NZD/JPY Price Analysis: Cross dips towards 20-day SMA, sellers strengthen

- Kiwi's grip loosens against the Yen on Friday, moving towards the 20-day SMA.

- The cross cruises through a consolidation phase while the stance of the bear is strengthening.

- Defense around the 20-day SMA starts showing signs of weakness, hinting at potential declines.

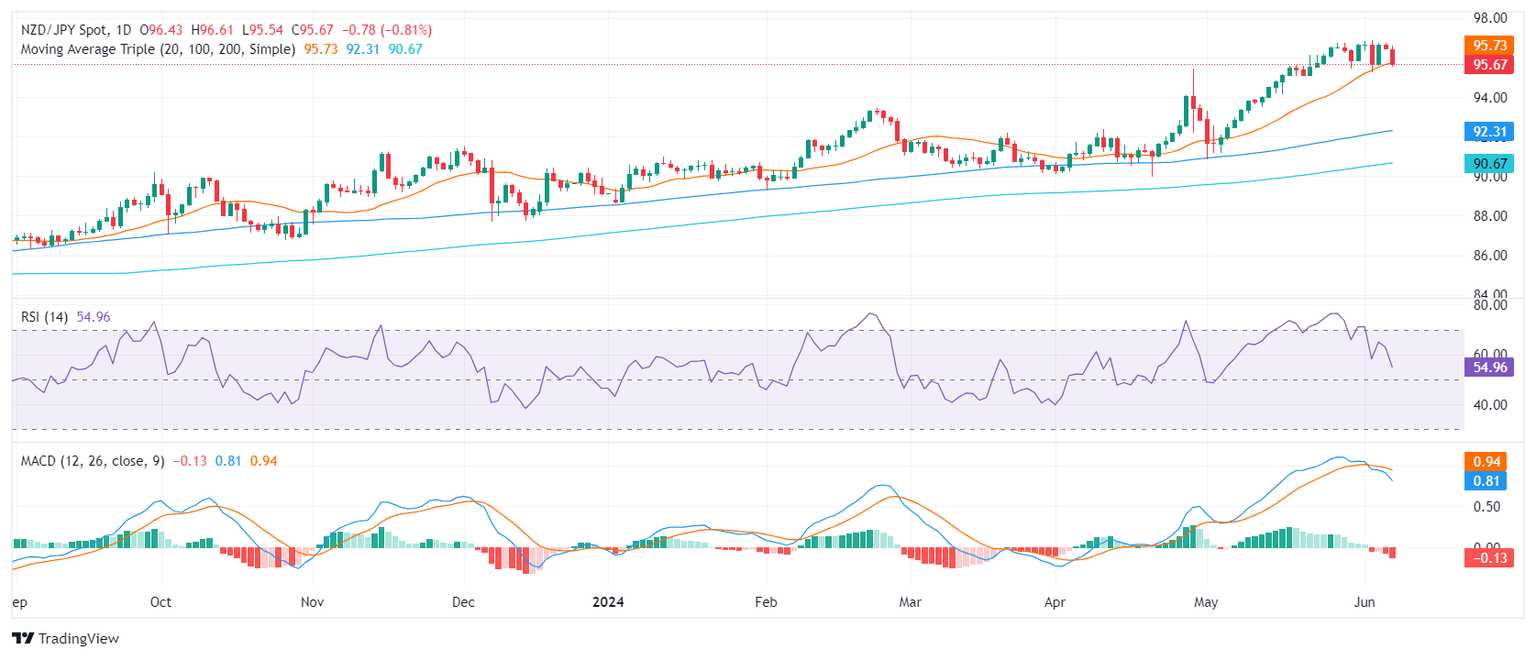

On Friday, the NZD/JPY pair faced selling pressure, with the cross declining towards the 20-day Simple Moving Average (SMA) at 95.70. It appears that the consolidation phase might have tightened its grip around the pair, restricting the buyers' ability to keep the cross afloat.

The Relative Strength Index (RSI) for NZD/JPY on the daily chart currently stands at 53, reflecting a decrease from the previous session's RSI value of 62. The RSI's movement towards the neutral zone, away from the oversold or overbought regions, hints at a moderation in buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) has started to print rising red bars, indicating a growing selling momentum and reinforcing the possibility of extended consolidation or even possible declines.

NZD/JPY daily chart

The cross's decline towards 20-day SMA coupled with strengthening selling pressure could potentially disrupt buyers' defense of the mentioned support. Despite the recent jump from around 91.00 to 96.00 since early May, it seems that consolidation has started to reign, marking a pause in the uptrend as gains are consolidated.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.