NZD/USD Price Analysis: Bulls testing the 0.63s for bears lurking in key resistance

- NZD/USD bears could be about to make a move.

- The NZ Dollar bulls are probing key resistance on Friday.

The NZD benefited from the risk-on tone on Thursday and is yet to confirm a top. However, there are prospects of a bearish correction as the following analysis will illustrate.

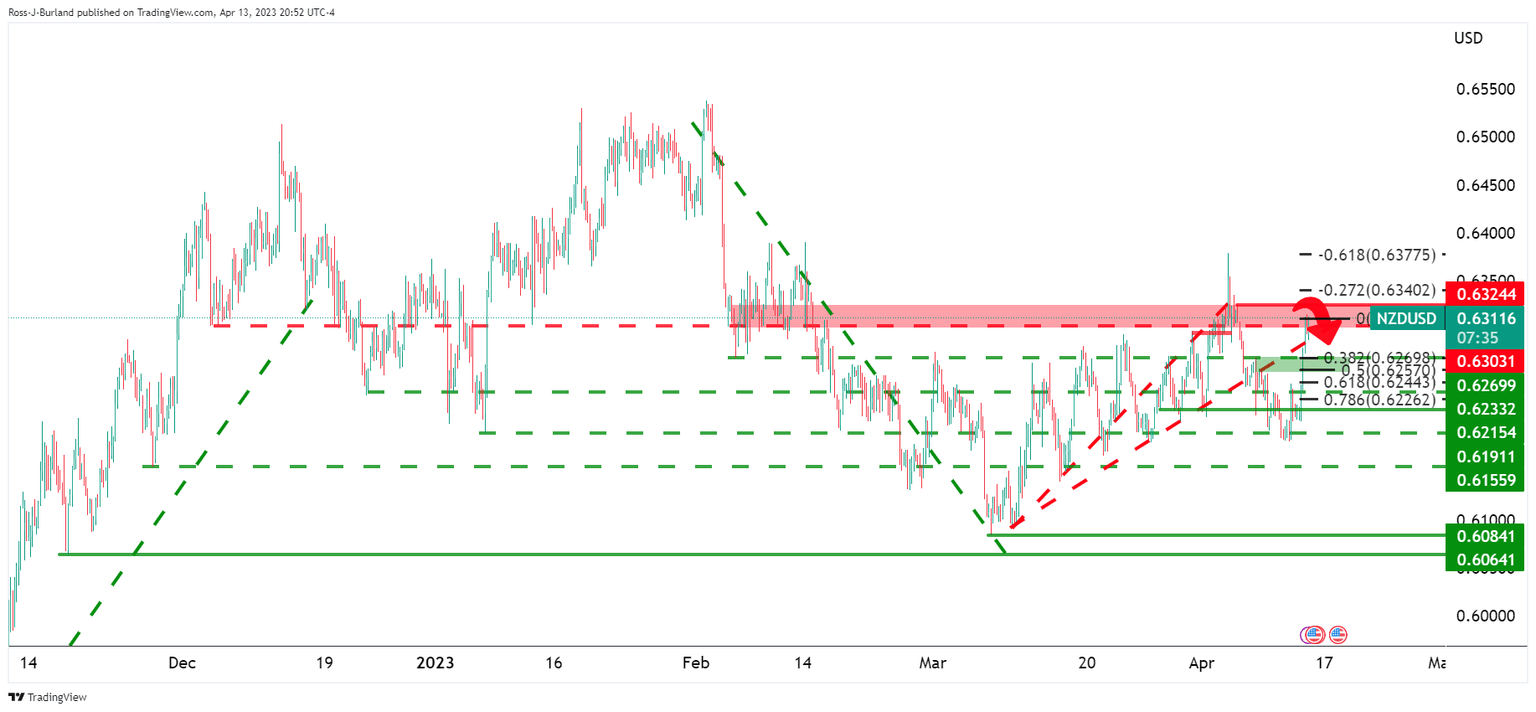

NZD/USD H4 charts

The pair has reached resistance and could be on the verge of a significant correction toward an area of confluence, better seen on a cleaner chart as follows:

A 38.2% Fibonacci retracement could be on the cards to test the trendline support.

