NZD/JPY Price Analysis: Pair corrects around 98.00, positive outlook prevails

- NZD/JPY trades neutral around 98.00 as buyers take a breather.

- The cross might find supports at the 97.50-97.00 range for deep corrections.

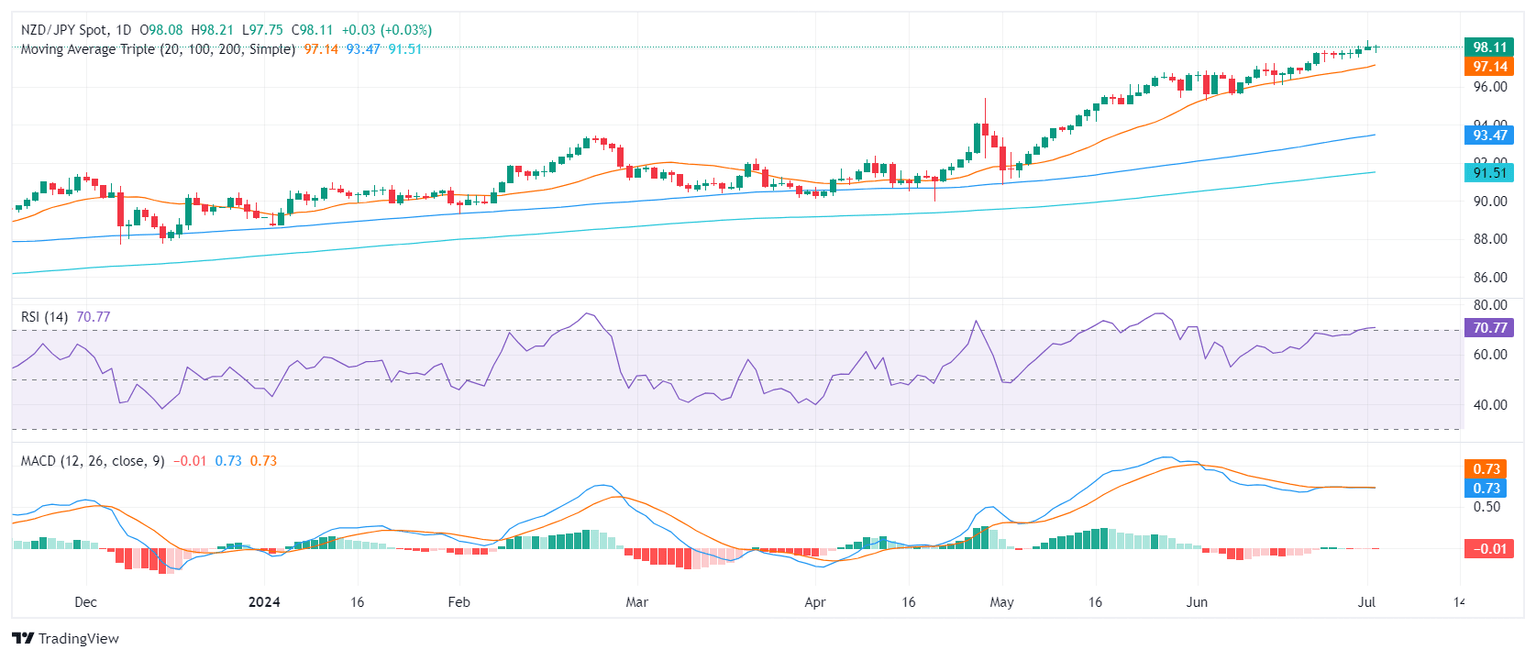

On Tuesday, the NZD/JPY pair noted neutral movements as indicators retreated from overbought levels, and the cross called for a slight correction.

The daily chart's Relative Strength Index (RSI) which approached overbought levels on Monday has shown a decline, indicating a potential cooldown in the bullish run observed last week. Even as the bullish drive remains the leading factor for this pair, the Moving Average Convergence Divergence (MACD) manifests red bars, implying that the recent bullish acceleration might be easing off.

NZD/JPY daily chart

Looking ahead, in case of further correction, immediate support is currently seen at 97.50, and near the 20-day Simple Moving Average (SMA) at the 97.00 mark. Buyers ought to concentrate on defending these levels prior to targeting newer peaks.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.