NVIDIA Corp. (NVDA) Elliott Wave technical analysis [Video]

![NVIDIA Corp. (NVDA) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/music-board_XtraLarge.jpg)

NVDA Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: ZigZag.

Position: Intermediate wave (A).

Direction: Downside in wave 3.

Details: We are looking at either a significant top in place in wave (5), or else we could be continuing higher, after a clear three wave move to the downside, leaving us with one more leg lower to come before upside resumption.

NVDA Elliott Wave technical analysis – Daily chart

The daily chart suggests that NVDA might have reached a significant top in wave (5). However, there is a possibility that the market could resume higher after completing a clear three-wave move to the downside. This implies that we might see one more leg lower before an upside resumption. Traders should be prepared for continued downside pressure in wave 3.

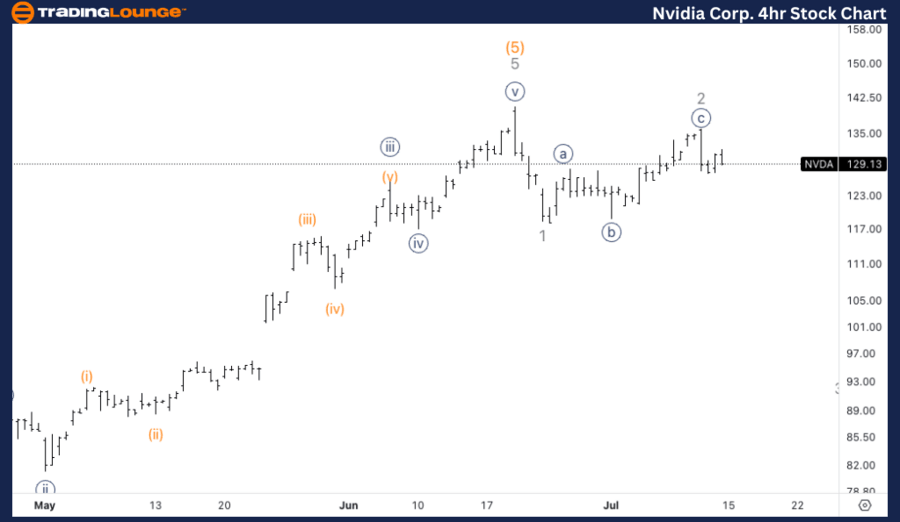

NVDA Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: ZigZag

Position: Wave 3 of (A).

Direction: Downside in wave 3.

Details: Looking for acceleration lower into wave 3, as we failed to find support on top of MG1, looking for 100$ as next downside target.

NVDA Elliott Wave technical analysis – Four-hour chart

The 4-hour chart indicates that NVDA failed to find support on top of MG1 and is now looking for acceleration lower into wave 3. The next downside target is around $100, which traders should monitor closely for potential support.

Welcome to our latest Elliott Wave analysis for NVIDIA Corp. (NVDA). This analysis provides an in-depth look at NVDA's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on NVDA's market behavior.

NVIDIA Corp. (NVDA) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.