NZD/USD Price Analysis: NZD/USD rises and eyes the 0.6000 level

- NZD/USD rose by 0.80% in Wednesday's session, to land at 0.5950.

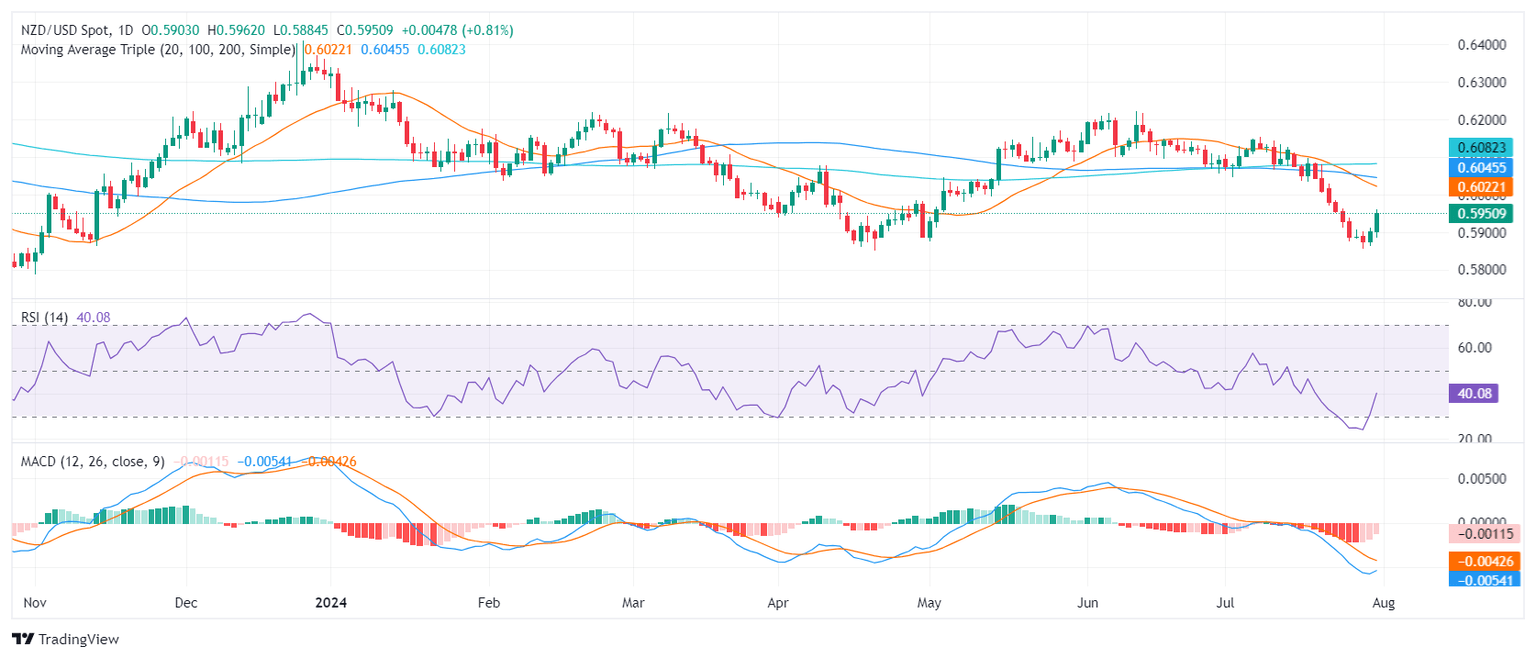

- The pair faces strong resistance at 0.5960, with support seen at 0.5880.

- RSI indicates oversold conditions, while MACD shows a steady bearish momentum.

In Wednesday's session, the NZD/USD rose by 0.80% to 0.5950. This surge comes as the pair attempts to recover from recent lows, buoyed by increased demand for riskier assets following the weakness seen in the USD following the Federal Reserve (Fed) decision.

The pair's upward movement brought it close to the resistance level at 0.5960, a key hurdle that has held in the past sessions. Should this level be breached, the next target would be the psychological 0.6000 mark. On the downside, support is solid around 0.5880, providing a safety net for bullish traders.

Technical indicators present a mixed outlook. The RSI, currently at 30, suggests the pair is emerging from oversold territory, potentially signaling further gains. However, the MACD prints flat red bars, indicating persistent bearish momentum. This divergence highlights no clear direction and as volume remains moderate a consolidation looms before a decisive move.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.