NZD/JPY Price Analysis: Persistent downtrend breaches more key support levels

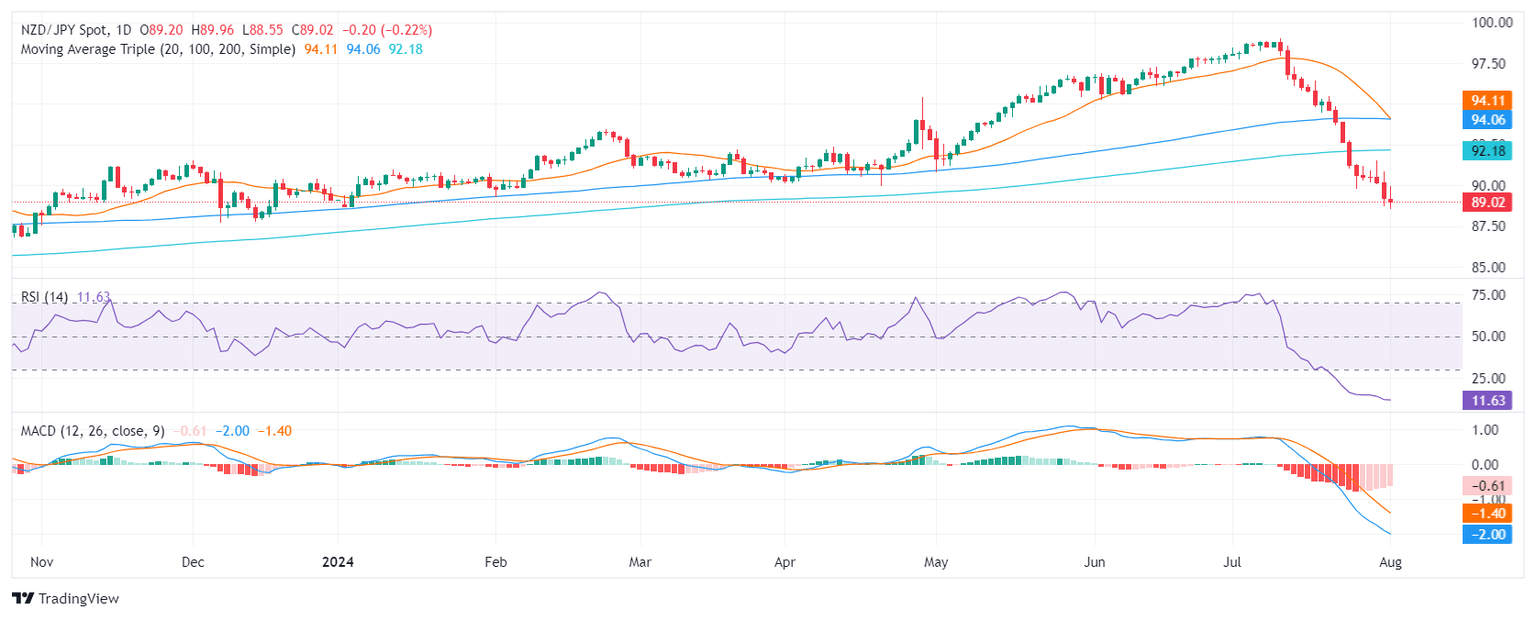

- The NZD/JPY continues its downward plunge, breaking several significant support levels in the recent sessions.

- The last hope for the pair is that the RSI remains deep in oversold terrain.

In the past trading sessions, the NZD/JPY pair has been moving on a downhill trajectory, now around the 89.00 mark. The pair has consistently posted losses, further highlighting the ongoing bearish impetus. Over the past few weeks, the cross has undergone a fall of over 7%, situating itself further below the crucial 200-day Simple Moving Average (SMA).

While the pair carries on with its steady decline, daily technical indicators hint at oversold conditions. These conditions indicate a potential for an upcoming period of stable trading, despite the continuing descent. The Relative Strength Index (RSI) has been dwelling in the oversold area which might prompt an upward correction to counter the selling pressure. Simultaneously, the Moving Average Convergence Divergence (MACD) continues to present flat red bars, suggesting a pause in the selling onslaught.

NZD/JPY daily chart

Situated south of 90.00, the pair grapples with the task of maintaining levels set at 88.50, 88.30 and 88.00. Conversely, resistance levels are eyed at 90.000, and 92.00 around the 200-day SMA.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.