NZD/USD Price Analysis: Kiwi struggles to justify Thursday’s Doji below 0.6100 ahead of US NFP

- NZD/USD retreats from intraday high, reversing previous day’s rebound from five-week low.

- Doji candlestick at multi-day low, below-50.0 RSI conditions put a floor under Kiwi price.

- Bulls have a long and bumpy road ahead, two-month-old previous support line guards immediate upside.

- US NFP bears downbeat forecasts but early signals make it interesting for Greenback buyers.

NZD/USD trims intraday gains around 0.6085 amid the initial European session on Friday as markets brace for the US employment report for July.

Also read: NZD/USD clings to modest recovery gains, struggles to capitalize on move beyond 0.6100

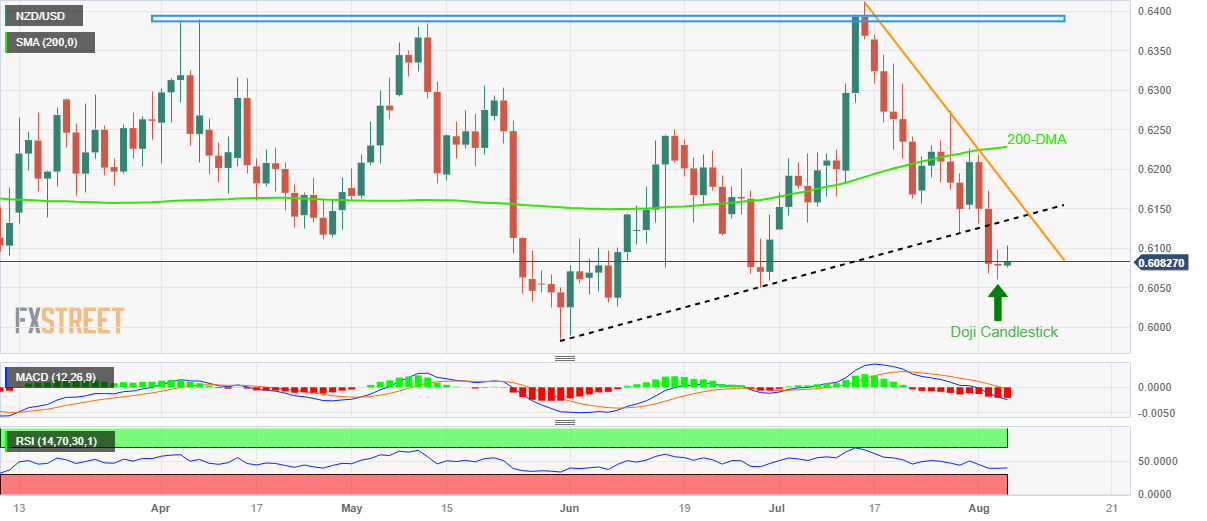

That said, the Kiwi pair recovered from the lowest level since June 29 the previous day but lacked follow-through, which in turn portrayed a Doji candlestick on the Daily timeframe, suggesting a reversal in the bearish trend established since mid-July.

Adding strength to the hopes of recovery is the RSI (14) line as it suggests bottom-picking by being below 50.0. Further, the position of the Doji candlestick at the multi-day low also increases the strength of the rebound.

However, the support-turned-resistance line from May 31 joins the bearish MACD signals to challenge the NZD/USD buyers around 0.6135.

Even if the quote rises past 0.6135 previous support line, a three-week-old descending resistance line, close to 0.6180, followed by the 200-DMA hurdle of 0.6230, will challenge the Kiwi bulls.

Above all, a four-month-old horizontal area surrounding 0.6390 appears a tough nut to crack for NZD/USD buyers.

On the contrary, the June 29 swing low of around 0.6050 will precede the lows marked during late May and early June, surrounding 0.6030, to challenge the short-term downside of the NZD/USD pair.

In a case where the Kiwi pair remains bearish past 0.6030, the 0.6000 psychological magnet and the yearly low marked in May around 0.5985 will be in the spotlight.

NZD/USD: Daily chart

Trend: Limited recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.