NZD/USD Price Analysis: Bulls approach 0.6800 as RBNZ’s Orr justifies rate-hikes

- NZD/USD remains on the front foot, refreshing five-week high at the latest.

- RBNZ’s Orr cites capacity constraints, rising inflation expectations to back the third consecutive rate lift.

- 100-DMA, January’s top on the bull’s radar amid firmer MACD, clear break of 50-DMA, previous resistance from October 2021.

NZD/USD justifies another bullish boost, recently from RBNZ Governor Adrian Orr while refreshing the multi-day top to 0.6777, up 0.56% intraday during Wednesday’s Asian session.

Reserve Bank of New Zealand (RBNZ) matched wide market forecasts as it inflated the benchmark rate by 0.25% to 1.0% during the latest monetary policy meetings. While justifying the move, RBNZ Governor Orr said, “Inflation expectations for 5-10 years are anchored, but have risen recently.”

Read: RBNZ’s Orr: Capacity pressures in the economy are tightening still

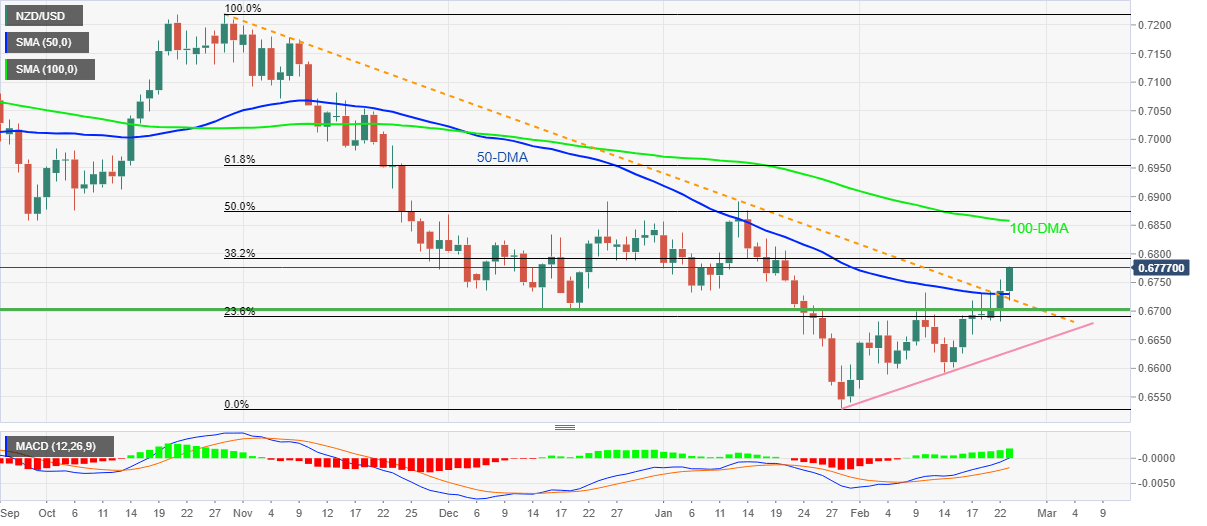

Technically, a clear upside break of 50-DMA and a descending trend line from October 2021, now support around 0.6730, joins the bullish MACD signals to keep NZD/USD buyers hopeful.

That said, the 0.6800 threshold lures intraday bulls before directing them to the 100-DMA and January’s peak, respectively near 0.6860 and 0.6890.

On the contrary, pullback moves remain elusive beyond 0.6730, a break of which will direct NZD/USD bears to December 2021 low surrounding 0.6700.

Even if the quote drops below 0.6700, an ascending support line from January 28, near 0.6630, will be crucial for NZD/USD sellers to retake controls.

NZD/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.