NZD/USD jumps from around YTD lows on slipping US yields ahead of Fed’s decision

- NZD/USD trades at 0.5917, up 0.37%, as US Treasury bond yields retreat, providing a tailwind for the Kiwi currency.

- Federal Reserve expected to hold rates steady; markets keenly await updates to the 'dot-plot' and Summary of Economic Projections.

- Busy week for New Zealand economic data, including Current Account and GDP, could further influence the NZD/USD direction.

The New Zealand Dollar (NZD) trims some of its losses vs. the American Dollar (USD) and prints solid gains of 0.37% as US Treasury bond yields retrace from last week’s high, ahead of the following US Federal Reserve’s monetary policy decision. Hence, the NZD/USD is trading at 0.5917 after hitting a daily low of 0.5895.

New Zealand Dollar gains against the US Dollar, buoyed by falling US Treasury yields and optimism ahead of the Federal Reserve's policy update

Market sentiment is upbeat ahead of the Fed’s decision, bolstering the Kiwi, though it remains near the day’s lows. Improvement on last week’s Chinese data sponsored a slim recovery on the NZD/USD pair amid an absent US economic docket on Monday.

Jerome Powell and Co. are expected to keep rates unchanged while updating their monetary policy path, as he and his colleagues would actualize the ‘dot-plot.’ Additionally, Fed officials would update their economic forecasts, included in the Summary of Economic Projections (SEP).

Should be said the latest US economic data showed inflation ticked up, retail sales hold the fort, growing at solid levels, while the labor market remains tight. Even though consumer sentiment deteriorated, they remain optimistic that prices would edge lower, as shown by the University of Michigan (UoM) Consumer Sentiment report.

Nevertheless, as US economic activity continues to slow down at a moderate pace, market participants have begun to price in a possible soft landing. In the meantime, the US Dollar Index, which tracks the Greenback’s performance against a basket of six currencies, dropped 0.17%, down at 105.15, a tailwind for the NZD/USD. Falling US Treasury bond yields are to be blamed, as the 10-year note coupon falls 0.39%, at 4.317%.

Aside from this, the New Zealand (NZ) economic docket during the current week could delineate the NZD’s direction. The release of the Current Account, the Westpac Consumer Survey, the Gross Domestic Product (GDP), and the Trade Balance would give us some clues regarding the status of NZ’s economy.

NZD/USD Price Analysis: Technical outlook

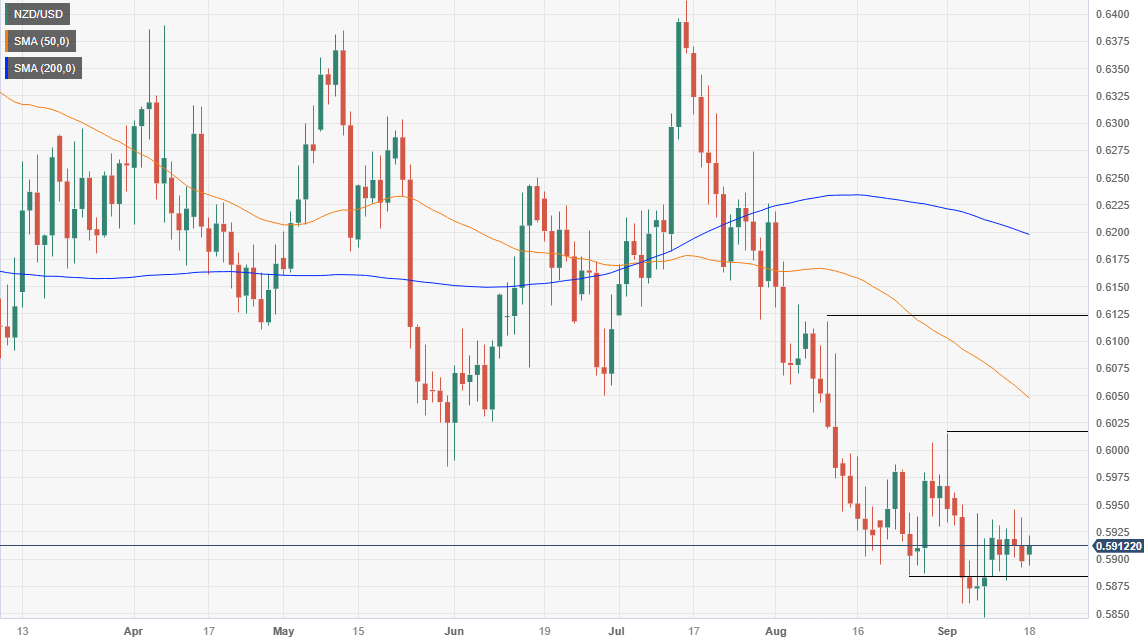

Last week, the NZD/USD remained in sideways trading, unable to break to new year-to-date (YTD) lows of 0.589, but unable to reclaim the 0.6000 figure. Nevertheless, the pair is still downward biased as the 50 and 200-day Moving Averages (DMAs) slopes aim downwards. That and price action remaining below the September 1 daily high at 0.6015 could pave the way for further upside and test the 50-DMA at 0.6047. On the downside, the 0.5900 threshold is the first support, followed by the YTD low.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.