- NZD/USD bulls let off as risk sentiment improves on the Russian pivot.

- The imbalance left between 0.6690's and the 0.6650's for the days ahead in focus.

NZD/USD is trading 0.37% higher on the day as markets suspect that an imminent Russian invasion has been averted which has enabled a recovery in risk appetite on Tuesday. Russia said it had withdrawn some of its troops from the Ukraine border. However, the announcement, the United States and NATO said they had yet to see evidence of a drawdown.

Nevertheless, the Kiwi is higher again, averting a sell-off from 4-hour resistance. However, there are still plenty of uncertainties within a very fluid situation surrounding Russia and Ukraine. Not least, the Federal Reserve could be a ticking time bomb for the forex space with regards to its next move at the March meeting.

''Volatility remains the order of the day,'' analysts at ANZ bank argued. ''Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative.''

US yields started the week off depressed from safe-haven flows but Federal Reserve's James Bullard’s continued hawkishness on Monday led to a complete turnaround. Bullard advocates for 100 bps of tightening by July. Bullard says that he is worried that the Fed is not moving fast enough as inflation is much higher than expected. On Wednesday, Bullards concerns were met by the US Producer Price Index data that arrived much hotter than anticipated for January at 9.7% YoY. Core PPI is now at 8.3% YoY indicating that inflation is running at a rampant pace.

Fed tightening expectations

Meanwhile, Fed tightening expectations remain elevated and the following is noted by Brown Brothers Harriman:

WIRP suggests nearly 70% odds of a 50 bp move next month, up from 60% at the start of this week. Two 25 bp hikes May 4 and June 15 are still fully priced in that would take the rate up 100 bp by mid-year. Another 50 bp of tightening in H2 is fully priced in, with 60% odds of another 25 bp hike by year-end vs. over 40% odds at the start of the week. Looking further out, swaps market now sees a terminal Fed Funds rate around 2.25% and that should eventually move closer to 2.5% or even higher once this risk off episode ends.

NZD/USD technical analysis

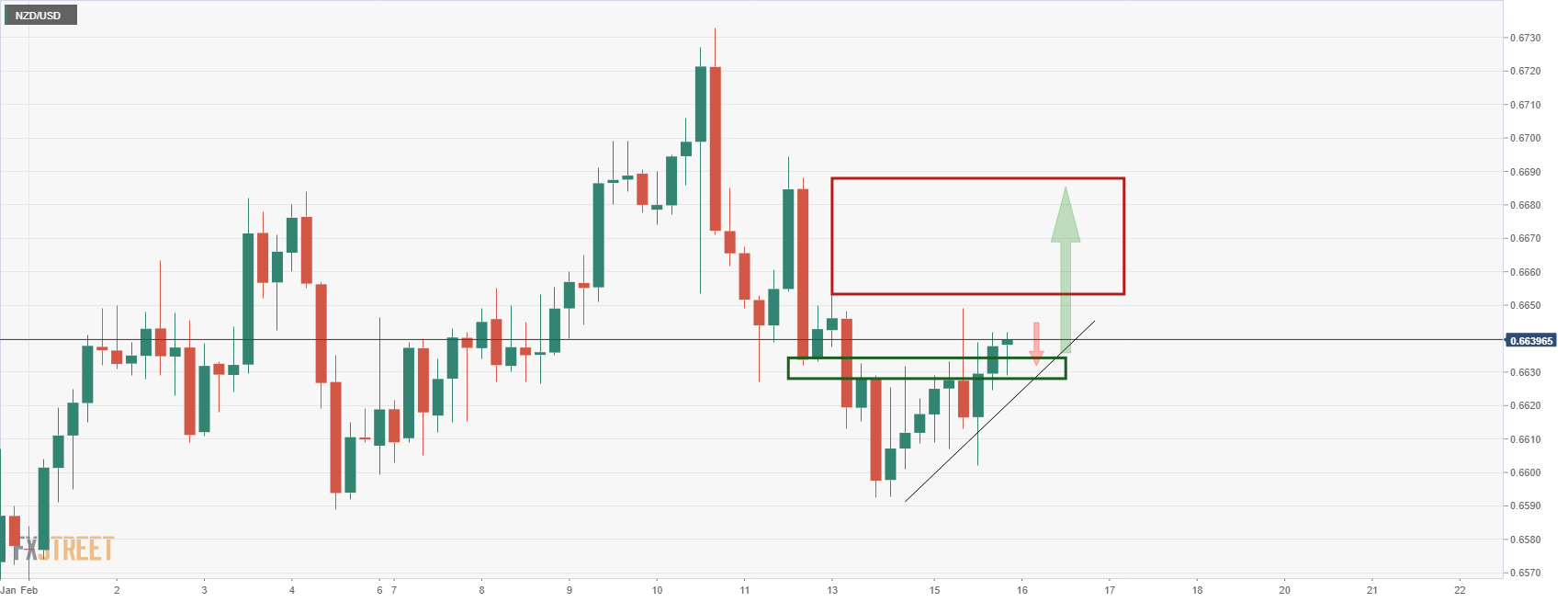

As per the prior analysis, NZD/USD Price Analysis: Trapped and consolidation is in play below bearish structure, it was noted that the price was respecting the prior 4-hour lows as resistance, but the daily support structure was menacing for the bears.

The price had been creeping in on the old support turned to resistance but the prospects of a downside continuation were thwarted in New York's trade when the price broke to fresh corrective highs:

This leaves the bulls in play and there are prospects of a surge into the imbalance left between 0.6690's and the 0.6650's for the days ahead.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak near 1.0400 as trading conditions thin out

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD consolidates below 1.2550 on stronger US Dollar

GBP/USD consolidates in a range below 1.2550 on Tuesday, within striking distance of its lowest level since May touched last week. The sustained US Dollar rebound and the technical setup suggest that the pair remains exposed to downside risks.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.