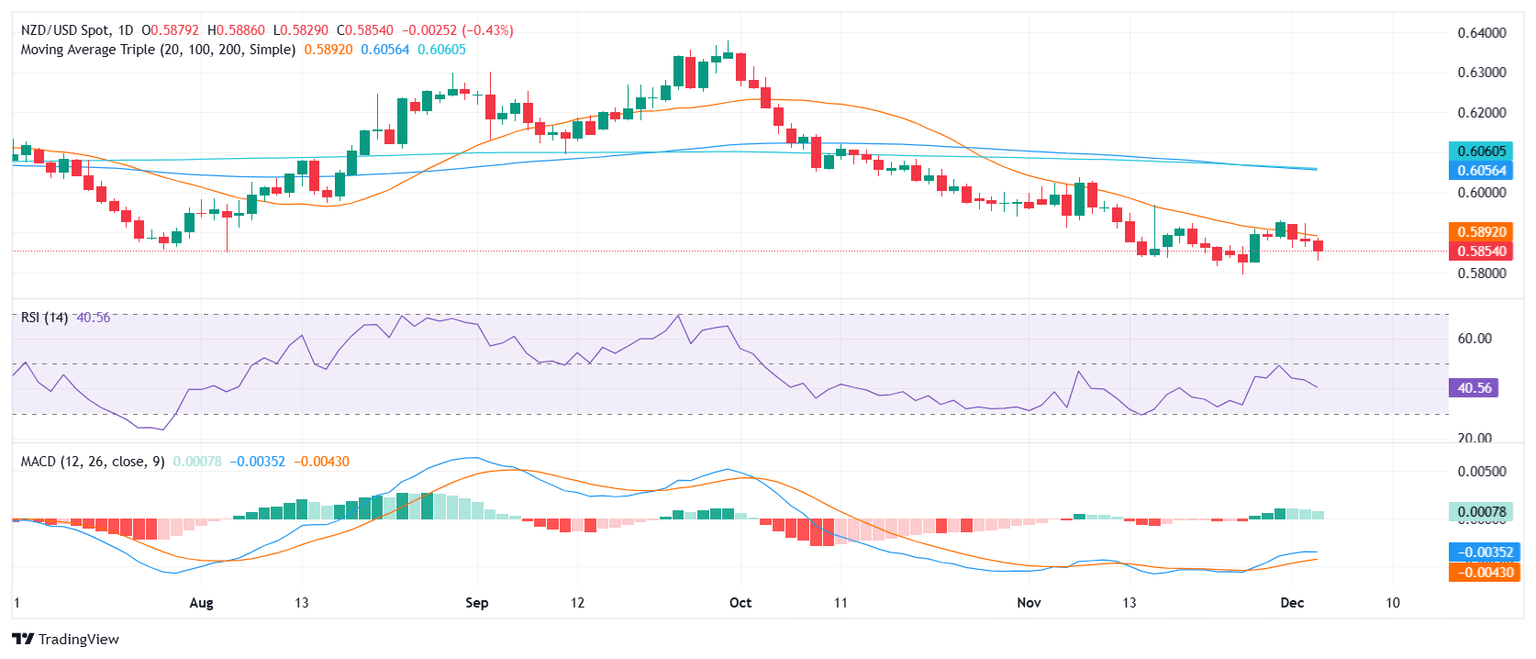

NZD/USD Price Analysis: Pair continues falling further below the 20-day SMA

- NZD/USD falls for a third consecutive session, settling near 0.5830.

- Bulls failed to reclaim the 20-day SMA, intensifying bearish momentum.

- Indicators show deepening negative signals, reinforcing the bearish outlook.

The NZD/USD pair extended its losses on Wednesday, marking a three-day losing streak as it continued to drift lower, closing near 0.5850.

The inability to regain the 20-day Simple Moving Average (SMA) highlights the pair’s struggle to find sustained bullish momentum. Technical indicators point to mounting downside risks, with the Relative Strength Index (RSI) slipping further into negative territory, currently at 34, nearing oversold levels and signaling sustained selling pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram has deepened in the red, with a widening gap between the MACD line and the signal line, underscoring intensifying bearish momentum.

With the technical outlook firmly bearish, the pair faces immediate support at 0.5850, with further downside risks toward the 0.5820 level. On the upside, reclaiming the 20-day SMA remains critical for any bullish recovery, but current conditions suggest that such a move remains unlikely in the near term.

NZD/USD Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.