NZD/USD Price Analysis: Pair struggles at 20-day SMA as selling pressure builds

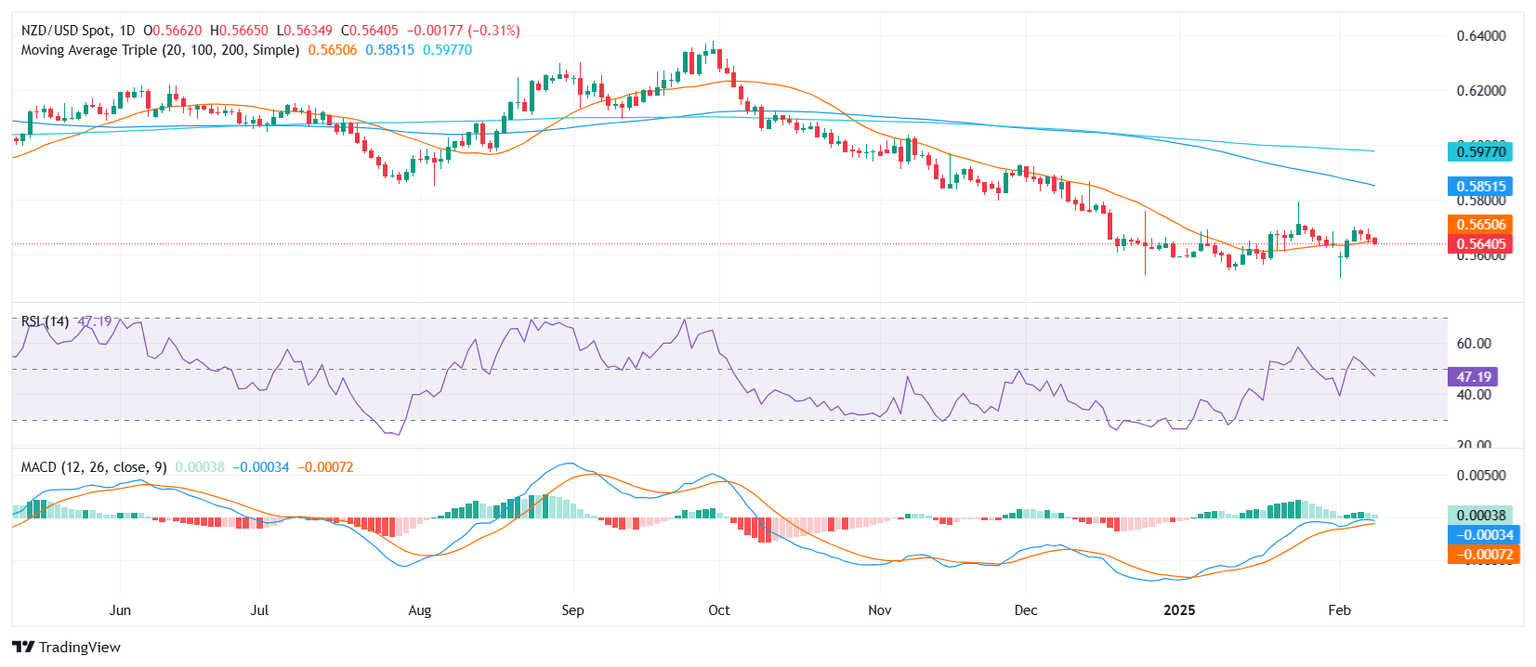

- NZD/USD dips 0.30% on Monday, trading near 0.5640 amid renewed downside pressure.

- The pair is testing support at the 20-day SMA, a key threshold for short-term direction.

- RSI declines in negative territory, while MACD histogram shows weakening bullish momentum.

The NZD/USD pair saw a mild decline on Monday, slipping to 0.5640 as selling pressure persisted. Despite previous attempts to hold above the 20-day Simple Moving Average (SMA), the pair remains vulnerable, with a decisive breakdown of this level likely to accelerate downside risks.

Technical indicators highlight fading bullish momentum. The Relative Strength Index (RSI) has declined sharply to 47, dipping back into negative territory, which suggests a weakening recovery attempt. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints decreasing green bars, reinforcing a slowdown in buying interest.

With the 20-day SMA around 0.5650 acting as a pivotal level, a confirmed break below this mark could push NZD/USD toward the next support at 0.5610. On the flip side, a bounce above 0.5675 would help stabilize sentiment and keep buyers engaged in the short term.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.