Nvidia Stock Price and Forecast: NVDA tracks the Wall Street sell-off on hawkish Powell

- Nvidia stock turned south on Tuesday as risk-off rules.

- Wall Street plunged to fresh November lows at the end of the month.

- NVDA is set to end the year at all-time highs.

Update: Nvidia (NVDA) fell 2.10% on Wednesday, correcting from four-day highs to settle at $326.76. Shares of semiconductors star Nvidia bore the brunt of the broader market sell-off after Nasdaq Composite Index (NASDAQ) tumbled 1.55% on US Federal Reserve Chair Jerome Powell’s hawkish comments. Powell underscored inflationary concerns, adding that speeding up of tapering could be on the table at the central bank’s December meeting. Adding to the dour mood, the Omicron covid variant concerns intensified on Moderna Inc.’s warnings against the vaccine efficacy.

Nvidia surged higher on Monday as risk-on sentiment bought up most stocks, but particular attention was paid to clear 2021 winners. This was not a case of Cyber Monday bargain hunting, rather investors overlooked stocks that have been struggling and instead bought up some already high-flying names. Nvidia is already nearly up 140% year to date, but that did not deter investors piling into the name on Monday. Laggard stocks were punished, Peloton (PTON) for example slumped over 4% on Monday. This was a time for risk to be taken but only into strong stocks. Momentum creates more momentum.

Nvidia (NVDA) stock news

Nvidia announced on Monday that it will participate at Deutsche Bank's Auto Tech Conference on Thursday, December 9, while the company will also attend JPMorgan's Tech/Auto Forum on Wednesday, January 5. Nvidia is due to speak today at the Credit Suisse Technology, Media & Telecom Conference and tomorrow at the Wells Fargo TMT Summit. Some headlines of note may be forthcoming from that suite of conferences. Also to note is that Nvidia goes ex-dividend tomorrow, December 1. The Nvidia dividend of $0.04 will be paid on December 23.

