- NZD/USD is consolidating just above the 0.7250 level, lower as a function of the stronger US dollar.

- Amid a lack of any New Zealand specific fundamentals, NZD/USD has traded mostly as a function of dollar flows this week.

NZD/USD has flatlined in recent trade just to the north of the 0.7250 level, having slipped back below 0.7300 early in the European morning. The pair closed Thursday trade with losses of about 0.5% or 34 pips.

Kiwi being driven by USD dynamics

Amid a lack of notable economic or political developments coming out of New Zealand, the kiwi has largely been trading as a function of global themes and US dollar flows. In recent days, rising inflation expectations have been helping lift NZD; rising inflation expectations have gone hand in hand with rising commodity prices that benefit commodity-export dependant economies like that of New Zealand’s.

The pair rallied from the week’s opening levels around 0.7150 to above 0.7300 at one point, its highest level since April 2018, but has since fallen back to 0.7250 amid a broad recovery in the US dollar that has seen the Dollar Index (DXY) recovery back towards 90.00 from weekly (and multi-year) lows in the 89.20s.

Driving the recent dollar recovery has been the Democrat’s Georgia election victory earlier in the week, which handed the party control of Congress to compliment the incoming Biden administration’s rule. Markets are now expecting the Democrats to in Congress to pass significant additional fiscal stimulus in the coming months and the debate as to the long-term impact this will have on the US dollar is raging.

The main bullish arguments go along the lines of further fiscal stimulus boosting US growth in 2021 and beyond leading to higher inflation and a more hawkish Fed. Indeed, the issue of when to start to ween financial markets off of the Fed’s ongoing QE programme already seems a hot topic of discussion amongst Fed members.

Meanwhile, the major bearish arguments are along the lines of more fiscal stimulus leading to higher government and trade deficits and rising bond yields, which put more pressure on the Fed to print money to keep government borrowing costs low.

