NZD/USD Forecast: Wall Street weighs on commodity-linked currencies

- Investors kept their eyes on government bond yields and stocks for direction.

- Reserve Bank of Australia Governor Michele Bullock will hit the wires early on Friday.

- NZD/USD could accelerate its slump on a break through 0.6078.

The NZD/USD pair trades just below the 0.6100 mark ahead of the Asian opening, ending Thursday with modest losses. The pair hit 0.6123 at the beginning of the day, but quickly turned south as the US Dollar found legs on strong American data and the soft tone of stock markets. It is worth adding, however, that after spending most of the day in the red, Wall Street has managed to trim early losses, with the Dow Jones Industrial Average and the Nasdaq Composite posting modest gains and the S&P500 poised to end the day little changed just below the 5,000 mark.

Focus on equities and yields

The focus was not only on equities. Investors were also paying attention to US Treasury yields, up on the day on the back of signs the Federal Reserve (Fed) has no reason to rush into cutting interest rates. Multiple policymakers hit the wires these days and backed Chairman Jerome Powell’s concepts, expressed in the aftermath of the latest monetary policy. The main idea is that interest rates will remain at current levels until officials are more certain inflation will stabilize around their 2% goal.

In the meantime, solid US employment-related data took out pressure from policymakers. The country reported that weekly unemployment claims rose to 218K in the week finished February 2, beating the 220K expected.

The macroeconomic calendar will remain scarce in Asia on Friday, with only a speech from the Reserve Bank of Australia (RBA) Governor Michele Bullock in the docket.

NZD/USD Technical Outlook

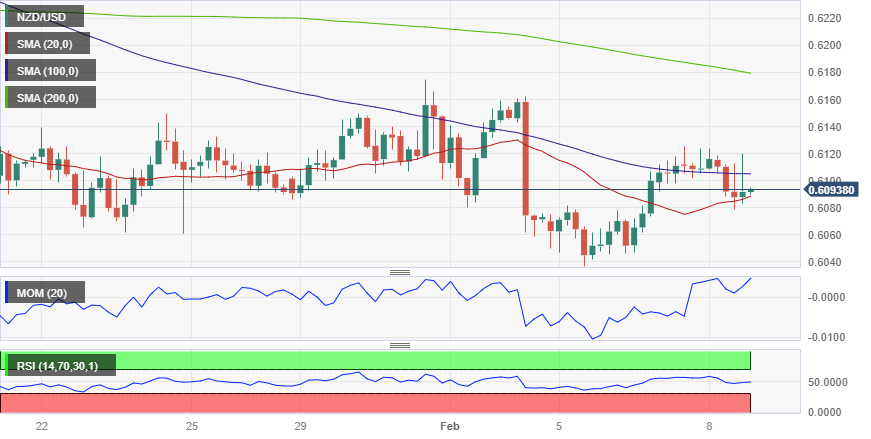

The NZD/USD pair held within familiar levels, maintaining a technically neutral stance. The daily chart shows sellers are aligned around a bearish 20 Simple Moving Average (SMA), while intraday buying interest surged around a flat 200 SMA, the latter at around 0.6080.

The same chart shows technical indicators have lost momentum within negative levels, lacking enough directional strength to anticipate a new leg south.

The case for another leg lower should be stronger on a break through the daily low, at 0.6078. Speculative interest will then look to test buyers´ determination at 0.6028, the February monthly low.

Author

FXStreet Team

FXStreet