- NZD/USD currently trades just below the 0.7250 mark, but is holding above the 0.7220-0.7240 support zone for now.

- NZD/USD continues to focus on global themes, such as sentiment towards the US dollar and the reflation narratives.

NZD/USD currently trade just below the 0.7250 mark, down about 0.2% or just under 20 pips on the day amid indecisive US dollar trading conditions. The pair has swung as high as the 0.7280s and as low as the 0.7220s but has been moving closer to Friday’s lows again in recent trade amid a pick up in the US dollar that has seen the Dollar Index move back above 90.00.

The pair did not see much of a reaction to the release of the December US labour market report, given that markets are looking through any near-term economic weakness and towards the post-Covid-19 recovery at the moment.

Driving NZD/USD this week

NZD/USD continues to focus on global themes, such as sentiment towards the US dollar and the reflation narratives, both of which have received a boost since the victory of the Democrats in the Georgia Senate elections that handed them control over Congress and ensures that more US stimulus is on the way.

These two factors have had a mixed impact on NZD/USD thus far; the more markets bet on inflation (i.e. the higher US inflation expectations and commodity prices rise), the better this is for commodity-export dependent countries such as New Zealand and their currencies. Meanwhile, the more USD sentiment improves, the more this weighs on the cross; the bullish USD arguments right now go along the lines of more fiscal stimulus translating into stronger short, medium and long-term growth and a more hawkish Fed.

While most analysts expect the markets to continue to bet on higher inflation (meaning inflation expectations, nominal bond yields and commodity prices ahead) as a result of expectations for more stimulus, the debate on the ultimate impact this will have on the US dollar rages on. The dollar bears maintain that further fiscal stimulus will not be a USD positive given that 1) it will be funded by more government debt and will likely widen the US trade deficit, 2) higher debt will make it even harder for the Fed to normalise policy and 3) it will boost global growth and risk appetite which is generally bad for safe-haven USD.

Ultimately, what happens with USD will be the ultimate determinant of whether NZD/USD is going to continue to rally or will stall for a while, but given the boost to NZD from the reflation trade, the kiwi is likely to continue to outperform its less commodity-export dependent G10 peers such as EUR, GBP and JPY.

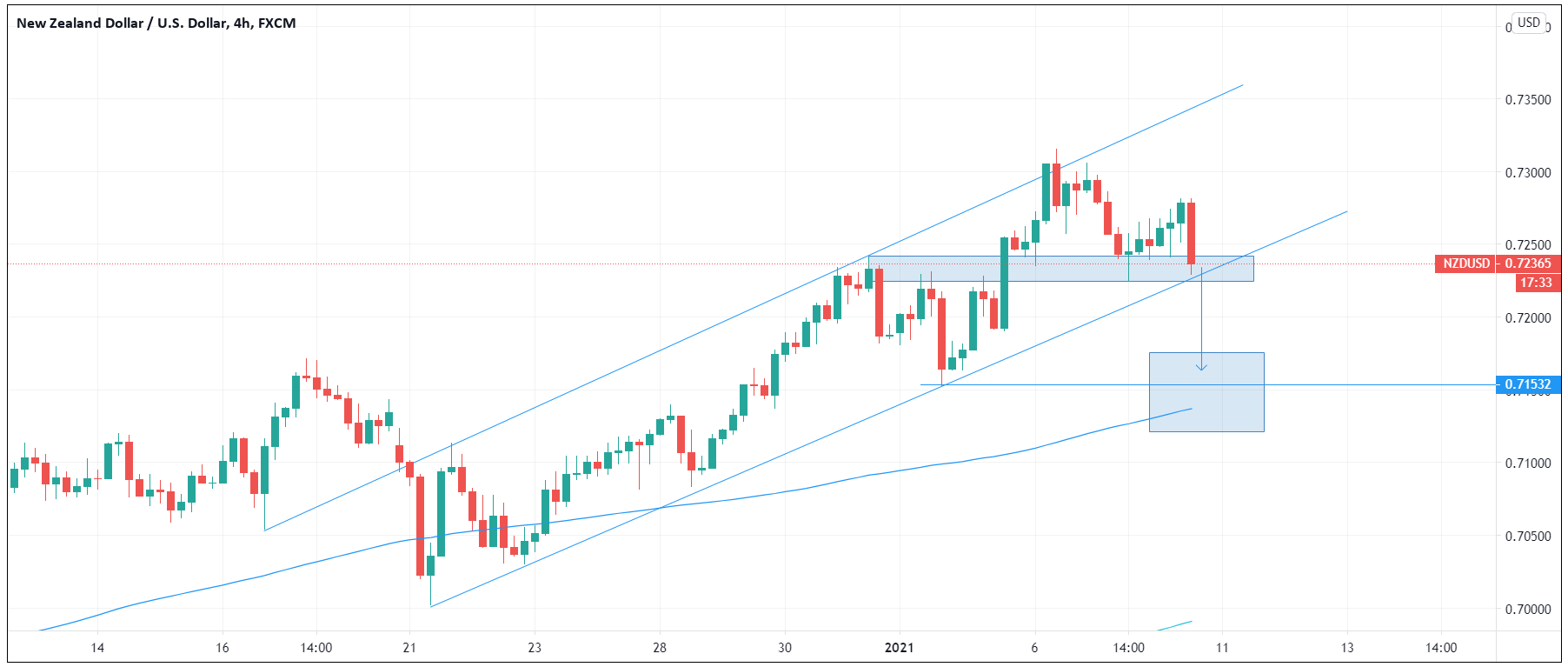

NZD/USD still in bullish trend channel

NZD/USD continues to advance within a bullish trend channel that has been in play since the second half of December 2020. To the downside, the price action has been supported by an uptrend linking the 21, 21 and 28 December, as well as the 4 January lows and to the upside, the price action is being capped by an uptrend linking the 16 December low and 21, 30 and 31 December highs.

A break below this trend channel would require a definitive break below the 0.7220-0.7240 support/resistance area that has been in play since 31 December 2020, and would likely open the door to a move towards Monday’s low at 0.7150 and perhaps a test of the pair’s 21-day moving average just below that at 0.71371.

NZD/USD four hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.