NZD/USD Price Analysis: Bears stacking their chips at critical support structures

The NZD/USD is under pressure on recent comments from the central bank's officials where a lower currency is their preference.

The following 1-hour chart offers the downside support structure for which the price could find its sell testing following those bearish comments on a break of current support.

Meanwhile, the following is a top-down analysis of the market structure which favours a run to the downside should daily support give out.

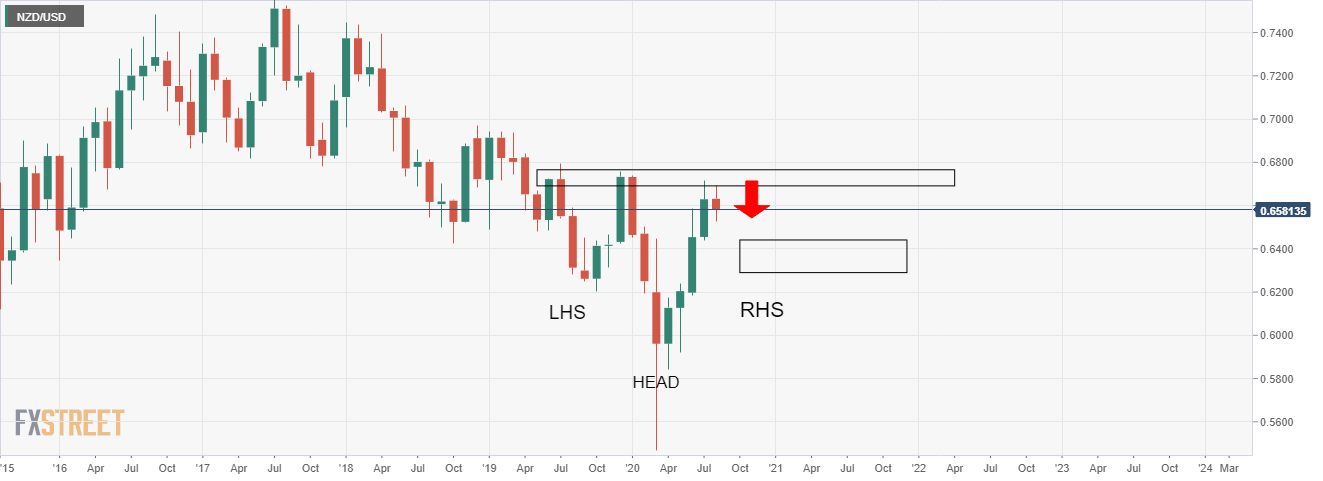

Monthly chart

The monthly outlook is bearish as price struggles with the upside and an equal high/resistance level.

A head and shoulders could be in the making.

Weekly chart

The weekly chart has test the upside resistance and is now holding at support.

The bears need to crack this support for a resumption to extend to the downside.

Daily chart

The daily chart completed and head and shoulder reversal pattern.

However, the support needs to give at this juncture or the upside has a chance to resume.

On a break to the downside, however, the price will enter the barroom brawl and a retest of the prior support turned resistance could open the prospect of the downside playbook for the monthly head and shoulders targets.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637328811789674827.png&w=1536&q=95)

-637328815232956413.png&w=1536&q=95)

-637328816197915739.png&w=1536&q=95)

-637328816867869584.png&w=1536&q=95)