NZD/USD pressured amid subdued conditions, below 0.6000

- China’s measures to boost its property market initially lifted investor sentiment.

- Traders price in a less aggressive Federal Reserve; first-rate cut expected in May.

- The upcoming week features sparse New Zealand economic data but includes the RBA monetary policy meeting.

The New Zealand Dollar (NZD) losses some traction against the Greenback (USD) on thin liquidity conditions due to the observance of Labor Day in the United States (US). Even though China’s measures to boost its economy and a risk-on impulse, the pair is under stress after hitting a daily high of 0.5961. The NZD/USD is trading at 0.5935, down 0.04%.

The NZD lost ground despite positive news from China and the Fed’s less aggressive outlook

Price action remains subdued as volume remains scarce. Overnight news from China improved investors’ mood as the country established measures to boost its property market, which is at the brisk of a crisis. As the Government easied measures, home sales rose, as reported by Bloomberg.

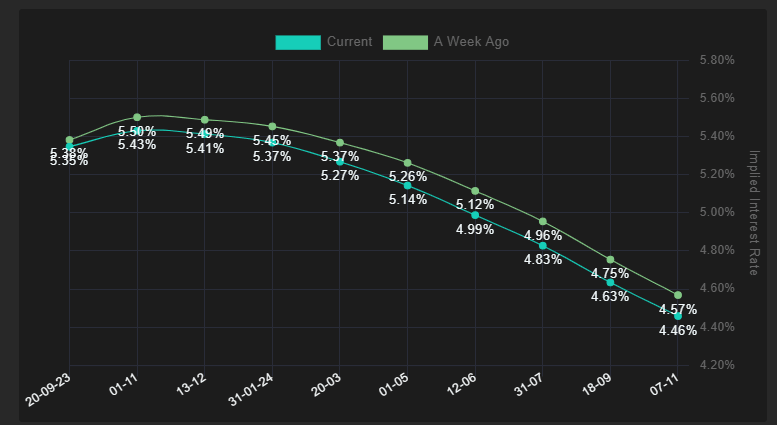

Aside from this, traders have begun to price in a less aggressive Federal Reserve (Fed) in the US. Interest rate probabilities for the September meeting remain at 92%, with the first-rate cut seen on May 1, as shown by the bottom picture. On that date, traders foresee rates at around 5.14%, 19 basis points below the effective Federal Funds Rate (FFR) of 5.33%.

Source: Financialsource

The latest round of US data witnessed Nonfarm Payrolls for August at 187K above estimates, which warranted a US Dollar upside in other conditions. Still, it wasn’t the case as the Unemployment Rate rose by 3.8% YoY, above estimates of 3.5%. Analysts at TDS Securities noted, “We think this week’s labor-market and consumer prices data should be judged as positive news by Fed officials, and we continue to view July as the last hike of the Fed’s tightening cycle.”

In the week ahead, the New Zealand economic docket is empty, except for the Global Dairy Trade Price Index release. Nevertheless, one of its largest trading partners, Australia, has scheduled the Reserve Bank of Australia’s (RBA) monetary policy meeting, in which the central bank is expected to keep rates unchanged. In that outcome, the NZD/USD could continue to resume lower unless an upbeat market mood keeps flows going toward riskier assets.

On the US front, a slew of Fed officials would keep traders entertained before policymakers enter their blackout period ahead of September’s monetary policy meeting.

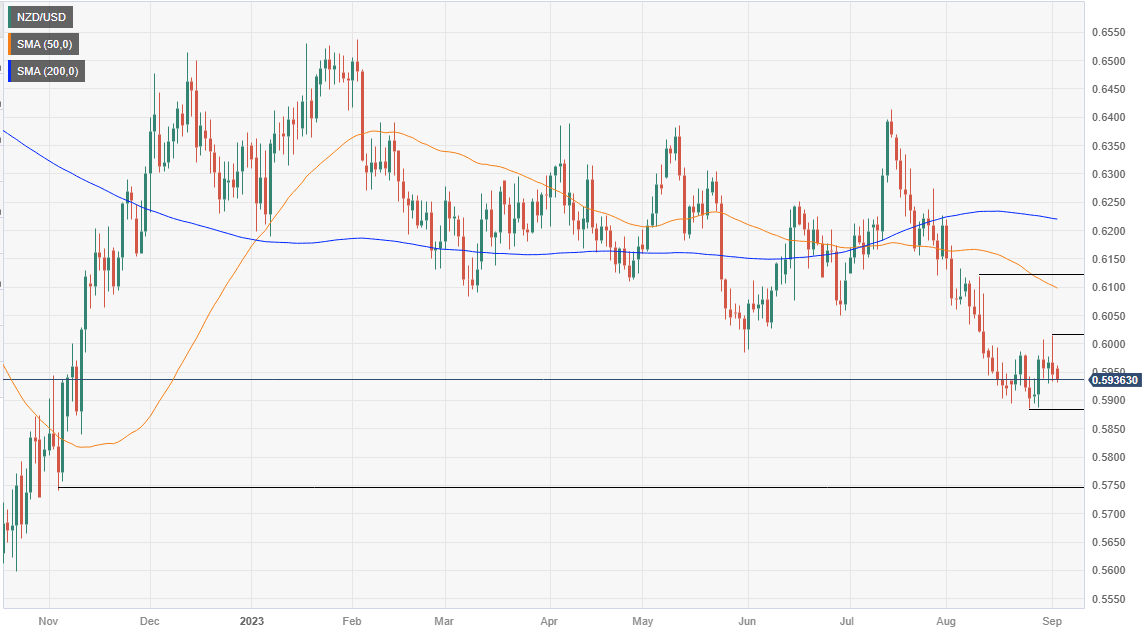

NZD/USD Price Analysis: Technical outlook

From a technical standpoint, the NZD/USD is downward biased, but in the short-term, it’s sideways, in the middle of the August 25-September 1 swing low/high at 0.5886-0.6015, waiting for a clear direction to resume a larger correction. However, if the pair tumbles below 0.5900, expected sellers to pile up and drive prices toward the year-to-date (YTD) low of 0.5886, with further downside seen at the November 3 low of 0.5740. Conversely, a rally to 0.6000 could pave the way for an upward correction, with the 50-day Moving Average (DMA) targeted at 0.6098.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.