Nvidia (NVDA) stock forecast

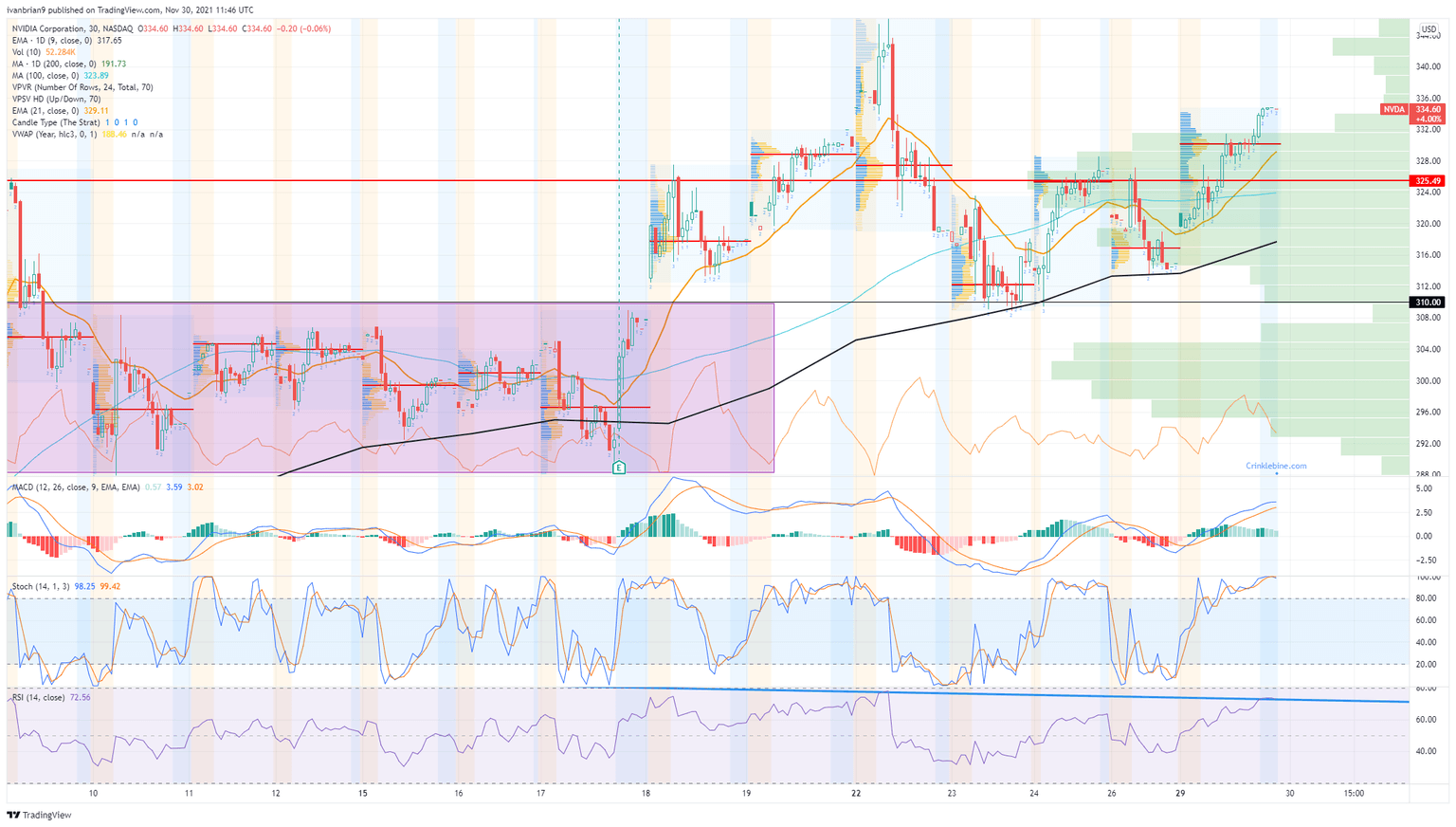

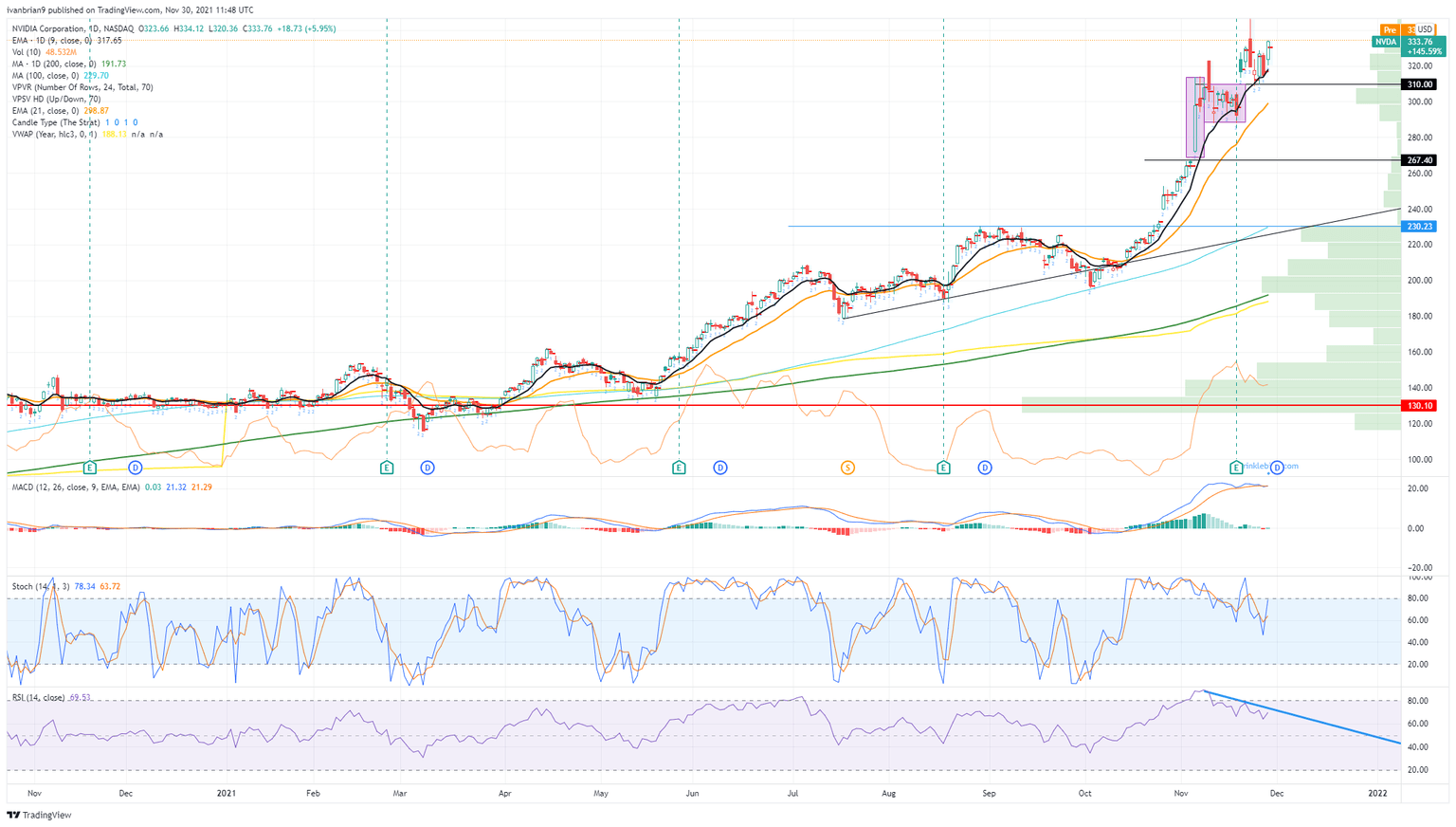

The drive to end the year above $350 is still on track after Monday's powerful recovery. We should also take some credit for identifying the $310 support last week. This is where Nvidia bottomed out on Thursday and Friday. It is the top of the flag formation from the daily chart further down. From the 30-minute chart, we can see the concentration of volume from $328 to $310. Breaking out of this range then sees the next high volume zone around the $302 to $294 range.

The $310 level from the daily chart is holding the current potential for a move to $350. Once below, all bets are off, and the stock becomes neutral in the short term. The bearish divergence in the Relative Strength Index (RSI) is a bit concerning as we would like to see this broken to confirm any move to $350.

NVDA 1-day chart

Previous updates

Update: Nvidia (NVDA) is down over 3% heading into the close and, trimming most of its Monday's gains. Wall Street plummeted following comments from US Federal Reserve Chair Jerome Powell. He said that it is time to retire the term "transitory" for inflation."Risk of more persistent inflation has risen," Powell added. He also noted that supply chain issues are one of the reasons for persistent inflationary pressures. Market participants fear that measures to contain the latest coronavirus variant, may exacerbate such issues and further delay the economic comeback. At the time being, the DJIA is down 660 points, while the Nasdaq Composite loses 1.60%.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.