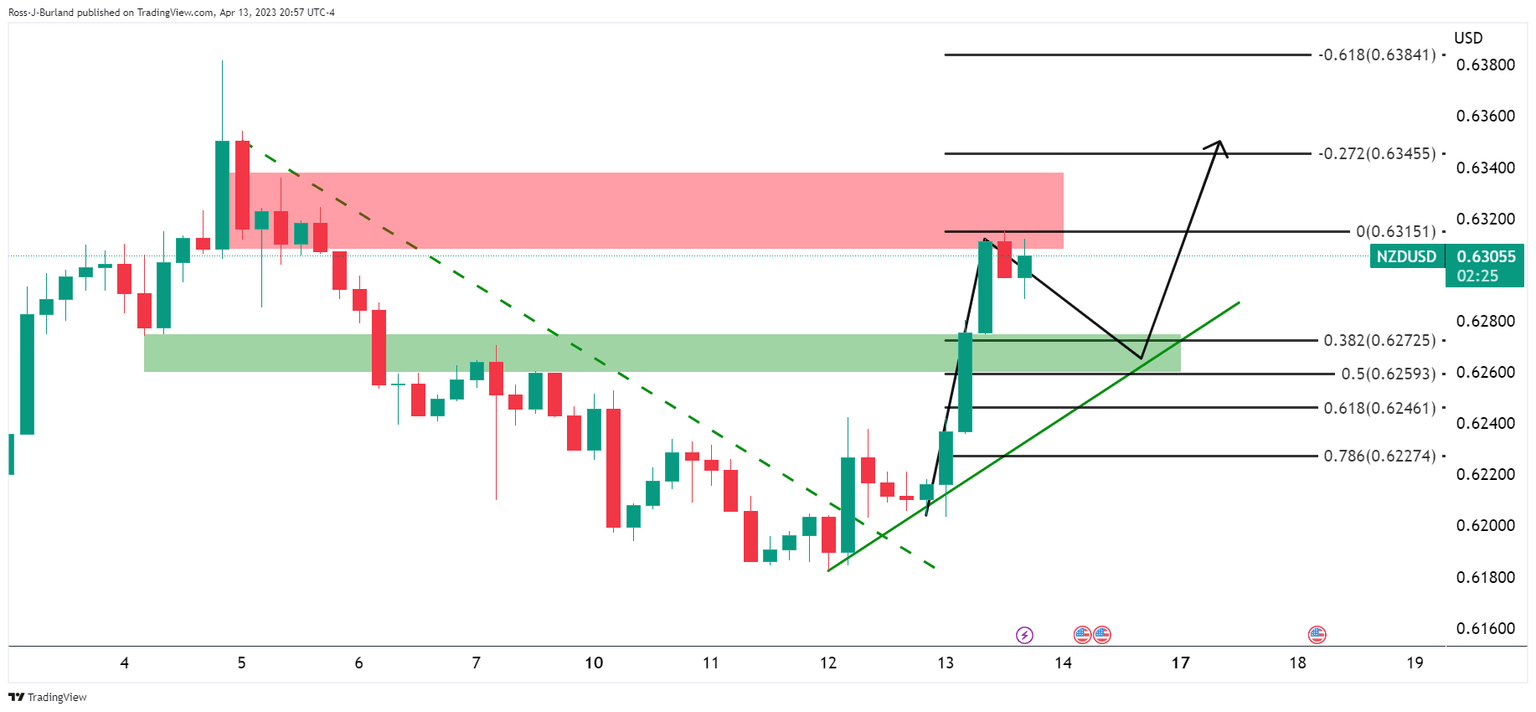

NZD/USD H1 chart

Meanwhile, from an hourly perspective, the 0.6280s is an area of support that if broken, will likely confirm the bearish bias. However, although the price is now on the backside of the prior hourly bullish dynamic supporting trendline, the bulls are coming up for a retest of the highs in the 0.63s and thus a peak formation is yet to be put in.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.