- NZD/USD bulls step in and target the 38.2% Fibo.

- The 50% mean reversion is eyed as a potential deeper target.

- US dollar is expected to be stronger for longer.

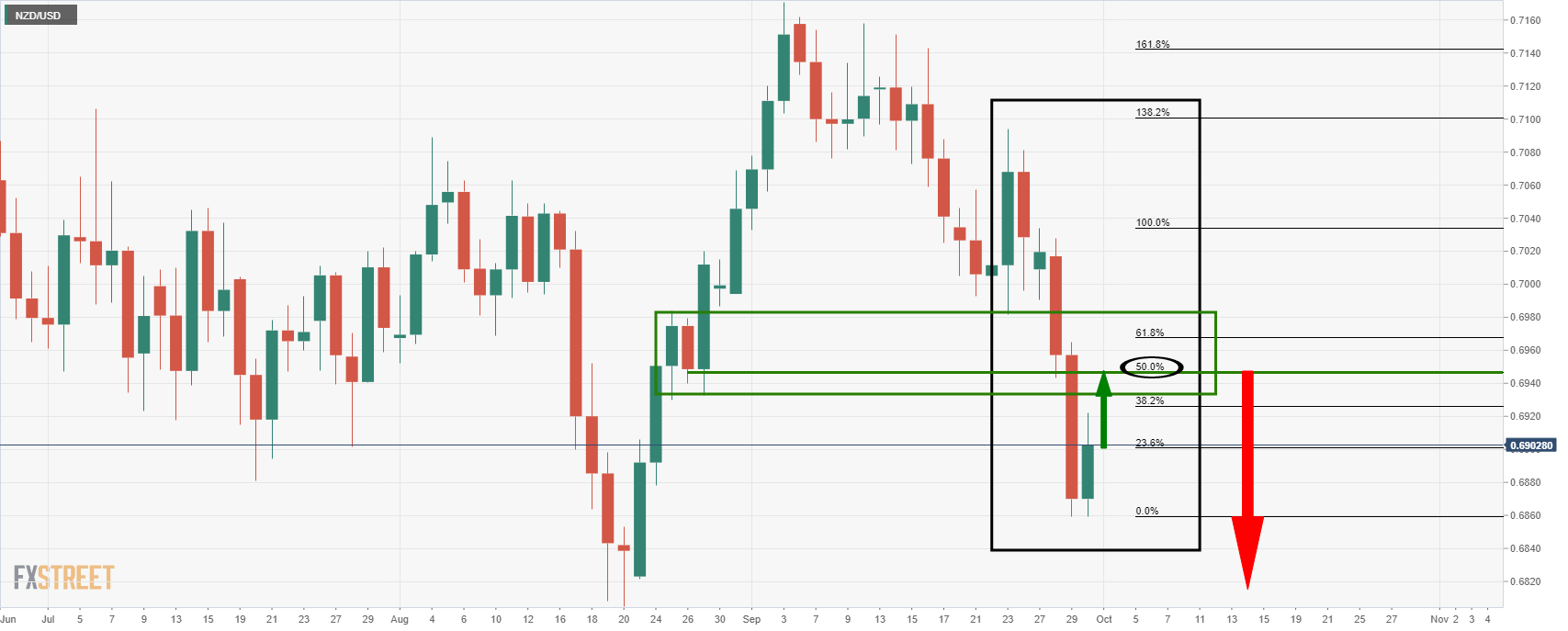

NZD/USD is trading around 0.58% higher on the day and has risen from a low of 0.6859 to a high of 0.6921, coming close to its 38.2% Fibonacci retracement of the daily drop at 0.6927.

The surprise rise in US jobless claims weighed on the greenback on Thursday. US Initial Jobless Claims rose for a third straight week to 362,000 for the period ending Sept. 25. Economists polled by Reuters had forecast 335,000 jobless applications for the latest week.

However, US equities have also responded in kind as the markets still expect the Federal Reserve to taper its monetary stimulus beginning in November. Last week, the Fed also flagged interest rate increases may follow sooner than expected.

At home, however, the overall story for the Kiwi is one of altitude adjustment, analysts at ANZ Bank said in a note on Friday in Asia. ''The three most correlated variables for the NZD of late have been US high-yield bond spreads, the USD against a basket of Asian currencies, and emerging market equities.''

''As each of these have come back, so has the NZD. Overlay the long tail of Delta over that, and the picture is arguably less optimistic than it was, even with OCR hikes and carry coming next week.''

You can't keep a good US dollar down

Meanwhile, switching back to the US dollar, a correction might be all that we get for the meantime and a move higher could be just around the corner. Analyst's at Brown Brothers Hamrriam are of that mind. ''The speed of this dollar move is quite frankly very surprising,'' the analysts said. ''Based on the previous experience, we believe that this period of dollar strength still has legs.''

With regards to US yields, the analysts target higher in the 10-year. ''It remains on track to test the May high near 1.70% and then the March 30 high near 1.77%. The real 10-year yield is also higher and at -0.85% is the highest since July 1. A break above -0.82% is needed to set up a test of the March 19 high near -0.59%. If this rise in US yields can be sustained, it is yet another dollar-positive factor to consider. Of note, the Fed Funds strip now has lift-off in Q4 2022 almost fully priced in.''

NZD/USD technical analysis

NZD/USD is establishing and there could be a continuation to the upside beyond the 38.2% Fibo to target near 0.6950.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Further gains need more conviction

AUD/USD reversed two-daily pullbacks in a row on Tuesday, staging a decent comeback from Monday’s troughs near 0.6220 to the boundaries of the 0.6300 hurdle propped up by the RBA hawkish hold and firm data from Chinese business activity.

EUR/USD remains offered below 1.0800 ahead of “Liberation Day”

EUR/USD came under extra downside pressure on Tuesday, returning to the sub-1.0800 region on the back of tepid gains in the US Dollar and rising caution prior to Trump’s announcements on Wednesday.

Gold nears $3,100 as fears receded

Gold is easing from its fresh record high near $3,150 but remains well supported above the $3,100 mark. A generalised pullback in US yields is underpinning the yellow metal, as traders stay on the sidelines awaiting clarity on upcoming US tariff announcements.

Bitcoin just as vulnerable as major assets – Anthony Yeung, Global Head of Strategic Development at CoinCover

Bitcoin trades under the $85,000 mark, holding on to nearly 3% gains on Tuesday ahead of Donald Trump’s Liberation Day. Crypto traders remain fearful, the sentiment reads 34 on a scale of 0 to 100 on the Fear & Greed Index.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.