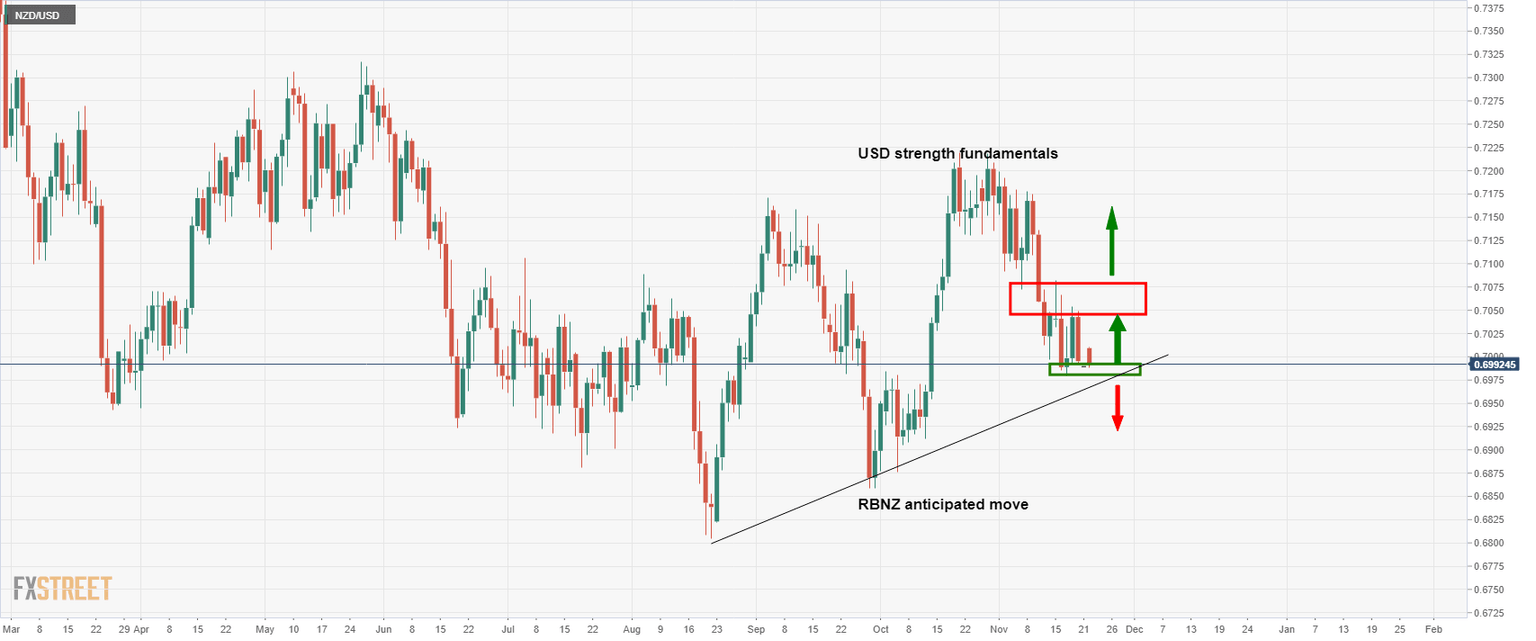

NZD/USD is on the forex watchlist, RBNZ showdown this week

- NZD/USD volatility is on the cards this week around the RBNZ.

- 0.7220 and 0.6800 are daily swong levels eyed depending on the outcome.

NZD/USD is sitting near 0.7000 in the open and seemingly resistant to the US dollar's strength despite the risk-off mood. On Friday, the pair shed around 20 pips but eld up relatively well as traders position for higher interest rates in New Zealand ahead of this week's Reserve Bank of New Zealand meeting.

''Whippy price action looks to be on the cards this week,'' analysts at ANZ Bank said noting that markets are split on whether the RBNZ will deliver a 25bp or 50bp hike on Wednesday. ''Fireworks are all but guaranteed no matter what they do,'' they added.

''Markets seem to be becoming a bit glass-half-empty, and we wouldn’t be surprised if 25bps puts the NZD under pressure on the view that interest rate support isn’t as strong. Or ironically, 50bps might be viewed as the straw that breaks the proverbial camel’s back for the economy. But it might be a lot simpler than that: other countries are normalising too, and that could eat into New Zealand’s erstwhile lone star power.''

Meanwhile, analysts at TD Securities concede that 50 bps is a possibility given the surge in inflation expectations and the red-hot labour market. The analysts argue that the Bank risks missing its medium-term remit. ''If our baseline pans out, the Bank could signal a more rapid path to neutral,'' and this ''is likely over coming meetings once the economic recovery gains momentum as current COVID restrictions ease.''

NZD/USD technical analysis

The price is meeting support following the recent daily sell-off on USD bullish fundamentals. A break of the trendline support opens risk to the downside towards 0.6800 while a break of the recent highs should clear the way to the October highs near 0.7220.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.