NZD/JPY Price Analysis: Bears take control conquering key level, hourly chart signals oversold conditions

- The NZD/JPY is currently trading at around 91.20, recording a 0.73% decrease in Thursday's session.

- Based on the daily chart, RSI suggests a shift from a bullish to a bearish area.

- A closer look at the hourly chart underlines the intensified selling pressure with the RSI residing near oversold territory.

- Despite these short-term bearish signals, the NZD/JPY is still operating above main SMAs suggesting a continued influence from long-term bullish buyers.

In Thursday's session, the NZD/JPY pair is trading substantially lower at around the 91.20 level, implying a potent selling momentum marking a 0.73% decrease on the day. Despite the immediate downward inclination, the pair maintains its stance in a broader bullish territory as long-term buyers retain control and these movements could be considered as a consolidation phase after reaching multi-year highs.

Based on the daily Relative Strength Index (RSI), the pair has recently fallen from positive territories into negative. Yet, before this transposition, the pair spent considerable time in overbought territories, which could indicate profit-taking movements. Turning now to the Moving Average Convergence Divergence (MACD) histogram, an uninterrupted sequence of increasing red bars is seen. These highlight an expansion in negative momentum, suggesting that sellers are currently dictating the market dynamics.

NZD/JPY daily chart

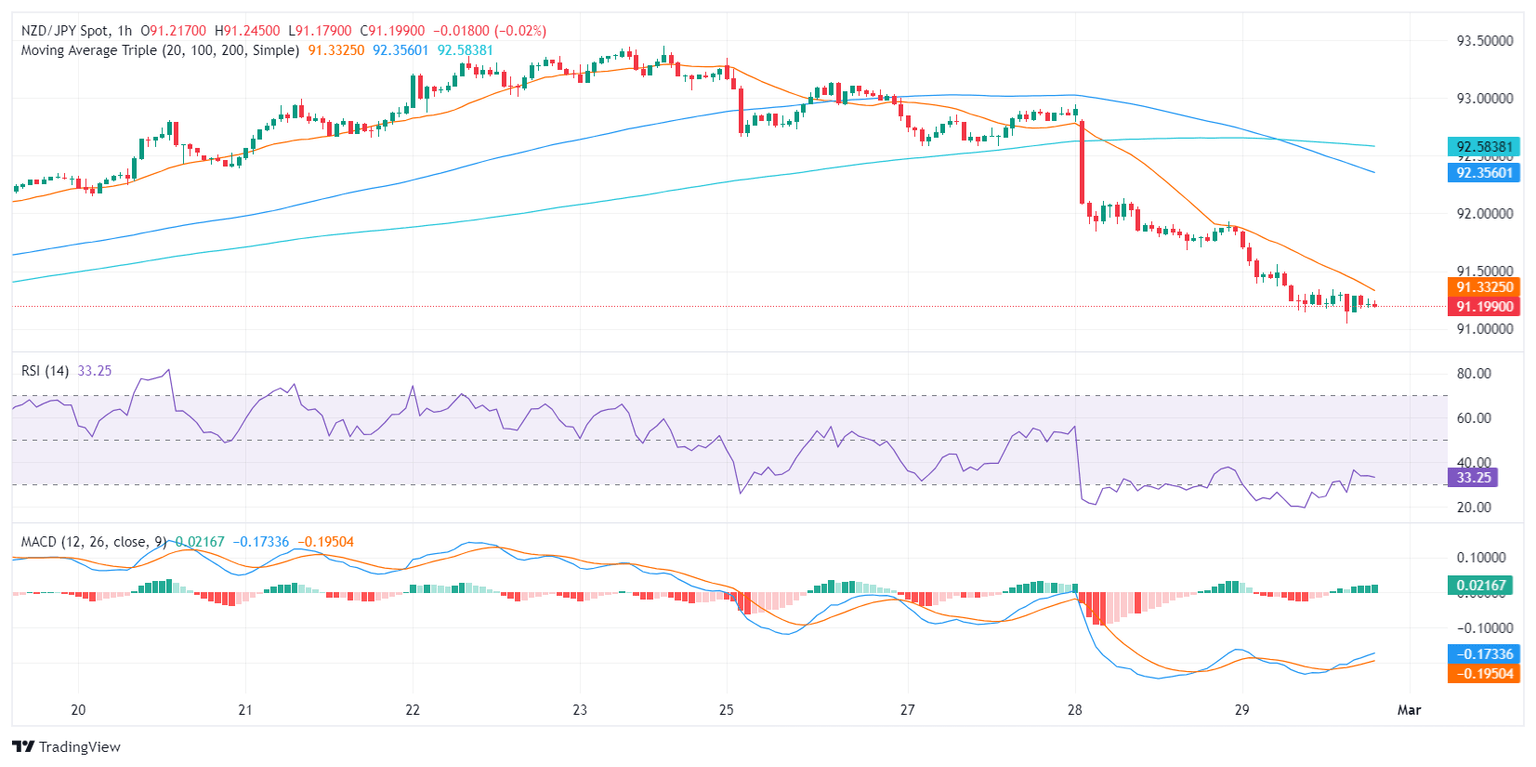

Shifting focus to the hourly chart, the RSI is noticeably near the oversold territories revealing how the selling pressure has accelerated. This is further strengthened when topped by the continuous red bars on the MACD in the hourly chart cementing the argument for the increased selling pace.

NZD/JPY hourly chart

Despite the bearish signals from the daily and hourly charts, the pair is still in broader bullish territory as it lies above the 100 and 200-day Simple Moving Averages (SMAs), showing that long-term buyers are still in command. This discrepancy could imply a temporary bearish correction within an overall bullish trend ordained by the alignment of the SMAs.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.