NZD/USD Price Analysis: Bulls reload ahead of RBNZ

- NZD/USD is perched at the top of the canopy leading into the RBNZ.

- Bulls will be looking for an upside extension on a less dovish outcome.

The following is an analysis of the hourly time frame and price structure ahead of the Reserve Bank of New Zealand event at 01:00 GMT.

When is the RBNZ and how it could affect NZD/USD?

It should be noted that higher volatility is expected around such an event and trading is a far riskier practice.

Reducing exposure to price volatility is common-practice around such high profile events.

Last meeting around, the price rallied around 90 pips within the hour immediately after the announcements, dropping from 0.69238 to 0.6809 before rallying:

NZD/USD hourly chart

As can be seen, the price is in an uptrend and there are little signs that the bulls are tiring while above support.

The upside target is modest but it is based on the correction's range and comes as a measured -61.8% Fibonacci retracement to 0.7354.

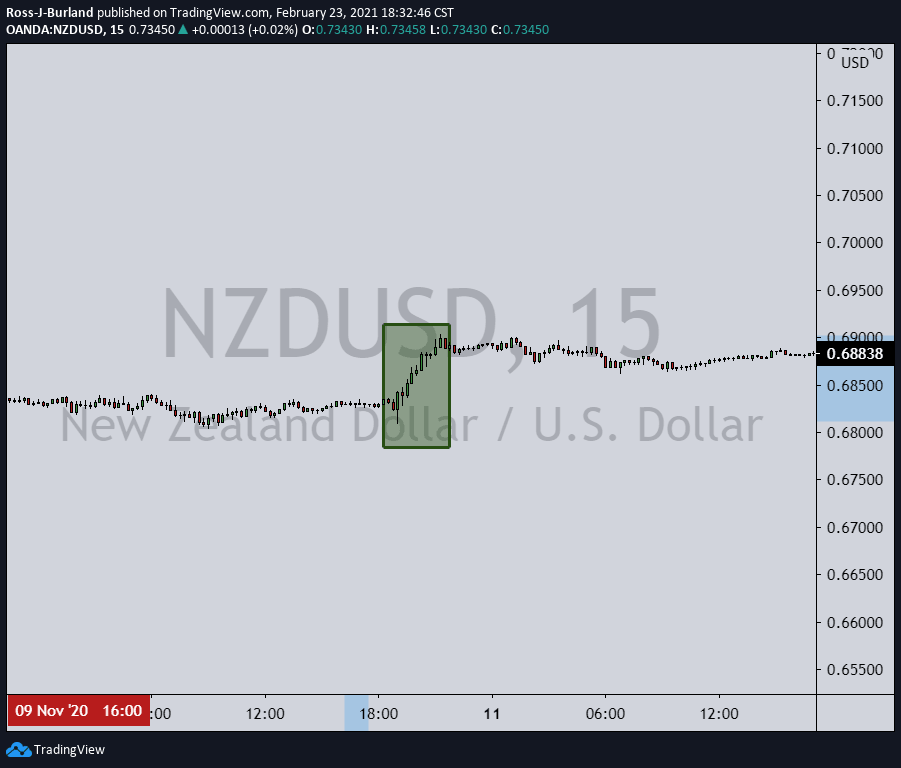

The setup can be better managed from a lower time frame, such as the 15-min chart as follows:

15-chart

In the build-up to the RBNZ event, a deeper retracement would be ideal which would raise the target level accordingly to the Fibonacci measurement of the correction's range and offer deeper support.

However, a position that is taken at the market with a stop-loss below the current lows and structure already offers a 1:2.7 risk to rearward ratio.

Update

At the time of publishing, the price had already rallied.

The following is a readjustment of the set-up in accordance with the bullish impulse on the 15-min chart and subsequent new support structure with a buy limit level set to 0.7342 to offer a 1:2 R/R with stop a at 0.7334.

The thesis is that the initial spike to the downside will trigger the entry and a subsequent rally on a less dovish RBNZ outcome will hit the target.

Again, this is a significantly reduced risk considering how low the bar is for extreme volatility over the event and stops are not always guaranteed by the broker.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.