NZD/USD Price Analysis: Climbs closer to 100-DMA, eyes triangle resistance ahead of NFP

- NZD/USD attracts fresh buying on Friday and snaps a two-day losing streak.

- A combination of factors underpins the USD and might cap gains for the pair.

- The symmetrical triangle formation also warrants caution for bullish traders.

- The market focus remains glued to the release of the US monthly jobs report.

The NZD/USD pair regains positive traction following the previous day's sharp pullback from the 0.6215-0.6220 area, or a two-week high and maintains its bid tone through the early part of the European session. Spot prices currently trade around the 0.6175-0.6180 region, up nearly 0.35% for the day, and for now, seem to have snapped a two-day losing streak.

The intraday move up, meanwhile, lacks any obvious fundamental catalyst and is more likely to remain capped in the wake of the prevalent risk-off environment, which tends to undermine the risk-sensitive. Apart from this, elevated US Treasury bond yields, bolstered by the prospects for further policy tightening by the Federal Reserve (Fed), act as a tailwind for the US Dollar (USD) and might further contribute to capping the NZD/USD pair. Traders might also refrain from placing aggressive bets ahead of the release of the US monthly jobs report, popularly known as the NFP report, due later during the early North American session.

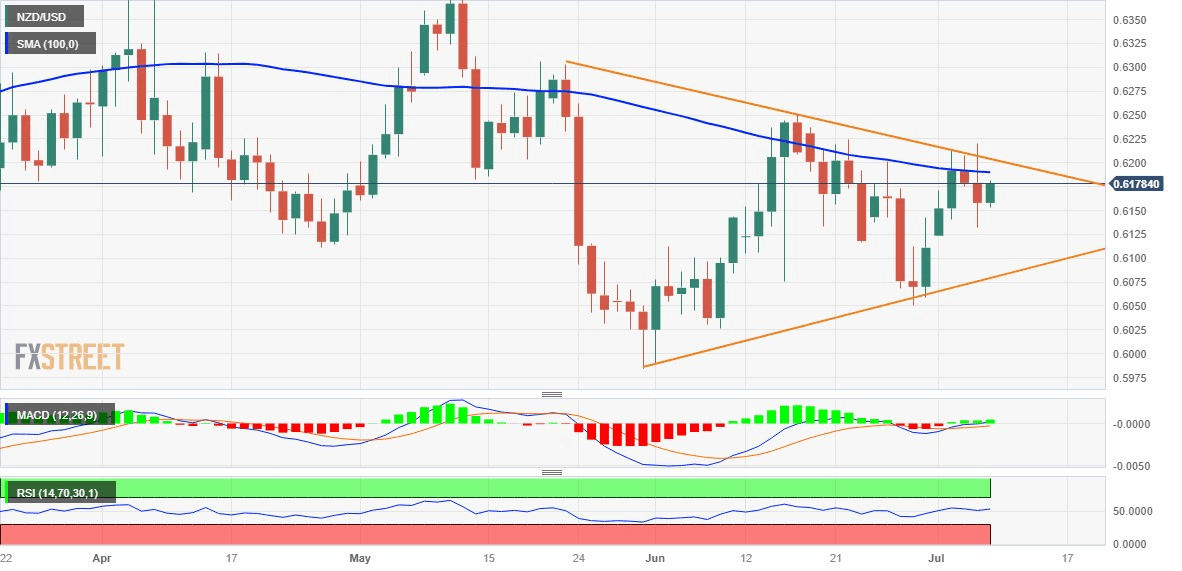

From a technical perspective, spot prices have been oscillating between two converging trend lines since the latter part of May, which constitutes the formation of a symmetrical triangle on the daily chart. Moreover, the recent repeated failures to find acceptance above the 100-day Simple Moving Average (SMA) warrant caution for bulls. Hence, it will be prudent to wait for some follow-through buying and a sustained strength beyond the 0.6200 mark before positioning for any further appreciating move. The NZD/USD pair might then surpass the 0.6235 intermediate hurdle and test the 0.6280-0.6285 supply zone, or the May monthly swing high.

On the flip side, the 0.6140-0.6130 area now seems to protect the immediate downside ahead of the 0.6100 round figure. Any subsequent decline might find decent support near the lower end of the aforementioned triangle, currently pegged around the 0.6070-0.6065 region. A convincing break below will be seen as a fresh trigger for bearish traders and drag the NZD/USD pair to the 0.6000 psychological mark. Some follow-through selling below the YTD low, around the 0.5985 zone should pave the way for further near-term losses.

NZD/USD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.