NZD/USD Price Analysis: Buyers recover, oversold RSI signals potential upturn

- NZD/USD recovers and seems some gains after Monday’s losses.

- Oversold RSI hints at potential corrective upswing.

- The potential correction might take the pair to revisit the 100-day SMA.

Tuesday's session brought a reprieve from the NZD/USD's recent bearish streak, as the pair managed to recoup some of its losses, rising by 0.15% to settle at 0.6045. While the technical outlook remains mixed, the latest price action and indicator readings suggest a potential shift in market sentiment.

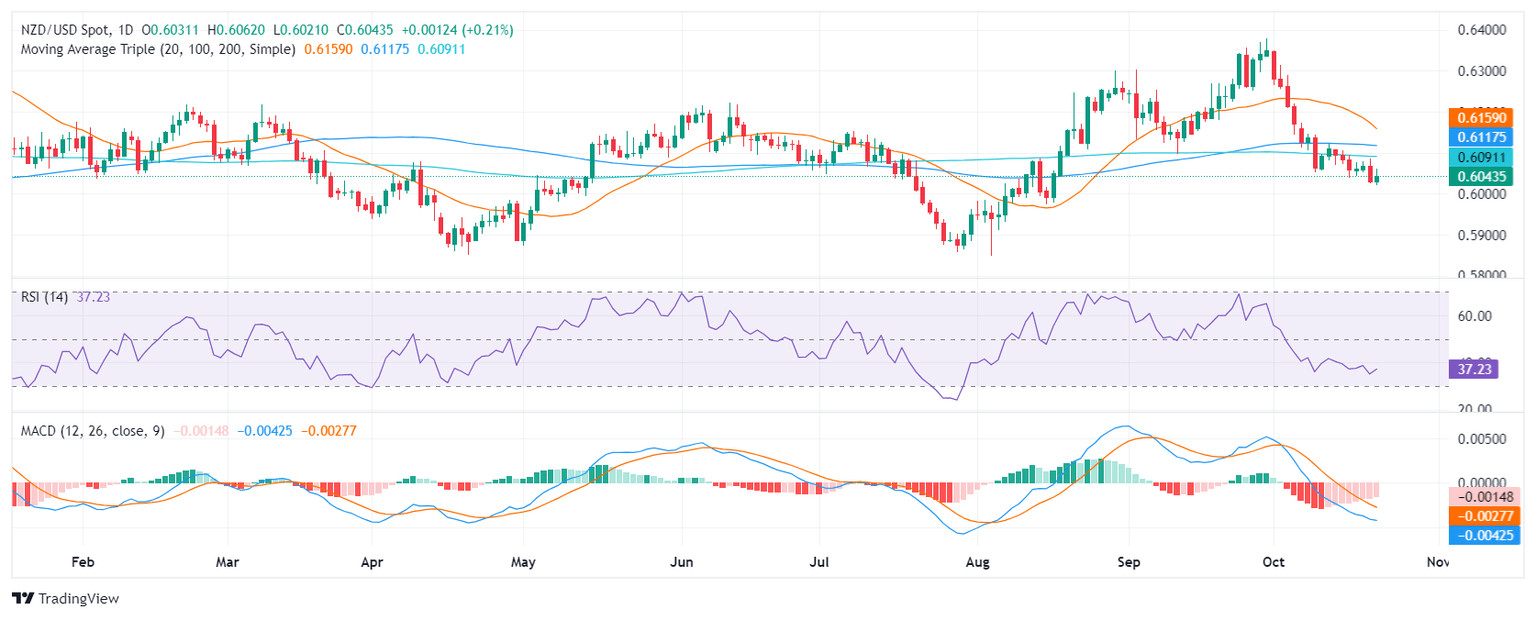

The Relative Strength Index (RSI) has rebounded sharply from the negative area, signaling a decline in selling pressure. The indicator's current reading of 37, combined with its upward trajectory, indicates that favorable buying conditions have emerged. The Moving Average Convergence Divergence (MACD) histogram, however, remains flat and red, suggesting that selling forces have not yet relinquished control.

NZD/USD daily chart

Technically, the NZD/USD pair remains constrained within a range bounded by key support and resistance levels. The critical 100 and 200-day Simple Moving Averages (SMAs) continue to act as formidable barriers at 0.6100 and are likely to impede any significant upward momentum. Despite these obstacles, the pair's recent recovery from lows since mid-August indicates that buyers may be regaining their footing.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.