NZD/USD heading back towards 0.5800 as Greenback sees Friday bids

- The NZD/USD is back into Friday's lows as the US Dollar sees a late bid on Friday.

- The Kiwi continues to face topside rejection as broader markets choose safer havens.

- Kiwi traders will be looking ahead to next Tuesday's NZ labor figures.

The NZD/USD is ticking back towards 0.5800 heading into the Friday market close, falling back from the day's peak near 0.5845 as traders step back into the Greenbac, tilting risk-off to wrap up the trading week.

The Kiwi hit a new eleven-month low this week, tapping 0.5772 on Thursday, and the NZD/USD is seeing resistance clamping off a successful rebound bid.

US Personal Consumption Expenditure (PCE) Index figures came in at expectations, and markets will be turning eyes towards next week's showing from the Federal Reserve (Fed), where the US central bank is broadly expected to hold off on rate hikes.

Investors will be keeping close watch of Fed Chairman Jerome Powell's speech slated for half an hour after the Fed's rate call, and market participants will be keeping an ear out for any changes to the Fed's rhetoric. Despite the expected rate hold, markets continue to see increasing odds of one last rate hike from the Fed in December as inflationary pressure continue to stick higher than markets had expected or hoped for.

Next week also sees New Zealand labor data late Tuesday. The NZ Unemployment Rate is expected to tick up from 3.6% to 3.9% for the 3rd quarter, and investors are expecting the NZ Employment Change to slowdown hiring, with Q3 new jobs expected to increase by only 0.4% compared to Q2's 1.0% even print.

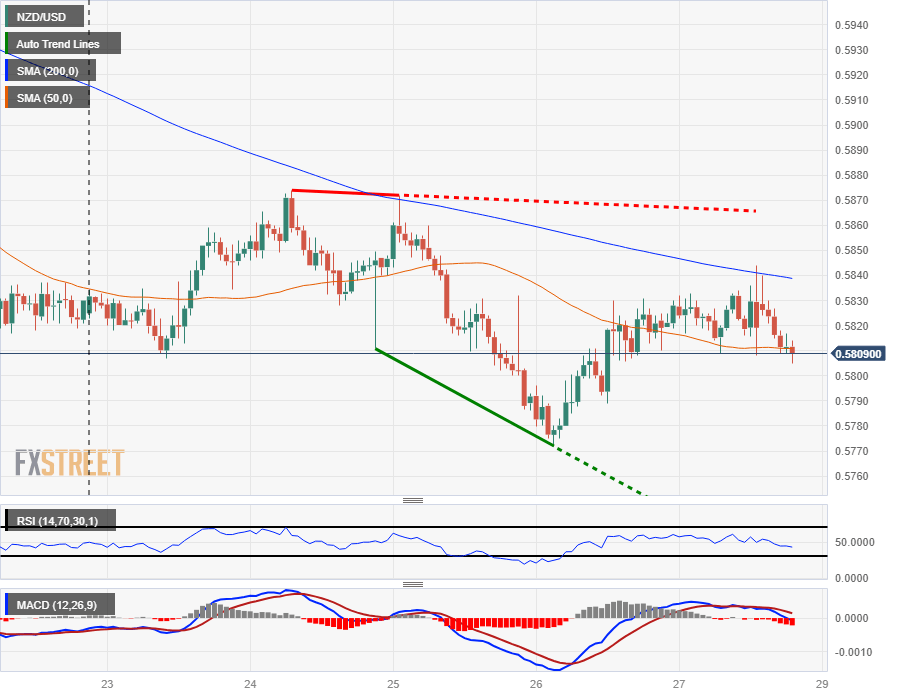

NZD/USD Technical Outlook

The NZD/USD continues to face rejection from the 200-hour Simple Moving Average SMA), seeing a bounce back from the technical barrier twice this week, and Kiwi traders are struggling to find technical reasons to bid the NZD back up from the year's new lows near 0.5770.

Daily candlesticks see the NZD/USD trading firmly into the downside, tumbling from the last swing high into 0.6050, but overeager bulls looking to catch falling knives will probably want to wait until a bullish crossover signal on the Moving Average Convergence-Divergence (MACD) currently settling into oversold territory with directional momentum bleeding towards the midrange.

NZD/USD Hourly Chart

NZD/USD Technical Outlook

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.