NVIDIA Stock Price and Forecast: Why is NVDA stock going up?

- Nvidia stock makes more all-time highs on Wednesday.

- No sign of risk-off before Jackson Hole here.

- NVDA up nearly 2% to $222.13 on Wednesday.

Nvidia stock just keeps bullishly powering ahead despite most other names settling down to wait-and-see mode ahead of the Fed's summer party at Jackson Hole, zooming straight from a screen near your local Fed member. The junket is off as it's a virtual event this year but the taper talk is likely and markets are nervous ahead of what could turn out to be a funky Friday. The Fed has to do something so it will likely opt for the least aggressive tone to try and placate and prepare markets for what is to come. The taper is over, turn off the taps!

NVDA, however, is still strongly bullish after breaking out and making all-time highs on Monday, taking it easy Tuesday before waking up on Wednesday and walking higher. A report from Reuters may have been the catalyst for this fresh move higher:

The US Department of Energy is nearing a deal to purchase a supercomputer made with chips from Nvidia Corp (NVDA.O) and Advanced Micro Devices Inc (AMD.O) as a key lab waits for a larger supercomputer from Intel Corp (INTC.O) that has been delayed for months, two people familiar with the matter told Reuters.

Nvidia closed up nearly 2% on Wednesday at $222.13.

It is always bullish when a stock reacts well to good news but overlooks bad news, which happened last week for NVDA as the UK Competition and Markets Authority outlined concerns with Nvidia's proposed purchase of British chipmaker ARM. "We're concerned that NVIDIA controlling ARM could create real problems for NVIDIA's rivals by limiting their access to key technologies and ultimately stifling innovation across a number of important and growing markets," said Andrea Coscelli, head of the Competition & Markets Authority.

NVDA statistics

| Market Cap | $547 billion |

| Price/Earnings | 77 |

| Price/Sales | 33 |

| Price/Book | 32 |

| Enterprise Value | $487 billion |

| Gross Margin | 0.64 |

| Net Margin |

0.32 |

| 52-week high | $224.70 |

| 52-week low | $115.665 |

| Average Wall Street Rating and Price Target | Buy $219.48 |

NVDA stock forecast

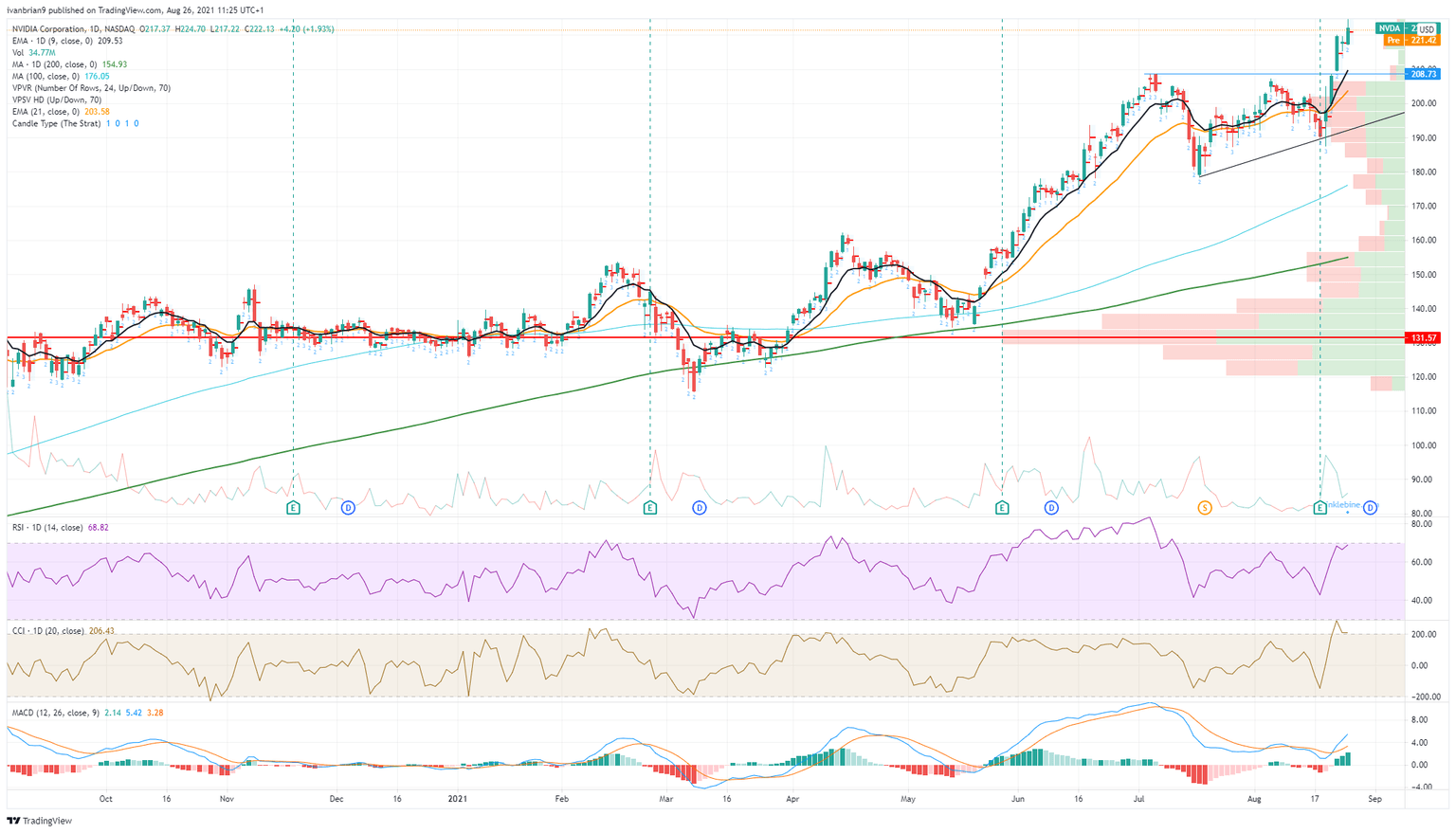

The breakout happened once NVDA stock got above $208.73. The entry leg of the triangle formation was from $208.73 to $178.66, a move of $30. The broad theory is that a breakout should be the size of the entry leg so in this case, our breakout target is $238.73 or thereabouts. NVDA certainly going in the right direction. Holding $208.73 is key as breakouts can retrace to test the breakout level but cannot break lower.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.