- Exxon Mobil's share prices are near the lowest in a year.

- Oil prices have failed to recover despite a fall in Libyan production.

- Growing concerns about the environment have been weighing on petrol companies.

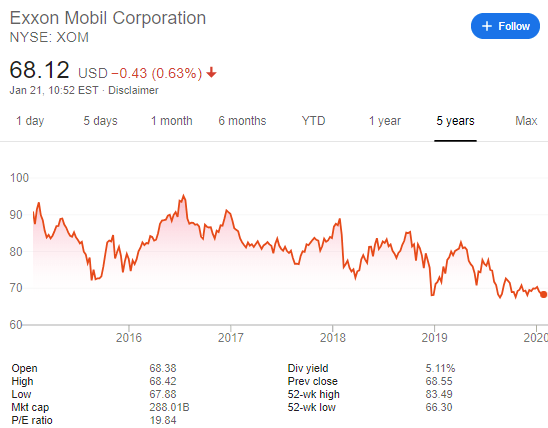

Exxon Mobil Corp. (NYSE: XOM) is trading around $68 at the time of writing, close to the 52-week lows of $66.30. The major oil producer has seen its price fall from a peak of $83.49 in the past year.

World leaders, including President Donald Trump – who took the US out of the Paris Climate Accord – are gathered in Davos, Switzerland. Another high-profile participant is Greta Thunberg, the Swedish teenage activist that has inspired the world. Her activity – alongside bushfires, superstorms, and other disasters linked to the climate crisis – have triggered action from governments that aim to stray away from fossil fuels.

The most significant direct descendant of John D. Rockefeller's venture has been struggling with the move toward renewables. Ursula von der Leyen, the new President of the European Commission, has launched the European Green Deal – a €1 trillion project aimed to make the old continent carbon-neutral by 2050. The British government's aim is even more ambitious.

NYSE:XOM Stock Price

Exxon had a better start to 2020. When the US killed top Iranian general Qassem Suleimani, fears of a war in the Persian Gulf triggered a shock to oil prices. The Irving Texas-based firm's equity rose alongside its peers. However, the dust settled quickly, and so did prices of the black gold.

Below $66.30, XON's price would reach the lowest since 2010, before the Arab Spring sent petrol prices to the roof. Bears will strive for a move below $66.30, while bulls may aim to break above the January peak of $70.90.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains near 1.0400 post-US PCE

The US Dollar’s inconclusive price action allows some recovery in EUR/USD, keeping the pair around the 1.0400 region following the release of PCE inflation data for the month of January.

Gold slumps to fresh multi-week lows below $2,840

Gold stays under bearish pressure and trades at its lowest level in three weeks below $2,840. The uncertainty surrounding the Trump administration's trade policy and month-end flows seem to be weighing on XAU/USD, which remains on track to snap an eight-week winning streak.

GBP/USD clings to gains just above 1.2600 after PCE data

GBP/USD remains positively oriented in the 1.2600 neighbourhood as the Greenback is navigating a vacillating range following the PCE inflation release.

The week ahead – US Payrolls, ECB rate meeting, ITV results – W/c 3rd March

Having seen the Federal Reserve keep rates on hold last month the US labour market continues to show remarkable resilience, despite seeing a slowdown in hiring in January, after a blow out December number.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.