NZD/USD Price Analysis: Persistent bearish trend prevails despite decreased selling momentum

- NZD/USD continues to struggle, after a two-day winning streak.

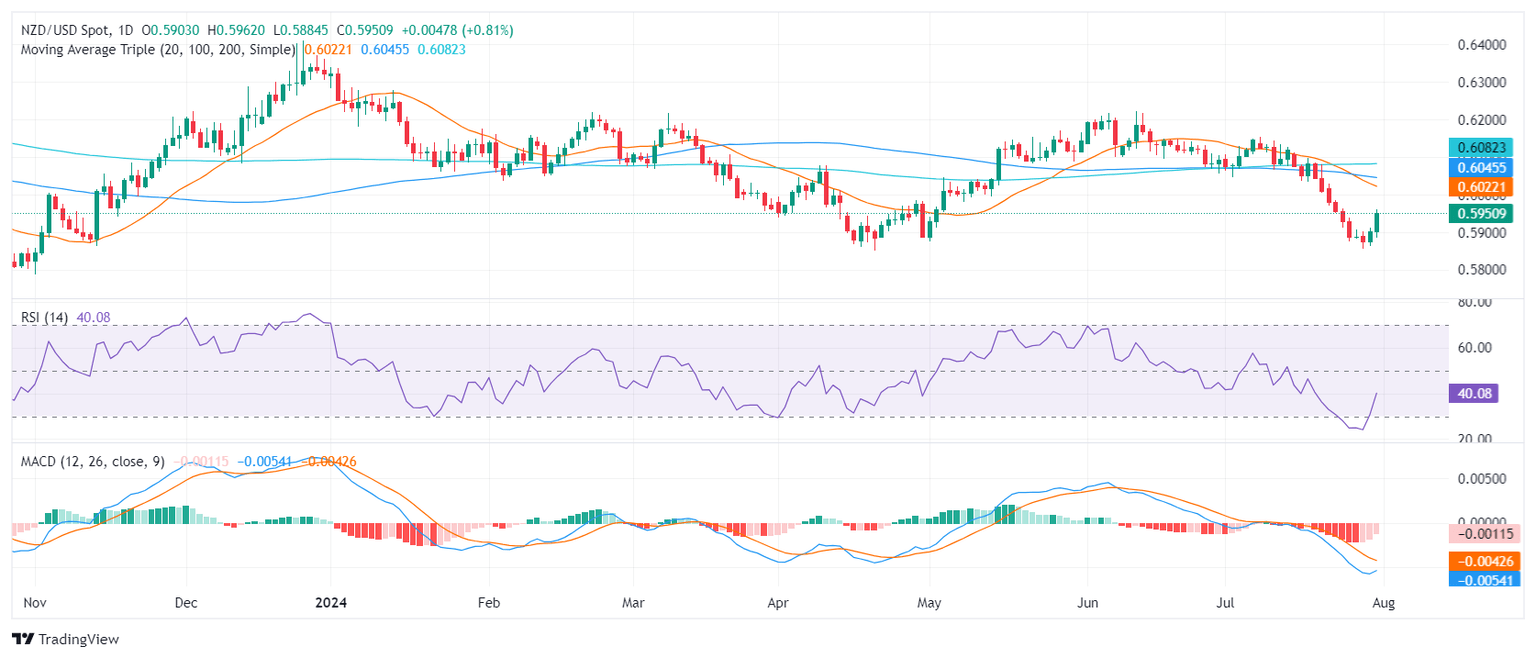

- The pair exhibits a pronounced bearish trend with a significant support level of around 0.5860 and resistance at 0.5980.

- The RSI remains below the midline, suggesting persistent bearish sentiment.

In recent trading sessions, the NZD/USD pair has seen a little recovery from its losses, but the general outlook continues to be bearish.

The daily Relative Strength Index (RSI) has stayed below the midline for the past 10 sessions while flattening around the 24-39 levels. This indicates that the pair might be heading towards oversold conditions, however, a significant bullish divergence has not been observed yet. This continuance below the 50-level threshold underscores the sustained bearish sentiment.

The Moving Average Convergence Divergence (MACD) remains below the signal line, further substantiating the ongoing bearish trend. The histogram highlights decreasing red bars, which might be pointing towards a diminishing bearish momentum. Nevertheless, a bullish crossover is still yet to be confirmed, sustaining the overall bearish outlook

NZD/USD daily chart

The NZD/USD pair's persistent bearish trend has kept it within a specified range with a solidified support level around 0.5860 and notable resistance at 0.5980. Future sessions may see the pair continue to struggle unless a significant bullish trigger emerges.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.