NZD/USD looking to firm up a rise into 0.5970

- The NZD/USD has recovered from daily lows, currently trading into 0.5970 after mixed US data.

- US jobless claims ticked up slightly, while the trade deficit contracted, limiting US Dollar upside for Thursday.

- Money markets are pricing in Fed rate cuts by mid-2024, snubbing the Fed's own dot plot.

The Kiwi (NZD) caught a bid against the US Dollar (USD) on Thursday, rising steadily from the day's opening bids near 0.5920. Mixed US economic data failed to revive Greenback buying in the markets, giving the NZD/USD a much-needed chance to recover some ground on the charts.

Forex Today: Dollar slides further ahead of NFP

US Initial Jobless Claims for the week ending September 30th increased to 207K, below the forecast 201K but still an increase over the previous period's 205K. Labor market conditions in the US remain tight despite the reading, and the US trade deficit again narrowed in August to $-56.3 billion, below the market forecast of $-62.3 billion, and is a three-year low for the figure.

US Treasury yields eased back on Thursday, sucking up some of the USD's broad-market bid strength, giving other major currencies a chance to find their footing. US money markets are beginning to price in the beginning of potential Federal Reserve (Fed) rate cuts in mid-2024, which runs contradictory to the Fed's own dot plot projections, and only time will tell which institution is more correct.

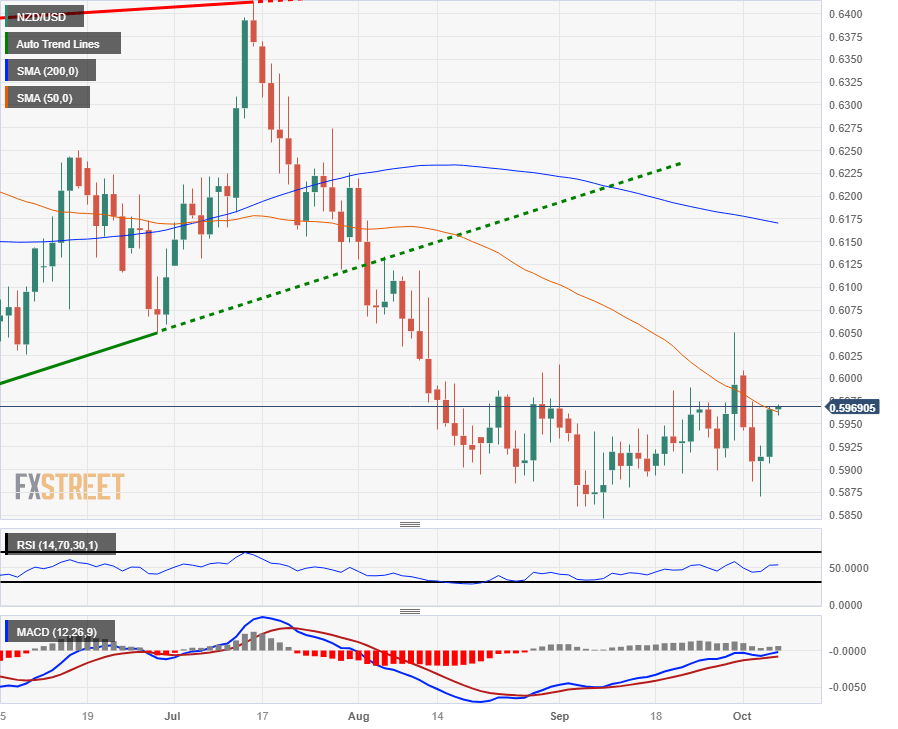

NZD/USD technical outlook

Despite Thursday's bump-and-run for the Kiwi, the NZD/USD remains notably bearish in the medium-term, with the pair pinging into the 100-day Simple Moving Average (SMA) and the 200-day SMA turning bearish from 0.6175, providing a technical resistance ceiling for the pair.

The NZD/USD has mostly consolidated since mid-August when the pair finished a backslide from the year's last swing high into 0.6414, and the Kiwi has plenty of ground to cover if it's going to stage a meaningful bullish push back to the year's highs.

The pair marked in a low for 2023 of 0.5847 back in September, and a resurgence of US Dollar bidding across the broader marketscape will see the NZD/USD tumbling back into the year's lows.

NZD/USD daily chart

NZD/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.