- The Kiwi finds buyers at 0.6100 although it remains capped below 0.6130 so far.

- Strong US data and concerns about China are weighing on the NZD.

- US Dollar losses are likely to remain limited ahead of US CPI and the Fed’s meeting.

The US Dollar staged a recovery against the New Zealand Dollar after US NFP data from Friday highlighted the resilience of the US labour market and curbed hopes of Fed cuts in early 2024.

Data released over the weekend showed that China’s Consumer Prices grew at their slowest pace in three years, adding concerns about the frail momentum of the world’s second-largest economy and hurting the China-proxy NZD.

The calendar is light today with traders awaiting Tuesday’s US CPI data and Wednesday’s Fed’s monetary policy decision to shed some more light on the bank’s next monetary policy steps.

Technical indicators are turning lower, with NZD/USD price action below the 4h 50 SMA and hovering above the 100 SMA. Resistance at 0.6130 is capping bulls so far, closing the path towards 0.6190 and 0.6225.

Failure to regain 0.6130 would increase pressure towards 0.6050 and 0.6000.

Technical levels to watch

(This story was corrected on December 11 at 15:01 GMT to say that NZD/USD remains capped below 0.6130, not 1.6130, and that resistance at 0.6130 is capping bulls, not support).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

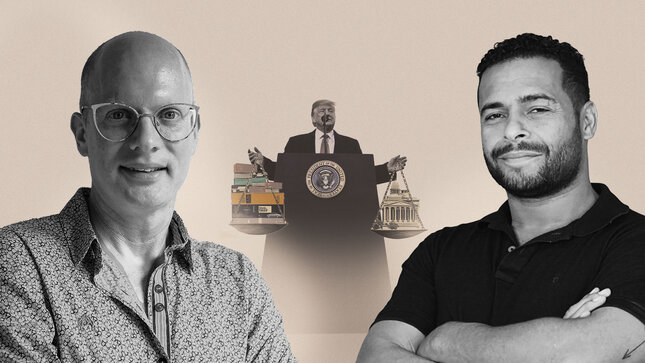

U.S. Pres. Trump expected to announce reciprocal tariffs –LIVE

U.S. President Donald Trump is set to unveil the details of his reciprocal tariffs on what he dubs "Liberation Day." Markets are on high alert, bracing for increased volatility amid growing concerns that these tariffs could negatively impact both economic growth and inflation prospects.

EUR/USD looks to retest 1.0900

EUR/USD surged to multi-day highs in response to further selling pressure on the Greenback and news that the EU could be planning measures to alleviate Trump’s tariffs.

Gold looks consolidative near $3,120 ahead of Trump's “Liberation Day”

Gold is regaining momentum, climbing above $3,120 after a slight pullback from Tuesday’s near-record high of $3,150. Retreating US yields are bolstering XAU/USD, ahead of President Trump's official announcement of the reciprocal tariff measures later this Wednesday.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

Grayscale launches Bitcoin options ETF with a focus on income generation

In a press release on Wednesday, Grayscale announced the launch of Bitcoin options-based ETFs, the Grayscale Bitcoin Covered Call ETF (BTCC) and Grayscale Bitcoin Premium Income ETF (BPI).

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.