NZD/USD Technical observations

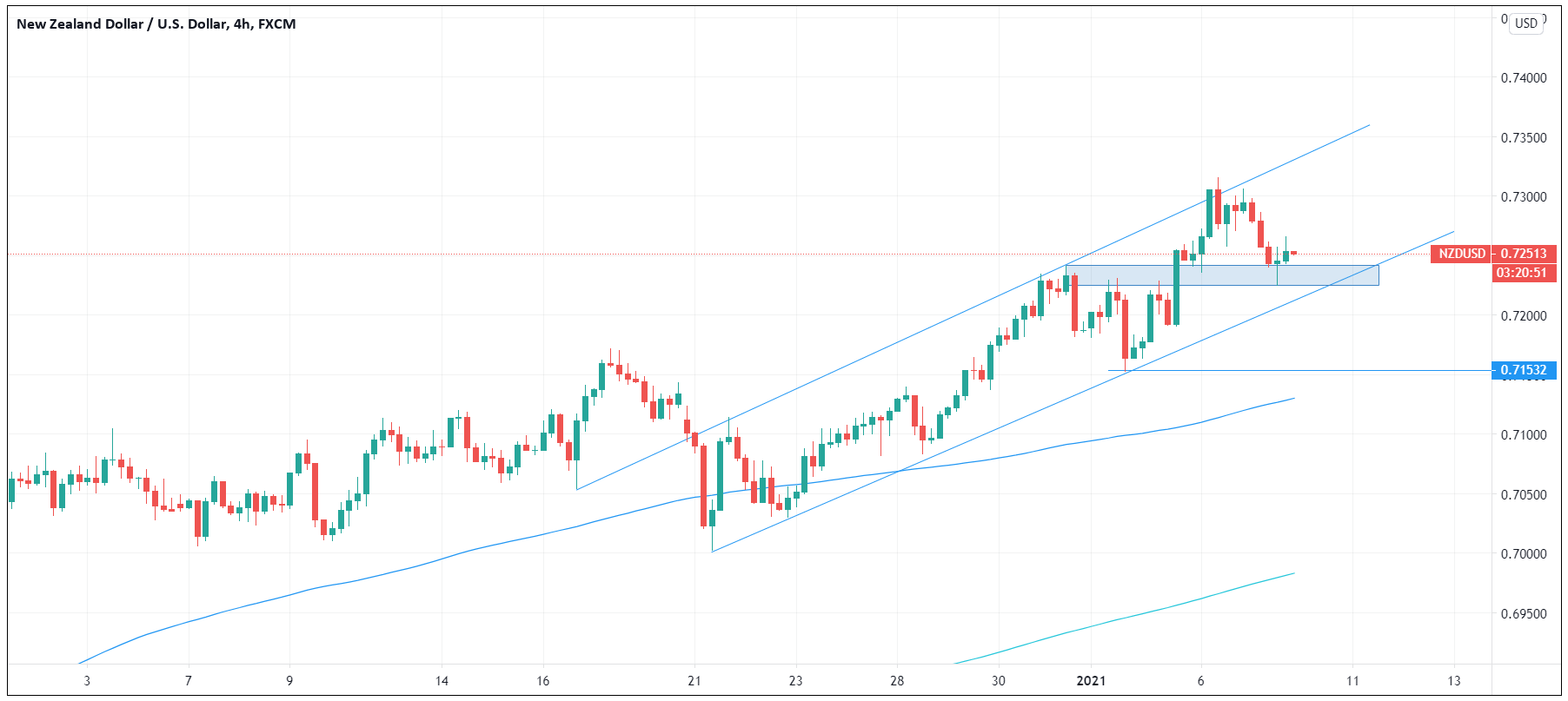

Looking at NZD/USD on a short time horizon; the pair continues to edge to the upside within a trend channel that links the 21, 22 December and 4 January lows. Therefore, its near-term bullish bias remains intact. The pair appears to have found support in support/resistance zone in the 0.7220-0.7240 area.

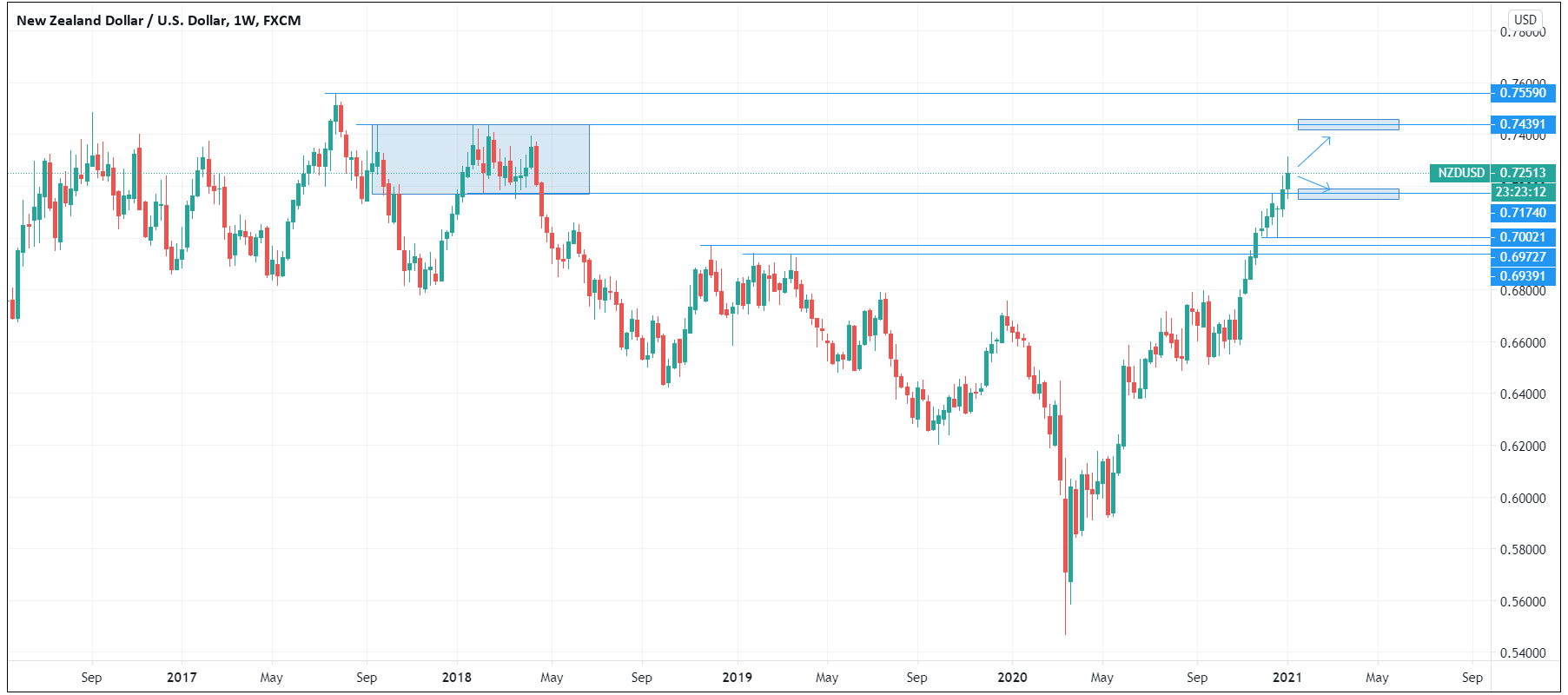

Looking at the pair over a longer time horizon, now that it has broken back into its early 2018 0.7170-0.7440ish range, bulls will be eyeing an eventual move back towards 2018 highs, perhaps coming via a retest of the bottom of this range just under 0.7200.

NZD/USD four hour chart

NZD/USD weekly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.