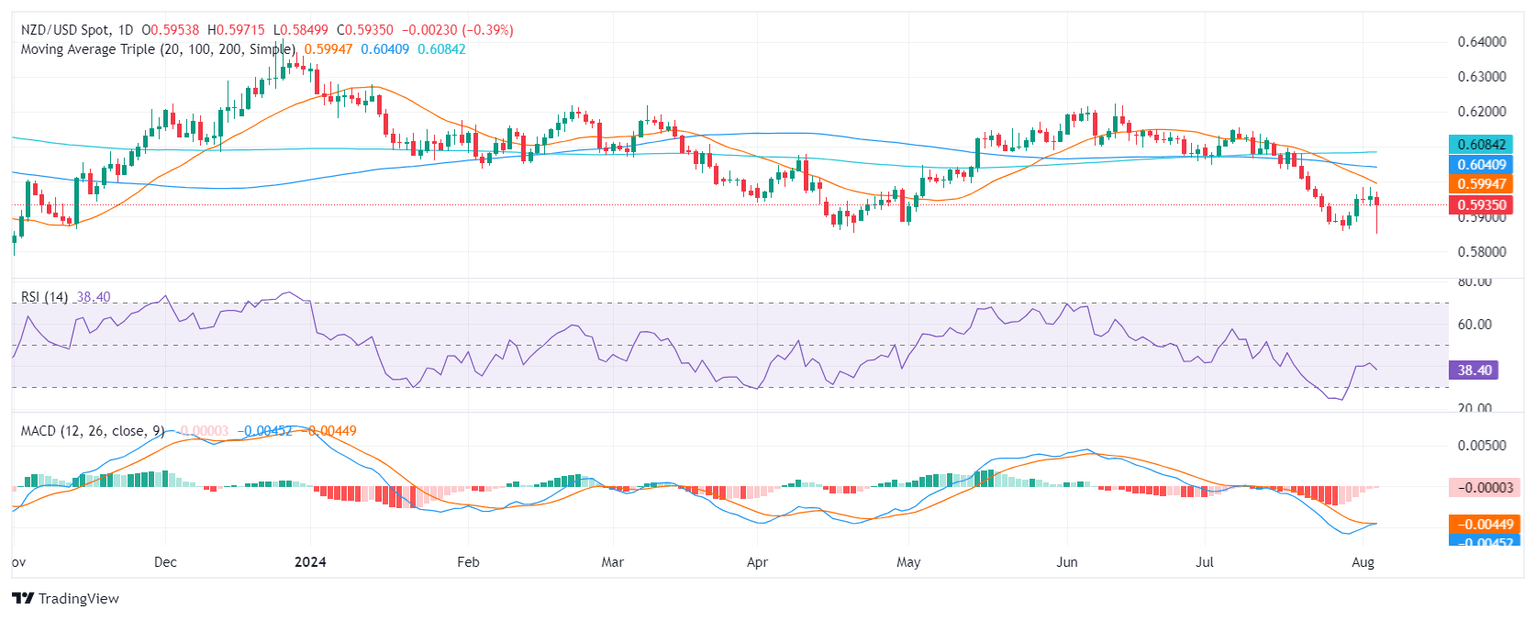

The daily chart shows that the Relative Strength Index (RSI) is hovering around 40, indicating a lack of clear direction. The Moving Average Convergence Divergence (MACD) continues to trend lower, suggesting that bearish momentum remains intact. In addition, the pair is currently facing support at 0.5910, a break below which could expose the next support level at 0.5890. On the upside, resistance is found at 0.5980, and a breakout above this level could signal a potential reversal in the trend.

The overall technical outlook for the NZD/USD remains neutral to bearish. While the pair remains rangebound, the bears hold a slight advantage. A break below support or above resistance could trigger a more decisive move. In the meantime, volume is average, with key support and resistance levels inching closer which gives neutrality to the technical outlook.

NZD/USD Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.