NZD/USD Price Analysis: Bears seeking a daily downside extension

- NZD/USD moves in on the critical daily resistance.

- NZD/USD bears are seeking a break of channel support.

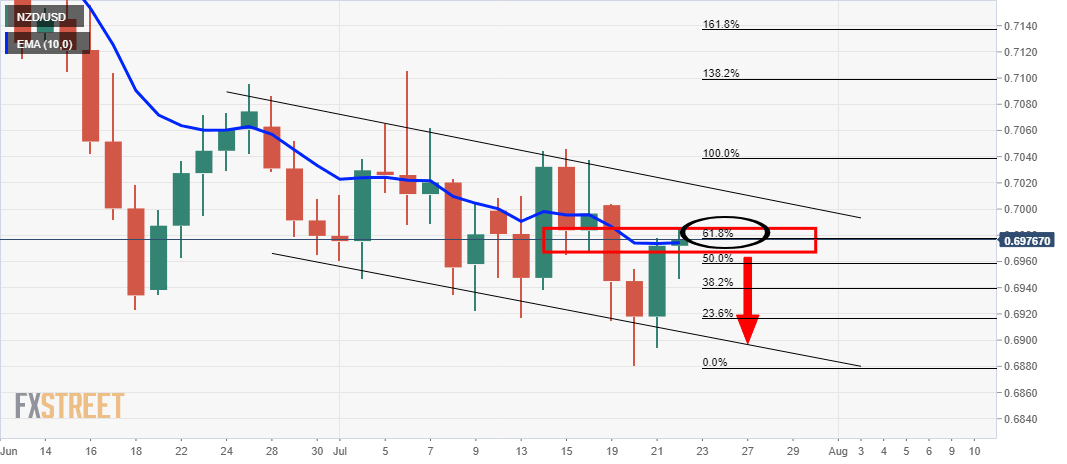

NZD/USD bears are moving in at a critical level of resistance and are seeking a break of 4-hour support which guards channel support and prospects of a lower daily low.

NZD/USD daily chart

The price is meeting a 61.8% Fibonacci confluence with prior lows and the 21-day EMA which would be expected to act as a tough level of resistance.

Bears will be seeking a break of the dynamic trendline support to target fresh lows towards 0.6850.

NZD/USD 4-hour chart

The bears will need to get below the 4-hour support for a higher probable ride to lower lows.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.