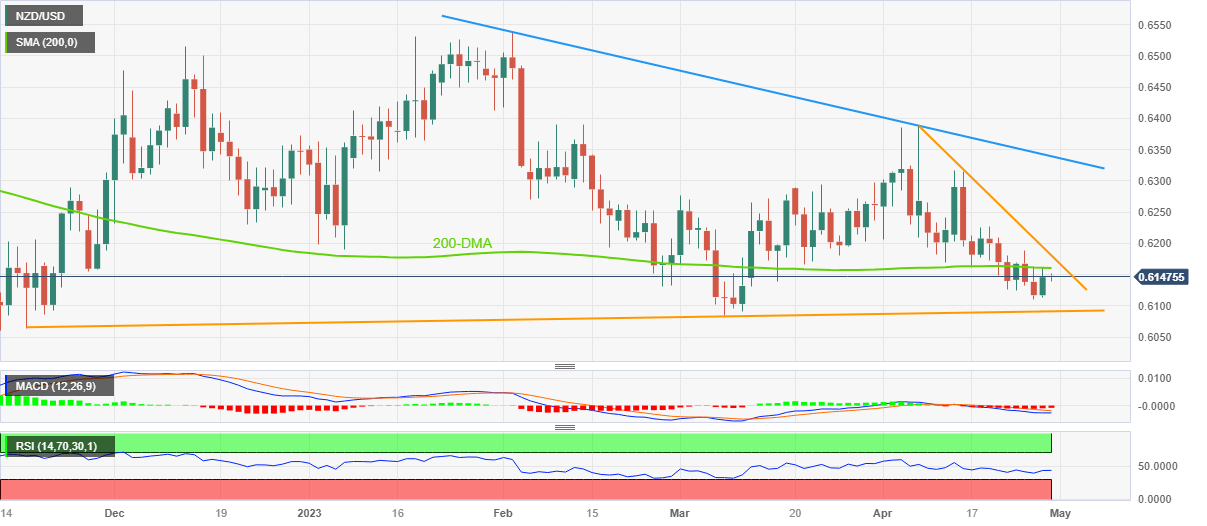

NZD/USD Price Analysis: Eyes another battle with 200-DMA resistance near 0.6150

- NZD/USD picks up bids to reverse late Thursday’s pullback from 200-DMA.

- Bearish MACD signals, steady RSI keeps Kiwi pair sellers hopeful.

- Three-week-old descending trend line adds to the upside filters.

- Upward-sloping support line from November 2022 becomes crucial to watch NZD/USD bears.

NZD/USD regains upside momentum after two failed attempts to cross the 200-DMA hurdles, grinds higher around mid-0.6100s during early Friday.

Not only the repeated failures to cross the 200-DMA hurdle, around 0.6160 by the press time, but the bearish MACD signals also weigh on the Kiwi pair prices. That said, a steady RSI (14) line signals further grinding of the NZD/USD.

It’s worth noting that the quote’s break of the 200-DMA resistance surrounding 0.6160 isn’t an open welcome for the bulls as a downward-sloping resistance line from early April, close to 0.6180 could challenge the pair’s further upside.

Even if the NZD/USD price rallies beyond 0.6180, multiple levels marked during late March around the 0.6200 threshold can act as the last defense of the bears.

On the flip side, the recent bottom around the 0.6100 round figure can prod the NZD/USD bears before directing them to the key support line stretched from November 2022, around 0.6090 at the latest.

Should the NZD/USD pair offers a daily closing below 0.6090, the previous monthly low of near 0.6085 and the mid-November 2022 bottom of around 0.6065 may act as an extra filter towards the south before welcoming the bears with open hands.

NZD/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.